In the last century, the fashionable and accepted route to success for young Africans was to complete their education and join the corporate world. A few university students aspired to become entrepreneurs; most educational institutions did not offer entrepreneurial programs. With few exceptions, African families used to guide their children to join a leading multi-national or work for a state institution, hoping they would climb the corporate ladder to become CEOs or at least senior management. That was prestigious until the paradigm shifted to tech entrepreneurship with the emergence of the computer, mobile and Internet industry in the latter part of the 20th century. Whilst a lot of African families have built successful entrepreneurial ventures in the past, this essay emphasis the growing move of corporates to tech entrepreneurship.

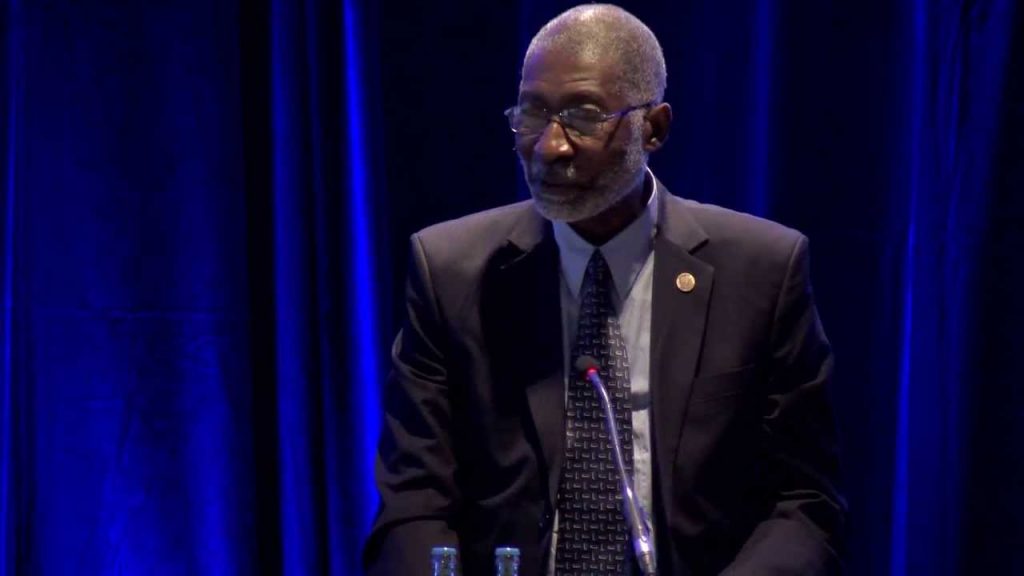

The likes of Dr. Nii Narku Quaynor who started Network Computer Systems (NCS) in 1988 and played a key role in establishing the Internet in 1994, Strive Masiyiwa, who started Econet in 1993, Mo Ibrahim, who built Celtel in 1994 and sold it for $3.4B in 2005, Irene Charnley who led the expansion of MTN into the rest of Africa and the world, making it a leading global telecom player whose current market capitalization is $4.8B and others deserve credit for breaking the mold and igniting a paradigm shift. Their transition from government and corporate life to building some of these leading African businesses served as a beckon of light to be followed in the 21st century. As mobile and connectivity became pervasive in Africa, a new generation of entrepreneurs – digital natives and digital immigrants — started creating digital innovations. Some of these digital immigrants are African corporate executives who are transitioning to entrepreneurship later in their career. In this two-part essay, I analyze the transitional path of some of these executives-turned-entrepreneurs highlighting their current innovative ventures that are changing the face of Africa. Starting with Ted and Adesuwa.

In a post COVID-19 world, the $8.2T global tourism market accounting for 10% of global jobs and GDP had to adapt or die.

Ted Koka started his corporate life at CNBC & Forbes Africa as a sales lead in South Africa. He grew into business development and what followed was an exciting journey as the head of content distribution and sponsorship at Viacom International Media Networks. Managing distribution for a portfolio of amazing global brands; including MTV, MTV Base, Comedy Central, BET, Nickelodeon, Nick Jr and Nick Toons gave him the edge he would need to succeed in his next venture.

