Africa’s leading Mobile Network Operators (MNOs), MTN, Vodacom and Safaricom, have recently made bold plans to venture into the increasingly dynamic world of fintech. On 23rd June 2021, Safaricom launched its super app, which creates an ecosystem of mini apps from the network operator as well as third party apps that feed off the super app. A month prior to this development, Safaricom, the leading MNO in Kenya announced plans to release an Application Protocol Interface (API) for the super app to enable third-party app developers to build more products and services on top of the super app. This means the super app is going to be an app store that consolidates the reach of Safaricom.

In May, MTN also announced plans to become a tech platform to rival the likes of Apple and WeChat as part of their Ambition 2025 which is currently being implemented. MTN, Africa’s leading telecom operator, is developing its Ayoba messaging platform into a super app that would include its Mobile Money (MoMo) application and video and music streaming services, largely inspired by the international success of WeChat, a powerful multi-purpose messaging, social media and digital wallet app. In April, Vodacom CEO sat down with CNN to discuss plans for building a super app in South Africa in partnership with Alipay. The new service will be integrated with Vodapay to create a financial services super app that will let users pay utility bills, transfer money and get connected with online merchants and suppliers. Although the partnership with Alipay was announced last year during the pandemic to bring the much-needed digital services to consumers under lockdown, it has taken almost a year for them to bring the service to life. This suggests that becoming a fintech startup is easier said than done.

In March, Liquid Telecom with operations in different African countries rebranded to Liquid Intelligent Technologies to show that it is now a one-stop-shop technology group. Very soon, the company would also launch a super app to allow consumers to access all its services through one platform. Although Orange, another MNO with operations in 18 African countries has not announced a super app, the company’s launching of Orange Bank Africa last year, in addition to their already existing Orange Money service, seems to play into the super app narrative. Airtel Africa has also not announced a super app although they had stella performances last year in the MoMo and data business.

Super apps act as a single point of entry for multiple consumer functions. The model emerged in Asia and allows a user to access a range of services — banking, ride-hailing, communication, hiring, trades, people, etc — all from within one app. Back in 2019, Cellulant from Kenya, a leading African fintech firm, also announced plans to launch a super app called Tingg. Super apps are trending not only in Africa. There is a global race to create the next super app that would rival the likes of WeChat, which has a billion users and now estimated to offer more than one million mini programs created by third parties. The other main player is Ant Group’s Alipay, which also has more than one billion users and offers 120,000 mini apps by third parties.

