When I first coined the KINGS (Kenya, Ivory Coast, Nigeria, Ghana and South Africa) concept in September 2013, Cote d’Ivoire also known as Ivory Coast was a small “i” in the KiNGS. The country was just emerging from a tumultuous civil unrest that followed a disputed election in 2010 that ousted then incumbent, Laurent Gbagbo and set the country back. In 2016, when I wrote about “The KINGS of Africa’s Digital Economy” Ivory Coast had fully recovered, and its tech sector was on an acceleration path similar to Kenya, Nigeria, Ghana and South Africa.

In 2017, encouraged by this impressive turnaround my team took our annual Angel Fair Africa (AFA) to the Ivorian capital of Abidjan. Archangel, Esther Dyson, the event’s keynote speaker reacted remarked “I was pleasantly surprised with the level of tech innovation and digital entrepreneurship”. This final essay to see off 2021, will focus on Cote d’Ivoire’s digital economy and the startups that have raised capital and are leading the charge in the country. In the concluding paragraphs, I will also highlight some of the non-KINGS countries whose digital economies have picked up pace in 2021 with the attraction of investments similar to the KINGS.

The francophone and the Portugese-speaking countries in Sub-Saharan Africa tend to get less attention compared to the English-speaking countries and thus Ivory Coast is rarely in focus.

West Africa was predominantly colonized by the French such that only five out of the 15 countries in the Economic Community of West Africa (ECOWAS) were British colonies and thus English-speaking (Ghana, Nigeria, Liberia, Sierra Leone and The Gambia) while Cape Verde and Guinea-Bissau were the only Portugese colonies with Creole being the official language. The remaining countries in West Africa were French colonies and comprise Cote d’Ivoire, Togo, Benin, Burkina Faso, Niger, Mali, Senegal, and Guinea. With the exception of Guinea, all francophone countries in West Africa use the same currency – Communauté Financière Africaine (“CFA”) that is issued by the Central Bank of West African States (BCEAO; Banque Centrale des États de l’Afrique de l’Ouest). The francophone countries in West Africa are members of the West African Economic and Monetary Union (UEMOA; Union Économique et Monétaire Ouest Africaine) – a French union within ECOWAS.

The CFA is pegged to the EURO and the members of the UEMOA have to keep 50% of their foreign assets in the French Treasury and have a French representative in its currency Board as a colonial-era arrangement to help stabilize the currency in the region. Ivory Coast is Africa’s 11th largest economy with a GDP of US$61B and population of 26M people with 13M active internet users. Having Ivory Coast as part of the KINGS is not only symbolic but important. In 2019, Ivory Coast ranked 110 in the World Bank’s Ease of Doing Business Report from 122 the year before.

According to Digest Africa, the 10 most funded startups in Ivory Coast have raised a combined $19M across 23 deals. Of these 23 deals more than half relate to early-stage investment: 12 are seed rounds, three are pre-seed rounds and grants each, two series A, and one venture deal, angel investment and series B. The largest amount was raised by “Afrimarket” in a series B round of $11.5M. The twelve seed rounds are worth $3.4M while the 2 series A are worth $3.3M. The most funded sectors by number of companies are financial services with three in the top ten while e-commerce and retail and energy and resources had two each. E-commerce and retail had the top two funded startups with Afrimarket and Afrikrea raising a stunning $16M (or 84%) of the $19M total. Financial services came in second with its three startups managing to pull in $1.17M.

In February 2021, the Ivorian and Luxemburg government partnered to invest $12M into Bamboo Capital Partner’s BLOC Smart Africa Fund, a technology impact fund that would invest in African startups with their first investment potentially going to Ivorian insuretech startup, Digitech which provides a fully integrated and cloud-based insuretech platform to insurance companies that want to attract the next consumer emerging segments. On March 8th, 2021, leading Ivorian Mobility-as-a-Service startup, Moja Ride, raised funding from Toyota Tsusho. In May 2021, two Ivorian fintech startups secured funding from local Venture Capital (VC) firm, Investisseur & Partnership (I&P) through its I&P Acceleration Technologies program, which is funded by the French development agency. Djamo, a finance super app for consumers in French-speaking Africa based in Abidjan was accepted into the Silicon Valley-based accelerator Y Combinator with an investment of $125K. Even during the pandemic Ivorian startups like Starnews, Coliba, Easy2toofacil and Julaya raised capital showing the resilience of the ecosystem and its strength under stress.