According to Ted “When I felt my time in the corporate world had matured, it was time to venture out to build my vision.” In the last quarter of 2019, Ted took the plunge and launched Epic Contests a social contest platform that designs and aggregates the world’s most amazing experiences to give users the opportunity to win them and create social good. Koka’s move from the traditional corporate world to engaging with social good highlights the global change in corporate ethos. Epic Contests is premised on the fact that there is a cost and accessibility barrier between people and their most coveted bucket list experiences. Their experiences are categorized into Music & Lifestyle, Sports & Fitness, Travel & Adventure as well as Kids and Family – this makes them the “Netflix of experiences”.

In a post COVID-19 world, the $8.2T global tourism market accounting for 10% of global jobs and GDP had to adapt or die. This is where Ted’s corporate experience came in handy. He was able to lead his team to pivot their business by creating a new product called Digital Formats. This vertical positioned them to disrupt the $3.1B TV formats industry. By digitizing the formats ecosystem (X-Factor, Idols, Got Talent, etc.) they created a scalable, digital environment for participants across the world to compete in digital formats that could change their lives forever. It means an aspiring musician, DJ or dancer in Johannesburg, Lagos or Accra can compete head to head against a counterpart in New York, London or Sao Paulo in a contest without being subjected to geographical or production restrictions. This capability provides significant cost savings and flexibility to an industry battling to monetize cost-intensive TV formats. Epic Contests is a new way to engage and reward consumers – their latest World of Wonder experience is the ultimate bucket list giveaway. The opportunity to win a Ferrari California and a trip for two to Milan in a post COVID-19 world.

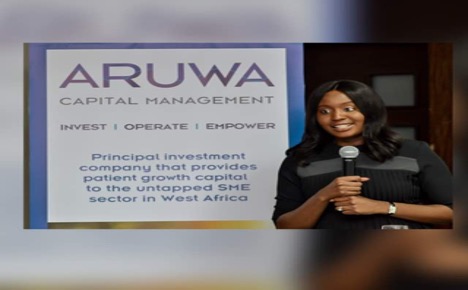

Having spent the last 12 years in investment banking and private equity at firms such as J.P. Morgan, TLG Capital & Syntaxis Capital Africa, Adesuwa Okunbo Rhodes launched Aruwa Capital Management with her own money in Nigeria in 2019, after leaving the comforts of a six-figure salary. In order to make an impact in society with her skills and track record – her focus is to change the narrative for women and small businesses in Africa. Aruwa Capital is one of the few African women-founded and led growth equity gender lens funds in Africa. Adesuwa had struggled at her previous fund to raise capital from institutional investors haven been on the fundraising trail for four-and-half years as the Managing Partner.

She adds, “I wanted to make sure that through launching my own fund, I would be able to provide female entrepreneurs with access to capital where they otherwise traditionally wouldn’t have access due to the structural barriers that exist for any woman raising capital let alone women and people of colour”. Adesuwa also wanted to change the narrative for other female fund managers who may have struggled to raise capital despite their track record. Aruwa as a success story would motivate and inspire them.

Aruwa Capital Management was founded on the conviction that the gender imbalance amongst capital allocators on the continent, provides a unique opportunity to invest in untapped segments of the economy whilst closing gender economic gaps across society whiles generating enhanced returns. When women are empowered as capital allocators, there is a natural trickle down to women entrepreneurs. When women with agency have access to capital, society is the better off for it. Aruwa Capital is currently investing from its inaugural $20M fund, focused on Nigeria and Ghana with a successful first investment in a local manufacturer of personal hygiene goods for women, girls, and babies.

I would end this first part with a quote from Adesuwa; “I believe the way to effectively provide women with more seats at the table is for us to create our own tables. More women succeeding as capital allocators means more women getting funded, more mentors, more torch-bearers, more examples to follow. We don’t need more seats, we need more tables!”