Raenest, the global multi-currency accounts platform for individuals and businesses across Africa, today announced the completion of its $11M Series A funding.

The round was led by QED Investors, with participation from Norrsken22, alongside follow-on investment from Ventures Platform, P1 Ventures, and Seedstars.

This equity-based capital injection brings Raenest’s total venture funding to $14.3M.

Driving The News

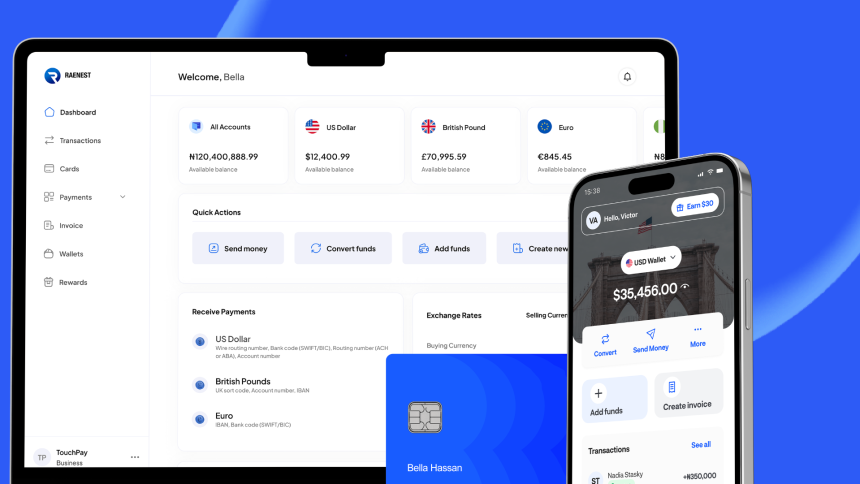

Through its retail product, Geegpay, the company offers freelancers virtual USD, GBP, and EUR accounts to receive payments, manage multi-currency wallets, and convert currencies.

It also provides virtual and physical debit cards for spending in multiple currencies.

Last March, Raenest expanded its platform to businesses under the brand Raenest for Business, helping streamline international remittance.

How it started

Raenest didn’t originally focus on freelancers. The startup launched in 2022 as an Employer of Record (EOR) service, helping foreign companies pay African employees in compliance with local regulations.

- Co-founders Victor Alade, Sodruldeen Mustapha, and Richard Oyome quickly realized the bigger issue wasn’t companies sending payments—it was individuals struggling to receive them.

- “A U.S. company might not care if a payment is delayed by five days, but for someone in Nigeria or Kenya, that’s a big deal—especially when converting to local currency,” said Victor Alade.

Why it matters

The demand for cross-border payment solutions is growing, and Raenest’s pivot to business banking came at a critical time.

- U.S.-based fintech Mercury recently restricted business accounts from several countries, including parts of Africa.

- Competition in the EOR space is heating up, with global firms like Deel eyeing Africa.

By the numbers

- Raenest has processed over $1 billion in payments since 2022—a 160% increase in two years.

- The platform has 700,000+ freelancers receiving payments from platforms like Upwork, Fiverr, and Gusto.

- More than 300 businesses use Raenest for cross-border transactions, including Moniepoint, Helium Health, Fez Delivery, and Matta.

What They’re Saying

Gbenga Ajayi, Partner and Head of Africa and the Middle East at QED Investors, added: “At QED, we’re thrilled to support Raenest as they redefine cross-border banking for Africans. Their commitment to financial inclusion, combined with a seamless user experience, positions Raenest as a game-changer in the region’s fintech landscape.”

Lexi Novitske, General Partner of Norrsken22, “Africa’s gig economy is growing at an impressive 20% year-on-year, yet cross-border payment challenges persist for workers and businesses alike.

What’s next

Raenest is expanding beyond Nigeria, securing licenses in Egypt, Ghana, Kenya, and the U.S.

- The company has banking partnerships in the U.S. and U.K. and aims to secure more as it scales.

- It plans to merge Geegpay and Raenest for Business under a single brand.

The bottom line

Investors are betting on Africa’s growing fintech sector. QED, which led Raenest’s latest round, has been increasing its presence in the region, backing five fintech startups since 2022.

Source: Techcrunch