Digital banking platform Affinity Africa has rolled out Affinity Boost, a new savings product designed to help individuals and small businesses reach financial goals faster through competitive returns and flexible saving options.

Why it matters

Ghana’s fintech market is getting increasingly competitive. By giving customers more control over deposits and returns, Affinity is positioning itself as a customer-first digital bank that blends savings, credit, and financial literacy.

How it works

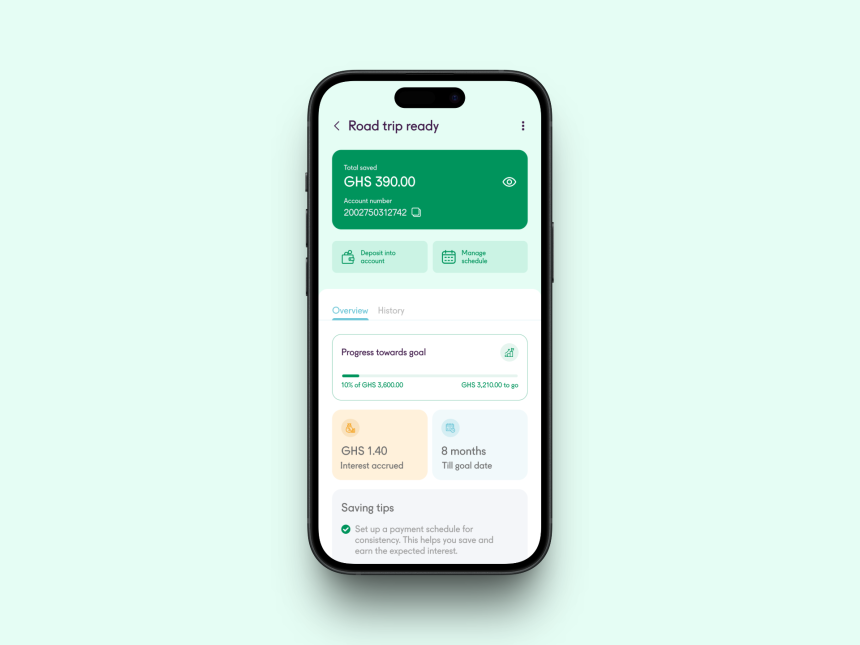

- Users set a savings goal — e.g., buying a motorcycle, starting a business, or planning a trip.

- Choose a fixed tenor (timeframe) and earn annual interest.

- Add extra funds anytime with the top-up feature or automate daily/weekly/monthly transfers.

What they’re saying

“Affinity Boost is a direct result of listening to the voice of our customers and building for what matters most: helping them achieve their goals,” said Abdul-Jaleel Hussein, CEO of Affinity Ghana.

Zoom out

- The new account expands Affinity’s portfolio of savings products, which include Affinity Daily, Affinity Growth, and Affinity Future.

- The company also offers a lending suite — from instant micro-loans to working capital and long-term growth capital.

- A redesigned app and website give users dashboards to track savings, make payments, and even apply for instant loans.

By the numbers

- 80,000+ customers onboarded.

- 80% actively use the mobile app.

- 55% transitioned from Affinity’s agent network to the app, signaling its role in digital and financial literacy.

The big picture

“More Africans are demanding smarter tools to manage their finances,” said Tarek Mouganie, Founder and Group CEO of Affinity Africa. “We remain committed to designing banking products that serve their needs.”

Learn more about other African tech startups on Labari Insights, our data repository for tech in Africa: insights.techlabari.com