The African technology ecosystem is growing and becoming more competitive over time. Africa startups keep coming up with innovative and unique solutions which help solve unique problems in their locality. Some of those startups are raising more and more money from Venture Capitalists both home and abroad. Last year, African startups raised approximately $1.31 billion in 2020 (Briters Bridges) and it won’t be surprising if they raised more in 2021.

Nigerian startups appear to be at the forefront of both raising capital and providing unique solutions for both Nigerians and the African market as a whole.

We took a look at 5 Nigerian startups which could make an impact if and when they expanded to Ghana.

Here are 5 Nigerian startups which could make an impact in Ghana:

Spleet

Spleet is an online marketplace for affordable residential rentals and rents financing in Africa. The startup offers access to premium residential solutions with options of daily, monthly, and quarterly, and biannual subscription.

Spleet is currently operational in Nigeria but is currently looking at officially launching in Ghana soon. No official date has been set yet.

Spleet launching in Ghana would be a great option for young people and professionals looking for affordable rentals and housing especially in the city of Accra where housing can be a headache and provide some health competition for other proptech startups in Ghana.

Mono

Mono is a Nigeria fintech startup which enables users to securely and reliably access financial accounts across Africa.

With Mono, users and businesses can access their account Data, transaction history, balances, and income insights. Mono also allows for direct debiting from your bank account.

Currently, some fintechs in Ghana allow for direct credit to users’ bank account but there aren’t many services that allow for direct debit and access a user’s bank data.

Mono could be a big deal if and when it eventually launches and could be a catalyst for Open Banking in Ghana.

Bamboo

Stock buying is becoming very trendy and open for the average user especially in the US with the rise of companies like Robinhood.

Not to be outdone, Nigeria also has a couple of fintechs which allow Nigerians to purchase US stocks.

Bamboo is one of those fintechs which gives unrestricted access to over 3,000 stocks listed on the U.S. stock exchange through their mobile app and web platform.

With Bamboo, users can fund their Naira and Dollar balance instantly and start buying and selling US shares.

Bamboo is looking at launching in other markets in Africa and Ghana is most likely on that list. Ghanaians having the option to buy US stocks would be great to help diversify their financial portfolio.

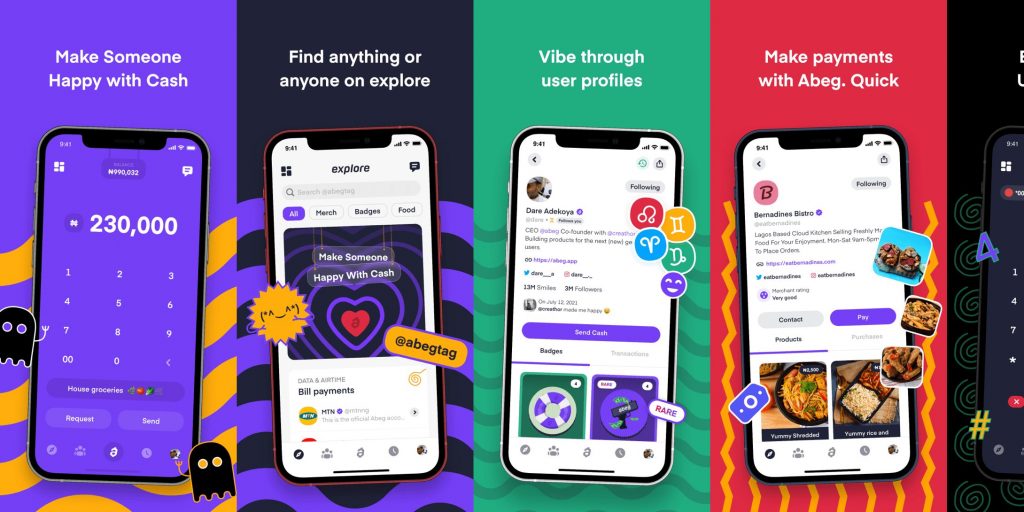

Abeg

Abeg can be compared to “Cash App” in the US. Users in Nigeria using the Abeg app can send and receive money with anyone, donate to an important cause, or tip professionals by entering in “abeg tag” similar to a cash app tag, and sending money easily.

Although the fintech and payment competition is a bit saturated in Ghana, Abeg coming to be Ghana could make an impact because it’s a bit more focused on P2P payments which seem to be its greatest strength.

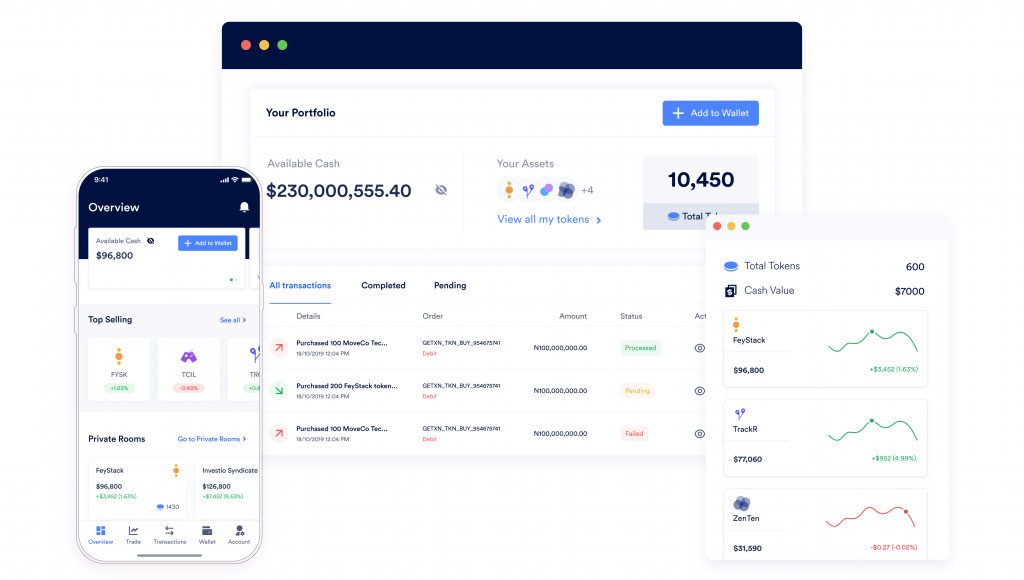

GetEquity

Get Equity is a private marketplace for investors and companies to trade digital securities and assets privately and securely, the platform allows companies or enterprises digitalise their assets via tokens and creates liquidity for them by connecting them to investors and syndicates who can buy and sell these assets.

What makes GetEquity exactly is the ability to easily invest in startups in Africa.