Las Vegas-based Chargeflow has launched a beta version of their chargeback automation software to help e-commerce entrepreneurs stop fraud and win payment disputes without breaking a sweat.

A chargeback is a forceful payment reversal by a cardholder’s bank, and research shows that chargeback makes up almost 80% of all payment fraud today.

Developed as a consumer protection tool, online shoplifters now use the chargeback mechanism to commit friendly fraud.

Industry estimates show that ⅓ of all customers committed friendly fraud in 2020 by claiming products were bad or not delivered. And 4/10 consumers ask for a refund despite knowing no fraud had been committed.

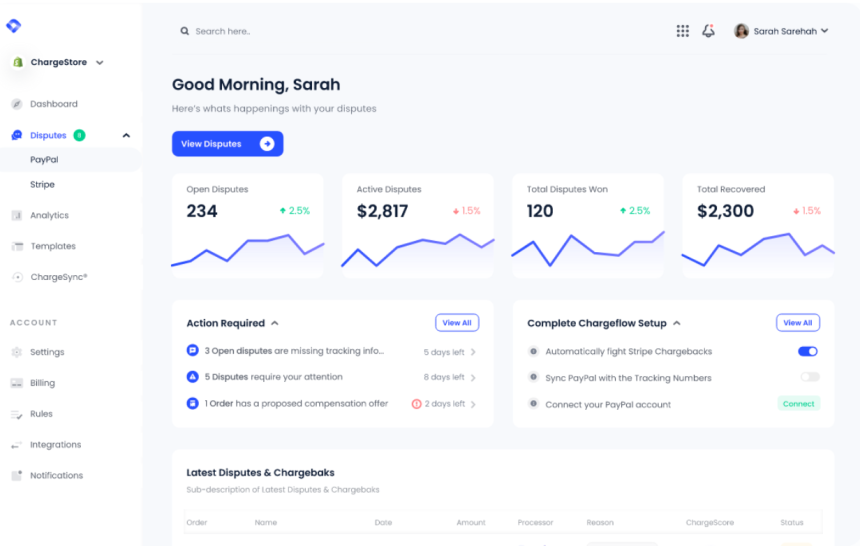

To help merchants gain the upper hand in stopping the rising threat of chargebacks and payment fraud, Chargeflow has developed an AI-enabled framework that fully automates your dispute process from A to Z. The team uses the official 1-click API’s from their connected partners to ensure seamless onboarding processes.

So, when a cardholder files a dispute, instead of the painful manual labor in evidence gathering and representment, which has only a 20% success rate, Chargeflow pulls data from over 50 datapoints and responds to any dispute on your behalf. But not just that. The system also stops disputes in their tracks by helping you understand which transactions would likely turn into a dispute, giving you historical data on each customer, and providing insights and tools to keep growing your business.

The system also stops disputes in their tracks by helping you understand which transactions would likely turn into a dispute, gives you historical data on each customer, and provides insights and tools to keep growing your business.

Made for digital technology entrepreneurs by digital technology entrepreneurs, Chargeflow operates on a security-first principle. OAuth 2.0, 128 Bit SSL, Secure Data Encryption, and Official APIs.

To join the private beta, visit www.chargeflow.io.