Based on a report by Disrupt Africa, funding for health tech startups in Africa jumped 257.7% from $28.8m in 2019 to $103m in 2020. These startups provide a wide range of services from scheduling medical consultations to telemedicine and digitalized imagery. MaiSoin from Cote d’Ivoire uses a decentralized, gig-economy model, to facilitate the relationship between healthcare professionals and patients needing care at home or via telemedicine. In their first year of operations, they have had an average 50% growth month over month and are already looking at potential expansions in the region. Last month, Nigerian fintech startup E-Settlement acquired the Ivorian QuickCash to start its expansion into francophone West Africa. And so did Kenyan logistics startup Sendy which also completed a strategic equity investment in Ivorian counterpart Kamtar to boost the former’s expansion plans in West Africa.

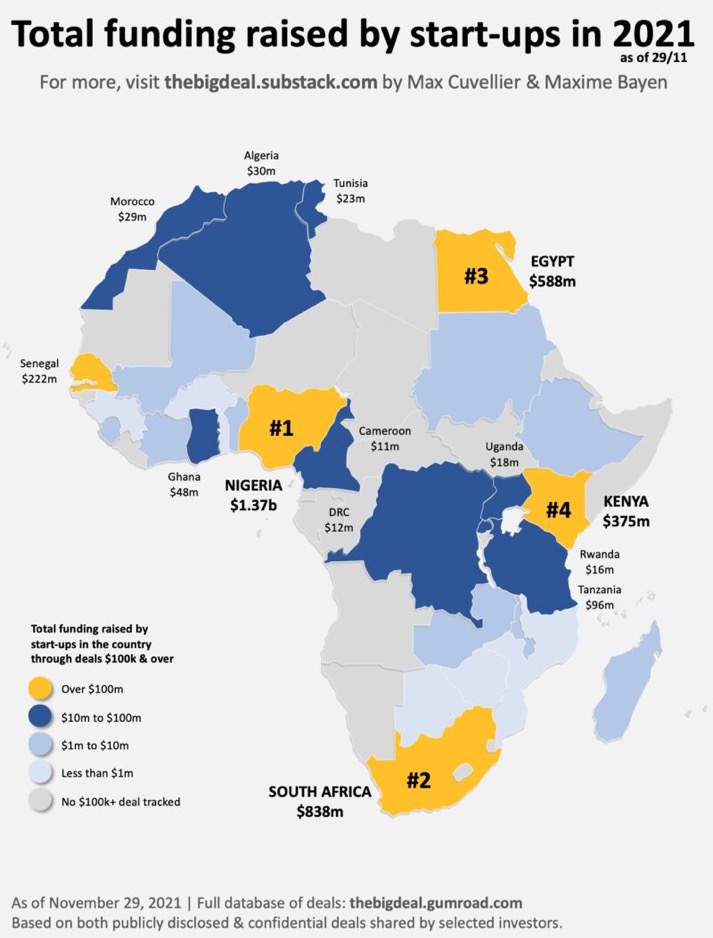

These seem to signal that Cote d’Ivoire is being targeted as an entry market for francophone Africa. Same seems to go for Senegal where Gebeya, an Ethiopian tech startup expanded to as its foray into the francophone market. Though not one of the KINGS, Senegal is punching above its weight as a startup nation by being the first francophone country to produce a unicorn in Wave which raised $200M at a $1.7B valuation. Egypt is another country that has caught up with the KINGS by producing a unicorn, Fawry, that trades on the local stock exchange – a first timer. Egypt was also among the top four destinations for VC investments in Africa as at the end of November 2021 according to the Big Deal by Max Cuvellier and Maxine Bayen.

According to their categorization below, there are about nineteen countries that are attracting investments beyond the KINGS totaling $4B in 2021 so maybe it is time for a longer or different acronym beyond the KINGS.