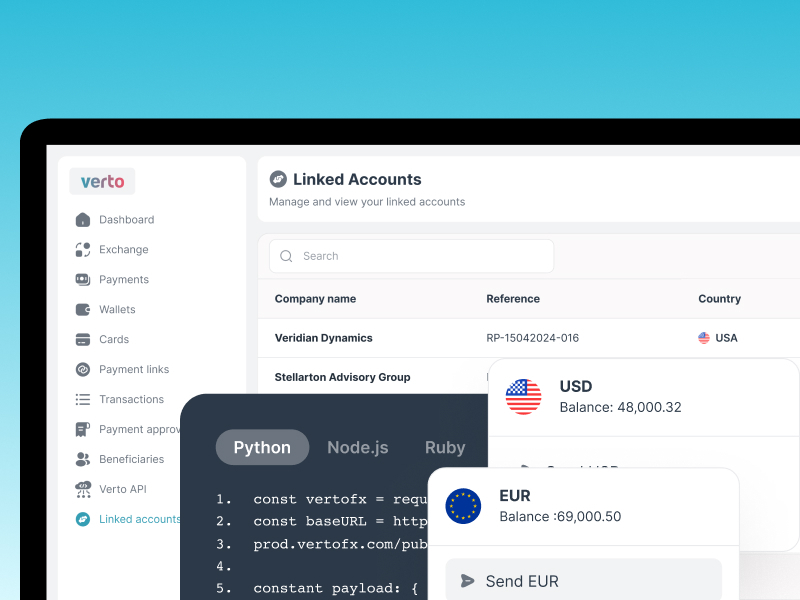

Verto, a B2B global payments platform, has rolled out The Atlas Suite, a set of API-first embedded finance tools designed to make global payments easier for fintechs, online marketplaces, platforms, and white-label brokers.

Why it matters

Africa’s financial systems are notoriously fragmented — with complex regulations, costly infrastructure, volatile currencies, and limited banking access. Atlas aims to break down these barriers by giving businesses instant access to local accounts, deep FX liquidity, and compliant infrastructure across 49 currencies.

How it works:

- Atlas for Fintechs: Lets banks, fintechs, and financial institutions plug directly into Verto’s banking, FX, and payments infrastructure. Through one integration, they can:

- Open local virtual accounts in 12+ markets

- Execute FX trades 24/7 across 49 currencies

- Make international payments to 100+ countries in their own names

- Atlas for Platforms: Enables marketplaces and e-commerce players to embed payments, banking, and FX services without securing licenses or building in-house solutions.

- White-label solution: Brokers can rebrand Verto’s infrastructure, set their own FX markups, and launch Africa-focused financial services with minimal cost.

The big picture

Embedded finance is becoming a major driver for cross-border trade in emerging markets. Verto’s CEO Ola Oyetayo says Atlas is a “game-changer” that removes complexity and gives businesses the freedom to scale globally.

Between the lines

The suite also supports:

- Local collection accounts and multi-account treasury management

- Mass payouts for payroll companies and remittance providers

- Mobile money and bank transfer integrations across Africa

Zoom in

Kenya’s Triply, a travel-tech platform, is among the first adopters. It uses Verto’s API to embed cross-border payments into its platform, giving travel businesses faster and more reliable financial services.

Learn more about other African tech startups on Labari Insights, our data repository for tech in Africa: insights.techlabari.com