Financial Technology, or FinTech, refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers and the general public.

In Ghana, fintechs play a transformative role, ranging from mobile money and digital wallets to lending platforms, digital banks, insurance, investment platforms, cryptocurrencies, and remittance services.

These innovations enhance financial inclusion, offering seamless access to financial services for the underbanked and unbanked populations.

But to operate legally, fintechs must or are obliged to be licensed and regulated by the Bank of Ghana.

The regulatory framework is anchored primarily in the Payment Systems and Services Act, 2019 (Act 987), which mandates all electronic money issuers, payment service providers (PSPs), and financial technology service providers (FTSPs) to be licensed by the BoG.

Key regulatory stakeholders include:

- Bank of Ghana – Primary regulator for licensing and supervision.

- Data Protection Commission – For data privacy compliance.

- Financial Intelligence Centre (FIC) – For Anti-Money Laundering (AML) compliance.

Additionally, compliance with AML/CFT Guidelines, 2018, the Anti-Money Laundering Act, 2020 (Act 1044), and Consumer Protection Mechanisms is mandatory.

Licensing Categories and Permissible Activities

| S/N | TYPE OF LICENCE | PERMISSIBLE ACTIVITIES |

| 1 | Dedicated Electronic Money Issuer (DEMI) | – Recruitment and management of agents – Creation and management of wallets – P2P transfers (on-net/off-net) – Cash-in and cash-out – Wallet-based domestic money transfers (including to/from bank accounts) – Investment, savings, credit, insurance, and pension products (only in partnership with banks and regulated institutions) – Mobile money merchant acquiring – Termination of inbound international money transfers |

| 2 | PSP – Scheme | – Domestic card brand associations (e.g., Gh-Link) – Switching and routing of payment transactions and instructions |

| 3 | PSP – Enhanced | – All activities under PSP – Medium – Financial services marketplace – Merchant acquiring and aggregation – Payment processing – Printing and personalization of EMV cards – Inward international remittances – 3rd-party payment gateway services – Closed-loop virtual cards funded via refunds, rewards, or user accounts |

| 4 | PSP – Medium | – Connected to an Enhanced PSP – All activities under PSP – Standard – Payment and merchant aggregation – POS deployment – Printing of non-cash payment instruments (e.g., cheques) – Mobile payment apps with liability shift |

| 5 | PSP – Standard | – Connected to an Enhanced PSP – Mobile payment apps (liability shift rests with Enhanced PSP) |

| 6 | Payment and Financial Technology Service Provider (PFTSP) | – Digital product development, delivery, and support services – Credit scoring and predictive analytics – AML/CFT centralized platforms – Fraud management services – Know Your Customer (KYC) and Customer Due Diligence (CDD) authentication services – Permitted to connect to DEMIs, PSPs, Banks, and other regulated Financial Institutions |

Capital Requirements and Fees

| Licence Type | Capital (GHS Million) | Processing Fee (GHS ‘000) | Licence Fee (GHS ‘000) | Renewal Fee (GHS ‘000) | Tenure |

| Dedicated Electronic Money Issuer (DEMI) | 20 | 25 | 100 | 10 | 5 Years |

| Payment Service Provider – Scheme | 8 | 20 | 90 | 8 | 5 Years |

| Payment Service Provider – Enhanced | 2 | 12 | 40 | 7 | 5 Years |

| Payment Service Provider – Medium | 0.8 | 8 | 15 | 5 | 5 Years |

| Payment Service Provider – Standard | No capital required | 0.5 | 1 | 0.2 | 5 Years |

| Payment and Financial Technology Service Provider (PFTSP) | No capital required | 10 | 20 | 5 | 5 Years |

Obtaining a Fintech License in Ghana

Step 1: Determine Your License Category

Evaluate your business model and map it against the five main licensing categories. Choose the category whose permissible activities align with your services.

Step 2: Incorporate Your Business

Register with the Registrar General’s Department, ensuring that:

- The objects of incorporation align with your license category.

- DEMIs must explicitly state that customer funds are held in trust and unencumbered during insolvency.

Step 3: Prepare Documentation (Per BoG Guidelines)

Here’s a breakdown of required documentation:

A. Company Profile

- Overview of business, history, address, and digital address.

- Registrar documents.

- External auditors, bankers, and 3rd-party service providers.

B. Governance Structure

- Shareholding structure, nationality, % shares.

- Shareholder agreements and certificates.

- Notary attestations for foreign shareholders (10%+).

- Board profiles (minimum 3 directors).

- Management team profiles (CEO, Risk, Tech, AML, Finance).

- Organogram and board charter.

C. Business Plan

- Business overview.

- Market analysis and product details.

- Five-year financial projections.

- Pricing model: commissions, fees, transactional limits.

D. ICT Systems

- ICT architecture & diagrams.

- Policy framework: cybersecurity, remote work, data privacy.

- 2FA, monitoring tools, and fraud detection.

- Business Continuity & Disaster Recovery Plan.

- ISO 27001 / PCI DSS / EV-SSL / vulnerability assessments.

E. Risk Management

- Enterprise risk framework.

- Operational, market, liquidity, credit, fraud, and legal risks.

- Business Impact Analysis.

- Anti-Money Laundering (AML)/CFT policies.

F. Consumer Protection Policy

- Complaint resolution process.

- Customer data rights.

- Disclosures and education per Act 987.

Step 4: Register with Other Key Institutions

- Data Protection Commission – For consumer data handling.

