MyCredit Score Limited, a Ghanaian company with a mission to promote financial inclusion through responsible borrowing, has been granted a Provisional Credit Bureau License by the Bank of Ghana.

Details

The company, although not fully operational pending the full license from the Bank of Ghana, is actively engaged in the groundwork to pave the way for its impactful initiatives.

Why This Matters

Currently, the lack of reliable credit assessment often imposes significant barriers for individuals seeking basic necessities such as housing and transportation. Acquiring a loan often necessitates a guarantor, a system that can be cumbersome and quite frustrating.

Furthermore, the absence of creditworthiness assessment stifles opportunities for economic advancement, hindering individuals from fulfilling aspirations such as owning a car for improved commute comfort.

MyCredit Score aims to address such challenges by leveraging credit scoring to facilitate access to credit for individuals with promising credit profiles.

What They’re Saying

- A MyCredit Scrore director remarked, “Our core mission is to provide unbiased and accurate information by leveraging already available data to help individuals make responsible borrowing practices and for businesses to make informed lending decisions.

- “In Ghana, due to the absence of credit assessment, individuals often face hurdles in accessing essential services such as renting a decent place to live.

Many are compelled to pay exorbitant sums up front, often equivalent to two years’ rent. With credit scoring, the average Ghanaian will have the opportunity to obtain credit to rent a place of their choice and pay monthly, provided they have a good score,” he explained. - Another Director also remarked, ‘With creditworthiness assessment, individuals like the young working-class male aspiring to purchase a car will find it much easier to obtain financing. This not only enhances their quality of life but also stimulates economic activity.”

Zoom In

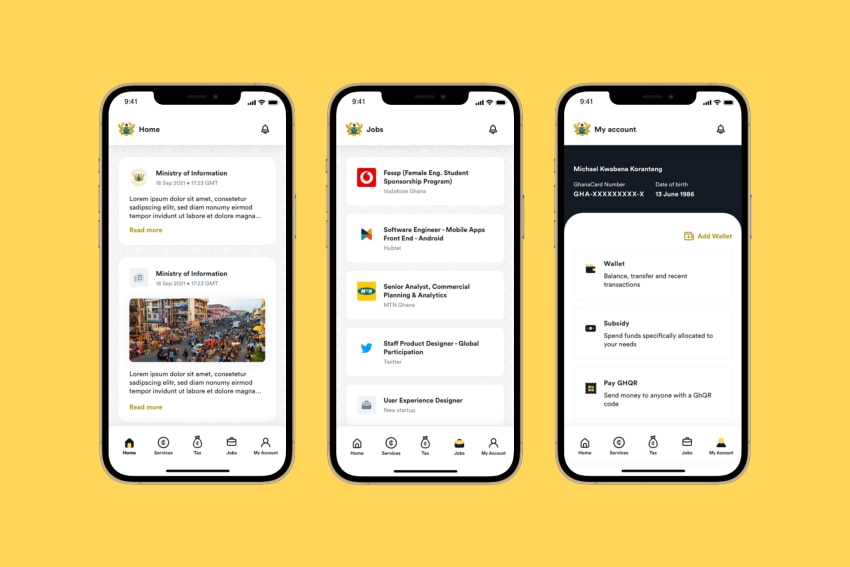

MyCredit Score is currently in discussions with the National Information Technology Agency (NITA) to collaborate on its CitizenApp project.

This strategic partnership aims to leverage technology to democratize access to credit scoring, making it accessible to all Ghanaians, including the average citizen.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.