Sparkle, a mobile-first digital ecosystem providing financial, lifestyle, and business support services to Nigerians across the globe, has partnered with Network International, the leading enabler of digital commerce across Africa and the Middle East, to power its recently launched payment card offering.

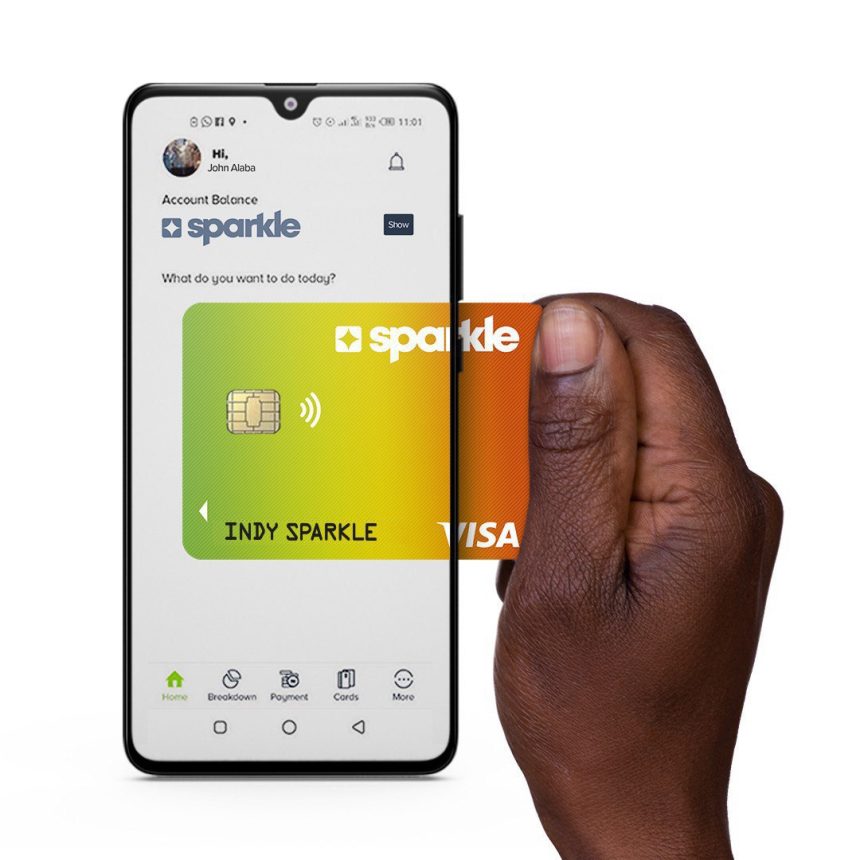

Sparkle’s new virtual and plastic debit cards are targeted at SMEs and upwardly mobile, unbanked consumers across Nigeria, bringing them the convenience, flexibility, safety and security of cashless payments across various channels. The cards will enable Sparkle customers to make in-app purchases as well as pay for e-commerce and m-commerce transactions.

Sparkle was founded by entrepreneur, tech pioneer, and financial inclusion advocate, Uzoma Dozie with the mission of helping Nigerians fulfill their financial and lifestyle needs. The company’s collaboration with Network International is based on their shared commitment to further the adoption of digital payments among emerging markets across Africa and the Middle East.

Collaborating with the region’s largest payment company offers Sparkle access to Network’s years of experience and expertise in creating card solutions for emerging markets. Sparkle can benefit from Network’s advanced digital infrastructure and robust security protocols, avoiding the need to invest in expensive card management infrastructure.

Commenting on the partnership, Uzoma Dozie, Founder of Sparkle, said, “Digital adoption and customer experience is going to be dependent on the people, platform and partnership. In the area of payment processing and data insights, Network International brings that to our platform, and we are truly excited about the future of the partnership and what it means for the enablement and transformational impact for Nigerians anywhere in the world who are connected to the Sparkle platform.”

Andrew Key, Managing Director – Africa, Network International, said, “We are delighted to strengthen our strategic alliance with Sparkle as it seeks to further disrupt the payments offering to consumers and retailers in Nigeria. Building on our two decades of experience within payments and deep insight of the African market, we look forward to deploying our trusted platform and best-in-class technology towards supporting digital and financial inclusion of Nigerian consumers and businesses.”