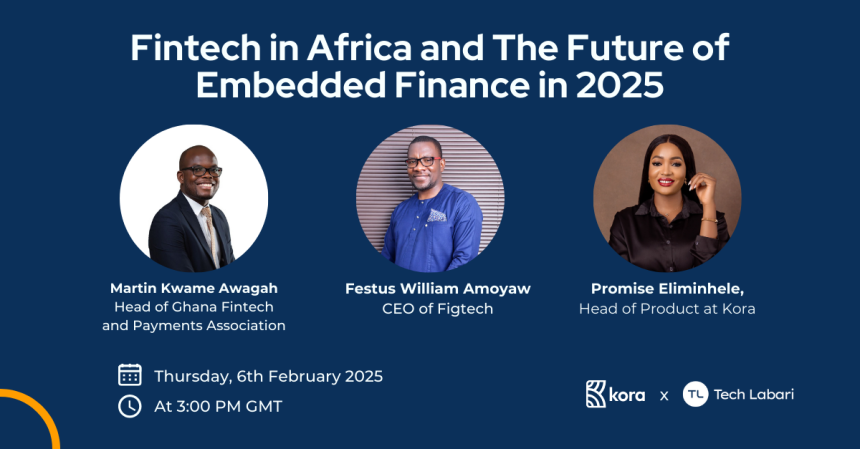

On Thursday, 6th February, Tech Labari, in collaboration with Kora, held an online webinar to discuss the evolving landscape of FinTech in Africa, highlighting trends, challenges, and future opportunities in the sector.

The panelists for the webinar included:

- Martin Kwame Awagah – Head of Ghana Fintech and Payments Association

- Promise Eliminhele – Head of Product (Kora)

- Festus Amoyaw – CEO fo Figtech

The webinar also delved into the topic of Embedded Finance in Africa and the opportunities that it helps for the fintech industry and consumers.

Kora has published a report in collaboration with Finextra, which dug deeper into the topic.

Here are some highlights from the webinar:

Key Takeaways

AI and FinTech Evolution

The panel discussed how Artificial Intelligence (AI) is being used to enhance customer experiences, credit verification, and fraud detection. Another way that AI helps is through the automation of providing lending and financial services across Africa. This process helps saves time and cut costs for fintech companies.

Embedded Finance Growth

On the conversation of Embedded Finance, the panel noted how the integration of financial services into non-financial platforms is gaining momentum.

There is a trend with ride-hailing apps, e-commerce platforms, and telcos like MTN embedding financial products like lending and insurance.

Festus Amoyaw, CEO fo Figtech, remarked about how his company is hoping that insurance might see a bigger breakdown with the help of embedded finance.

Regulatory Challenges

On the topic of regulation, the panelists discussed how FinTech regulations remain fragmented across African countries, making expansion difficult.

But it was noted by Martin Kwame Awagah that Ghana and Rwanda are pioneering FinTech licensing passporting to ease cross-border operations.

The panelists all noted that there are still challenges when it comes to harmonisation of regulation, and in the future, they hope that initiatives like the Africa Continental Free Trade Agreement (AfCTA) would help solve this.

Cross-Border Payments & Crypto

Another trend discussed was the rise of Stablecoins and blockchain technology, which are being explored for seamless cross-border transactions.

Some of the panelists noted how initiatives like the Pan-African Payment and Settlement System (PAPSS) aim to facilitate intra-African trade. They also noted that there are opportunities for embedded finance to help with some aspects of the system.

FinTech in Insurance

Insurance penetration in Africa remains low, with Ghana below 5%. Festus Amoyaw was on the view that embedded finance could help integrate microinsurance into everyday digital platforms. He noted regulators could take the lead to help the growth of embedded finance by making policy and regulation more open.

Predictions for 2025

All the panelists were asked about their predictions for FinTech in 2025. Here’s a summary of some of their predictions:

- Increased collaboration between banks and FinTech companies: Panelists expect more collaboration between FinTech players and banks for growth opportunities.

- More AI-driven financial solutions: There is expectation of more use of AI to help with financial solutions

- Growth of stablecoins and climate-smart financial services: Stablecoins are expected to be a big theme in 2025, helping with cross border payments and money transfers.

- Rising demand for embedded finance and regulatory reforms: As regulators look to enhance the market space, they will look to embedded finance to grow different sectors. They will also look at enhancing and strengthening polices for industry players.

You can listen to the webinar here