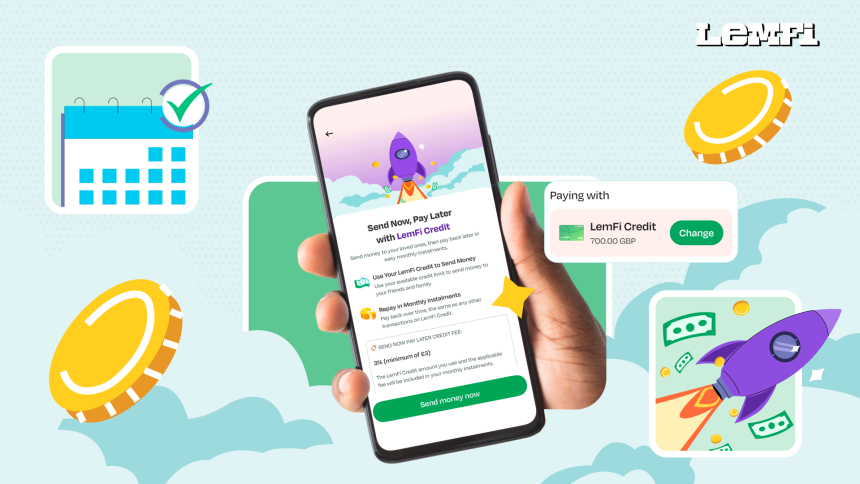

LemFi has launched Send Now, Pay Later (SNPL), an artificial intelligence-powered remittance feature that lets immigrants in the United Kingdom send money home instantly and pay later — a first-of-its-kind product blending credit and remittance.

Why it matters

For millions of UK immigrants who send nearly £10 billion home each year, cash flow timing often prevents them from sending funds when needed.

Traditional remittance services require full upfront payment, while access to regulated credit is limited for newcomers with thin or nonexistent UK credit histories.

LemFi’s new service integrates AI-driven credit scoring directly into the remittance process, allowing users to “send now” and repay later, helping families receive support on time.

How it works

- Users are onboarded to LemFi Credit, which offers lines ranging from £300 to £1,000.

- Eligibility is determined through open banking data, credit bureaus, and LemFi’s own remittance history.

- Once approved, customers can send money to 30+ countries, with LemFi disbursing funds instantly while deferring repayment.

The system is powered by LemFi’s Ensemble AI model, which analyzes multiple data sources to predict repayment behavior and dynamically adjust credit limits.

The model also accounts for international credit footprints, enabling fairer access for new immigrants.

“Buy Now, Pay Later has transformed shopping — but never remittance,” said Ridwan Olalere, LemFi’s co-founder and CEO. “We’re integrating credit directly into the remittance experience so financial support is never delayed by cash flow timing.”

The bigger picture

Roughly 5 million people in the UK are considered “credit invisible,” and immigrants are disproportionately affected. A 2024 study found 13% of migrants are excluded from banking services, compared to just 3% of the general population.

LemFi’s approach aims to reduce this “credit invisibility” by using AI to evaluate affordability across diverse datasets, helping new arrivals access credit responsibly while building their UK financial profile.

What’s next

LemFi plans to expand Send Now, Pay Later to the U.S., Canada, and Europe in the coming months. The company currently serves over 2 million customers across multiple regions and has raised $86 million to date, including a $53 million Series B round in January 2025 led by Highland Europe and LeftLane Capital.