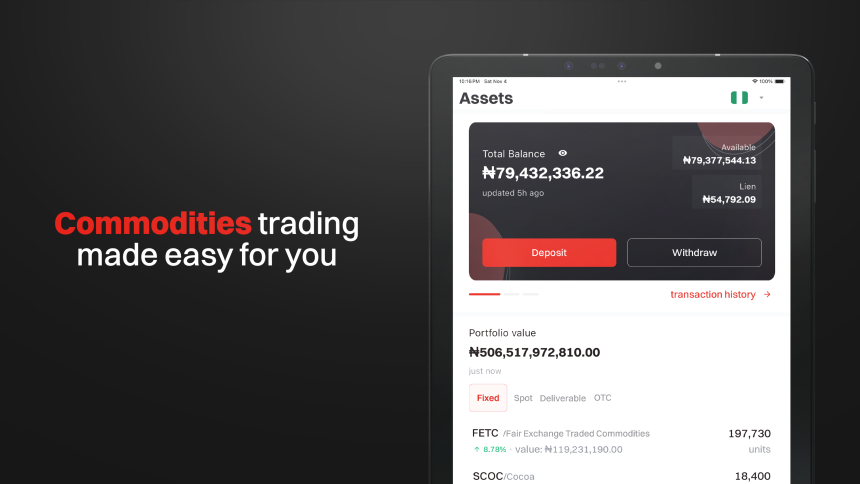

Africa’s leading commodities player, AFEX, has launched Africa Exchange, a digital platform for trading commodities. The platform follows AFEX’s first foray into digital commodities trading with the launch of ComX in 2020.

This new trading platform further transforms the commodities space in Africa by enabling commodities market players to meet and interact both in the physical and financial markets. Data and information crucial to decision-making are readily available on the platform, offering a comprehensive and informed trading experience.

Details

Africa Exchange provides a structured marketplace duly regulated by Nigeria’s Securities and Exchange Commission (SEC), ensuring that users can participate in various trade or investment opportunities. Africa Exchange will replace ComX, which has served over 80,000 investors in Nigeria and facilitated trades worth over USD 200 million since it was launched in 2020.

With Africa Exchange, we are opening the African commodities ecosystem to more investors and players. Through the platform, users can directly trade physical commodities or invest in commodity-backed financial instruments.

Akinyinka Akintunde, CEO and President of AFEX Nigeria

The transition further bolsters AFEX’s mission of facilitating wealth creation for a new generation of Africans by providing them with alternative investment options to enrich their existing portfolios. Additionally, AFEX aims to enhance intra-African trade by strengthening commodities trading within Africa and supporting the African Continental Free Trade Agreement’s (AFCFTA) mission to improve regional trade integration to boost economic development and food security across the continent.

By The Numbers

Presently, only 14.4% of Africa’s exports come from trade between African countries. However, the AfCFTA could increase intra-African trade by approximately 33% and reduce the continent’s trade deficit by 51%, according to the United Nations Conference on Trade and Development (UNCTAD). In line with the United Nations Sustainable Development Goals (SDGs) 1, 2, 5, 8, and 12, the launch of Africa Exchange is a significant milestone towards achieving the AfCFTA. The platform promotes fair market prices that help farmers earn more and increase food production. It also enables investors to diversify their portfolios while supporting the financing of the food ecosystem.

What They’re Saying

Commenting on the launch, Akinyinka Akintunde, CEO and President of AFEX Nigeria, said: “As a team, we are excited and proud to launch Africa Exchange as another step in building the digital infrastructure to facilitate trade across Africa. With this launch, our goal is to boost the commodities market in Africa and allow more investors to participate with all the information that they need at their fingertips”.

He continues, “Commodities have been high-performing assets in recent years; in 2021, commodities were the third highest performing asset class, averaging about 37.1% in returns, while stocks averaged about 36.9%. The commodities market has grown in sophistication over the years with the likes of commodity brokers and other institutional players making their mark and creating opportunities for trading. With Africa Exchange, we are opening the African commodities ecosystem to more investors and players. Through the platform, users can directly trade physical commodities or invest in commodity-backed financial instruments.”

Alongside the platform launch, AFEX is also reintroducing its innovative Fair Trade ETC (FETC) product. The FETC is a commodity bundle in one contract designed to provide investors with exposure to the market in a way that maximizes the risk-return balance of the underlying commodities. The instrument has a maturity period of 270 days and historically significant returns, with both tranches in 2022 returning 31% and 20%, respectively. The FETC is set to open on the Africa Exchange platform on the 1st of December at a unit price of just N1000, and for the first time in the product’s history, it will be tradeable within the tenor period, after a 120-day hold.

Funto Olasemo, Vice President, Financial Markets at AFEX, said, ‘For the last 8 months, we have been focused on improving our core infrastructure and delivering a better digital interface for commodities trading and investment on the continent. We have continued to also pursue product innovation, and the new tranche of our FETC product is a great example of that.”

“The FETC has been a hugely successful product since we introduced it in 2020, and we have structured a tradeable component into this tranche, giving investors even more freedom as they build wealth. The team is excited that we are facilitating wealth creation for a new generation of Africans by providing them with alternative investment options to enrich their portfolios.”

AFEX is committed to improving intra-African trade. To achieve this goal, the company has been bullish in pursuing its strategic Pan-African expansion plan since expanding into Kenya and Uganda in 2021 and 2022. AFEX is set to expand to six other African countries within the next few years with the aim of promoting efficient trade in commodities across the continent while supporting the objectives of the AFCFTA to boost regional trade integration.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.