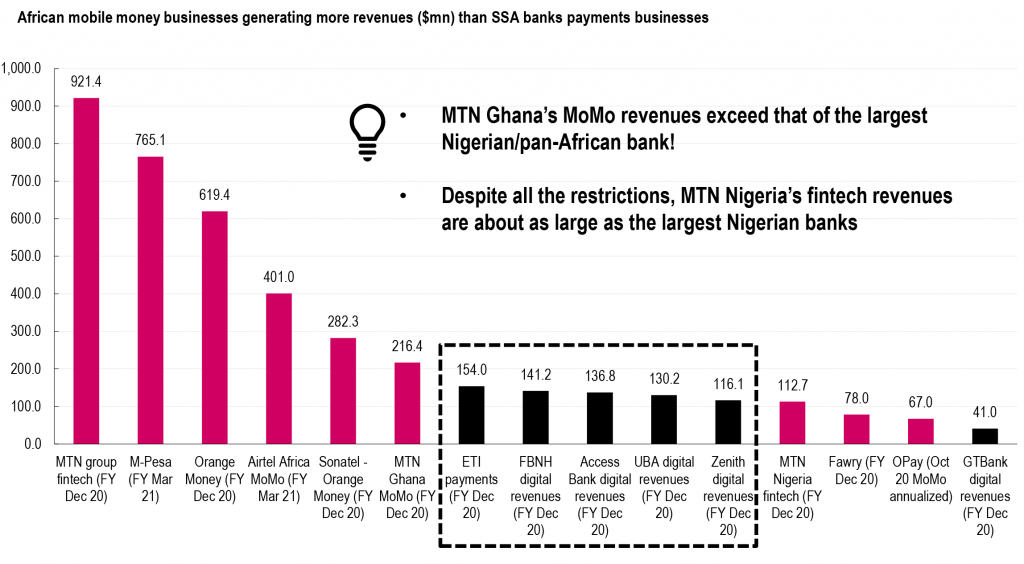

WeChat, owned by Tencent, the most valuable publicly-traded company in China, began making inroads in Africa in 2013 via South Africa’s Nasper, an early strategic investor in WeChat’s parent company. WeChat’s foray into Africa failed, with the company quietly exiting in 2017. Given that WeChat’s partnership with Nasper did not guarantee success, time would tell whether Alipay’s partnership with Vodacom would be successful. In 1994, Naspers, Koos Bekker, and other partners launched MTN, which is currently Africa’s largest MNO. Major MNOs are all eager to become nimble fintech startups to compete with the agile young tech ventures, which begs the question, can old dogs learn new tricks? The answer could be yes because the MNOs have led the innovation in MoMo dating back to 2007, when Safaricom ushered in M-Pesa, a pioneering MoMo app into the Kenyan market, leading to a remarkable digital payment and mobile banking revolution across the entire African continent. Today, all major MNOs have MoMo operations, which has become their new cash cow to the detriment of the banks. In some markets such as East Africa, the MNOs, including Safaricom, are operating “banking services” directly competing with traditional banks.

In Nigeria, this has not been the case until the 3rd quarter of 2020, when the Central Bank of Nigeria (CBN) issued final approval to Glo, 9Mobile and Unified Payment subsidiaries to operate as Payment Service Banks (PSBs). In parts of West Africa, the banks, including Fidelity Ghana and Ecobank Ghana, managed to lobby the regulators to “force” the MNOs to work with them to deliver those banking type services. Back in East Africa, the question has been asked, “Is M-PESA transforming into a bank” with the launch of its super app? This question has led regulators and public policymakers in some countries to require the MNOs to separate their MoMo operations (classified as fintech) from their mainstream voice business. In some markets, the companies are also required to make some ownership of their fintech ventures available to the public through listing on the local stock exchange, just as they are mandated to list their voice businesses. In Kenya, there is a bill before parliament requiring the separation of M-PESA from Safaricom as a standalone fintech business.

The MoMo operations of the MNOs made the most significant returns under the pandemic because majority of transactions were done through their networks. Nigeria recorded $428B worth of e-transactions in 2020, 42% higher than in 2019. In Ghana, MoMo transactions outstripped cheques by $40B in the first quarter of 2021. This sent shock waves to the Ghanaian banking sector such that the banks are now forging collaborations as they fear for their future. In other news, Ghana is edging towards a state-backed digital currency to mitigate against the volatility of unregulated digital currencies, such as bitcoin (BTC). The value of M-Pesa transactions in Kenya grew by 32.9% year-on-year to $82B in 2020, whilst the volume of M-Pesa transactions grew by 14.9%, to 5.12 billion transactions. Orange’s MoMo service also saw an 18.9% increase in active users to total 19.6M customers by the end of June 2020. In Kenya, MoMo payment rate represents 87% of the country’s GDP; in Ghana the figure is 82%. These are the highest ratios in the world after China where mobile transfers represent 125% of GDP (this includes person-to-person transactions not included in GDP calculations)

On the contrary, South Africa where Vodacom and MTN reside, have not seen that much success with mobile money mainly because that country has a solidly entrenched banking system, with 70% of adults having a transaction account. Earlier attempts by both operators to introduce MoMo in South Africa failed but in February 2020, MTN relaunched its MoMo service with UBank and in December 2020, with the mobile telecom giant claiming 2 million new customers. Vodacom’s new Alipay app is their second attempt to carve out a fintech niche in South Africa, whilst Discovery Bank and Tyme Bank have launched exclusive digital offerings without the telcos. Things are clearly playing out quite differently in Southern Africa. Given that the MNOs are in a fist fight with the banks with regards to fintech, would the banks also seek to become innovative mobile startups now that the MNOs are becoming fintech startups?