- Financial Intelligence Centre (FIC) – AML/CFT registration.

- Ghana Revenue Authority (GRA) – For tax registration and TIN.

- Submit Service Level Agreements (SLAs) with third parties.

Step 5: Submit Application to Bank of Ghana

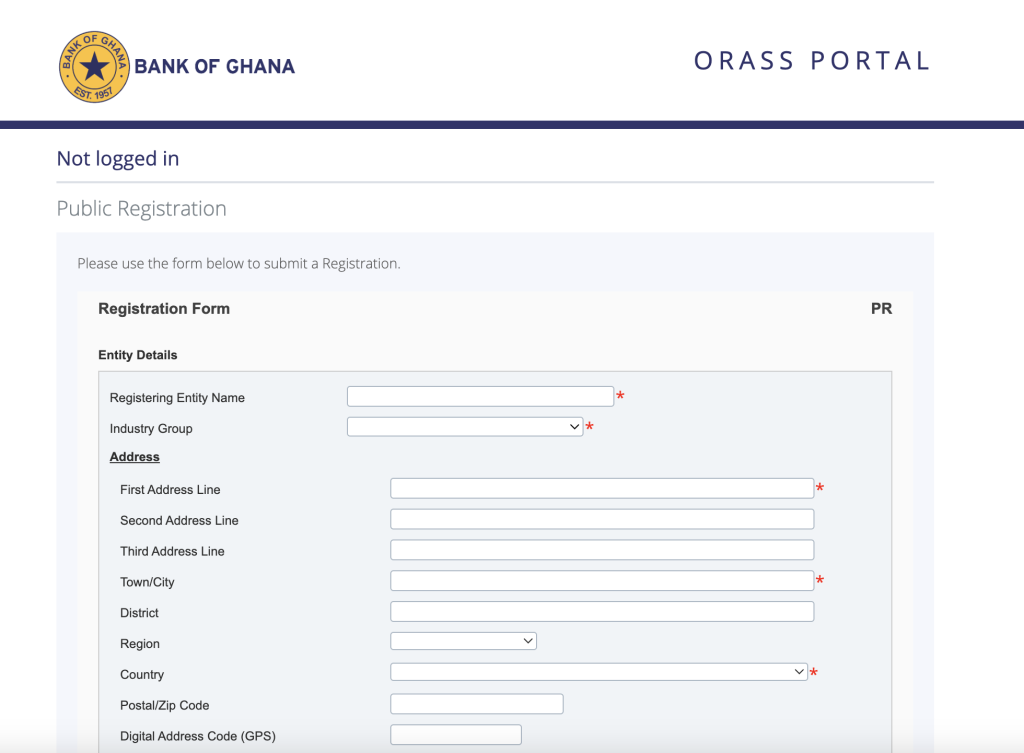

Start your licensing application on the ORASS portal (https://orassportal.bog.gov.gh/PublicForm/PublicForm.aspx) by submitting your entity and principal user details.

The Bank of Ghana’s Fintech & Innovation Office will then reach out to you to continue the application, which will include:

- All documentation listed above.

- Proof of capital (integrity capital must be in a BoG-approved bank).

- Payment of processing fees.

Step 6: Screening, Assessment & Site Visit

Bank of Ghana will:

- Evaluate corporate governance and risk management.

- Inspect ICT systems.

- Conduct site visits and due diligence.

- Verify the fitness and propriety of directors and shareholders.

Step 7: Licensing Decision

If successful:

- You will receive an approval-in-principle (AIP).

- After AIP conditions are met (e.g. systems tested), you receive the final license.

Step 8: Post-License Compliance

- Submit periodic returns to BoG.

- Comply with AML/CFT reporting.

- Implement customer recourse mechanisms.

Common Pitfalls to Avoid

- Incomplete application packages.

- Poor governance structures.

- Lack of internal AML/CFT frameworks.

- Undercapitalization.

- Not aligning objects of incorporation with regulated activities.

Additional Information

The Bank of Ghana has also initiated the mandatory registration of all Virtual Asset Service Providers (VASPs) operating in Ghana, whether through physical presence or digital platforms.

This move forms part of the Bank’s preliminary regulatory process to assess and map entities engaged in virtual asset activities, including exchanges, wallet services, custodial solutions, asset transfers, and token issuance (e.g. ICOs and stablecoins).

While registration is compulsory, it does not constitute licensing or regulatory approval. Rather, it provides the Bank with data to inform the development of a future legal and regulatory framework tailored to the virtual asset ecosystem, in line with international best practices and FATF recommendations.

This exercise signals BoG’s intention to formally introduce VASP as a new fintech licensing category in Ghana, alongside DEMIs, PSPs, and PFTSPs.

Once the framework is finalised, VASPs will likely be permitted to offer regulated services such as crypto exchange operations, token issuance, wallet custody, and blockchain-based payment or settlement infrastructure.

Acquiring a fintech license in Ghana is a structured and compliance process that sends a strong signal to consumers, investors, and partners that you are trustworthy, secure, and serious about sustainability.

With the BoG showing continued support for innovation, now is a good time to build credible fintech solutions in Ghana’s growing digital financial space.

For new entrants, it’s advisable to seek guidance from experienced consultants or legal experts to avoid costly mistakes.

To download the complete licensing requirement, visit: https://www.bog.gov.gh/wp-content/uploads/2020/07/Licensing-Requirements-for-EMI-and-PSP-latest.pdf