The Ghana Revenue Authority (GRA) in collaboration with the International Centre for Tax and Development (ICTD) has held a workshop in Accra to discuss the taxation of mobile money and its effects on the economy.

Details

Currently, Ghana’s E-Levy policy places a 1% tax on the transfer of mobile money between two different account/wallet holders with a threshold of 100 GHC.

At the end of 2023, the GRA achieved a revised target of GHC 1.19 Billion after the Minister of Finance revised the levy rate from 1.5% to 1%.

Digging Deeper

Collaboration between GRA and ICTD has been going on since November 11, 2022, after signing a Memorandum of Understanding (MOU), which would enable both entities to undertake research and support GRA’s research capacity to improve tax mobilisation.

Why It Matters

The introduction of a levy on Mobile Money in Ghana in 2022 was seen as controversial by different entities including civil society groups and the public at large.

Surveys conducted indicate that the E-Levy is highly regressive, with users at the bottom paying a large share of their income on the levy while home-based informal works are disproportionately burdened by the tax.

The workshop was to discuss the role of academia, research, and design of the E-Levy and its effects on the informal market in Ghana in the short and long term.

By The Numbers

Digital finance services have been increasing over the last 5 years with ~53 million users having a registered mobile money account.

The total value of mobile money transactions reached a high of GHC 1.9 Trillion at the end of 2023.

MTN accounted for 60% share of E-Levy proceeds coming from the telecom company at the end of 2023.

Zoom Out

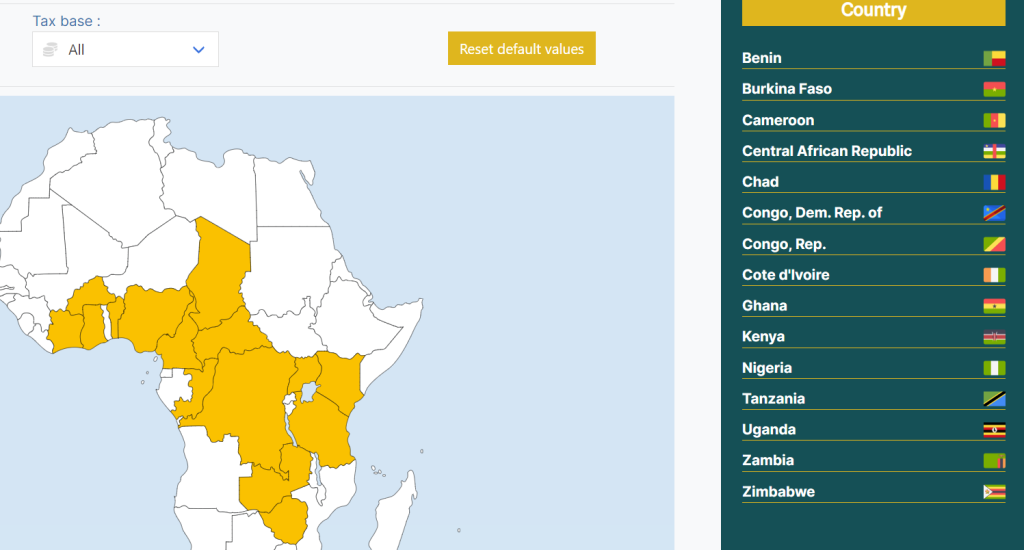

Africa at large currently has a total of 15 countries that are currently implementing taxes on digital financial services including mobile money transfers and withdrawals.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.