Satellite technology—led by SpaceX’s Starlink—is disrupting Sub-Saharan Africa’s broadband landscape by offering fast, widely accessible internet, especially in areas underserved by traditional ISPs.

But performance varies widely, and high latency remains a hurdle.

This is according to a report from Ookla.

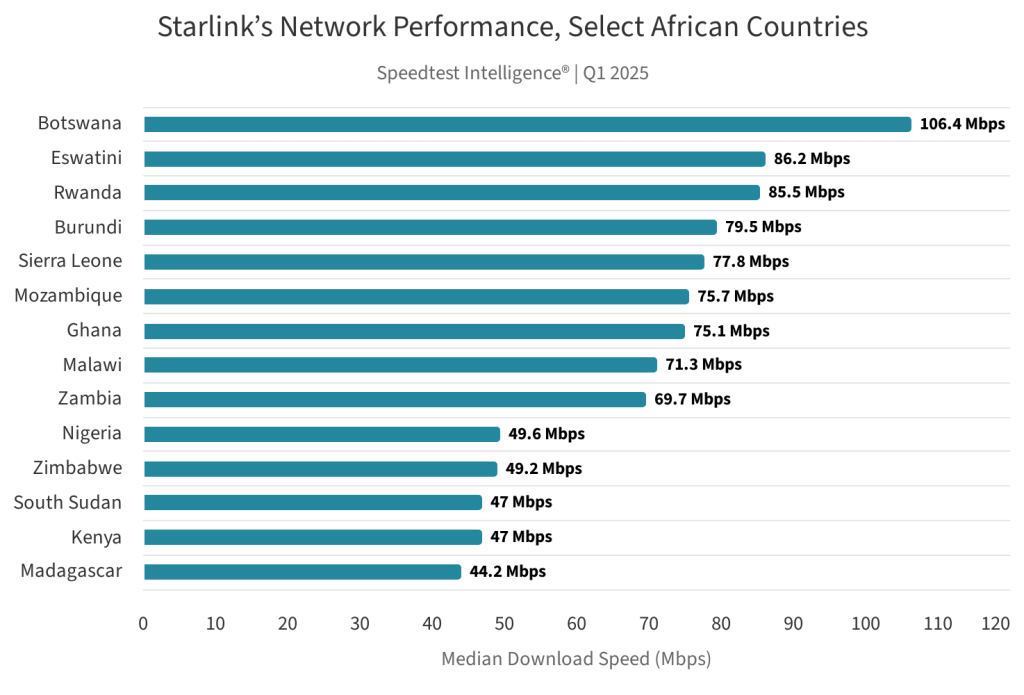

By the Numbers: Starlink’s Performance in Q1 2025

- Download Speeds:

- Top countries: Botswana (106 Mbps), Eswatini (86 Mbps), Rwanda (85 Mbps)

- Lagging: Nigeria, Zimbabwe, Kenya, Madagascar – all under 50 Mbps

- Still >2x faster than most terrestrial ISPs

- Upload Speeds:

- Kenya led with 14.85 Mbps, followed by Ghana and Rwanda (>13 Mbps)

- Latency:

- Best: Kenya (53 ms), Nigeria (60 ms), Rwanda (67 ms)

- Worst: Sierra Leone, Madagascar (>180 ms)

Why It Matters

Broadband in Africa has long suffered from poor infrastructure and slow speeds, especially in rural areas. Starlink’s wide LEO satellite network offers a leap in performance and access—if pricing and regulation don’t hold it back.

Country Highlights

- Kenya: Huge gains after a new PoP (Point of Presence) in Nairobi—upload speed doubled, latency dropped by 81%.

- Nigeria: Starlink is now the 2nd-largest ISP (65,000+ users), though sign-ups are paused in major cities due to capacity limits.

- Zimbabwe: Deep discounts ($30/month for unlimited data) are undercutting expensive fiber packages.

- Cameroon: Starlink was banned in April 2024 for operating without a license.

Starlink vs Traditional ISPs

- Starlink outperformed local ISPs in every country surveyed on download speeds.

- Example: Botswana – Starlink (106 Mbps) vs others (9.36 Mbps)

- Latency remains Starlink’s Achilles’ heel.

- Ghana: Starlink latency ~130 ms vs 13 ms on fiber

Roadblocks Ahead

- Regulatory challenges: Delayed launches in Angola, no licenses in South Africa, Senegal, DRC, Côte d’Ivoire

- Price barriers: Equipment costs range from $200–$700; monthly fees vary widely

- Capacity limits: Starlink has halted sign-ups in over 5 major African cities

The Path Forward

Starlink is partnering with telcos to scale responsibly.

In May 2025, Airtel Africa signed a deal to integrate satellite connectivity in 9 countries, hinting at a hybrid model combining satellite backhaul with local mobile or Wi-Fi infrastructure.

What’s Next

With next-gen satellites in orbit and more PoPs planned, Starlink may further narrow the digital divide. But affordability, regulation, and reliability will determine if it’s a short-term disruption or a long-term solution.