In Ghana, insurance penetration remains relatively low. Despite the industry’s growth, a significant portion of the population lacks access to insurance products.

This gap presents an opportunity for embedded finance to play a transformative role in enhancing insurance penetration.

What Is Embedded Finance?

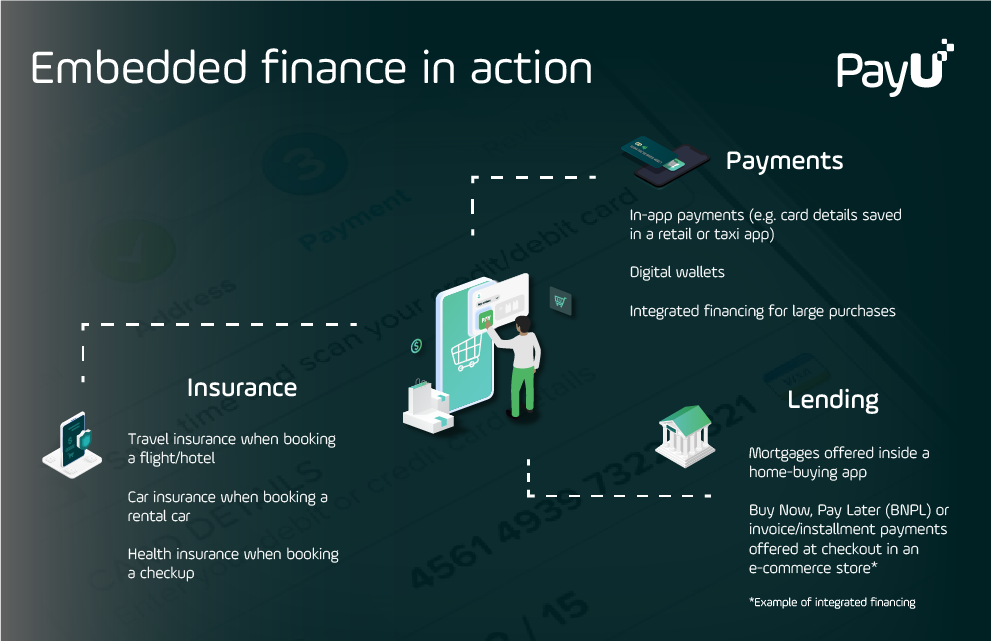

Embedded finance refers to the integration of financial services into non-financial businesses’ platforms, allowing consumers to access these services seamlessly during their regular interactions with the business.

This approach can be particularly effective in markets like Ghana, where traditional banking and insurance services may not reach the entire population.

Potential of Embedded Finance

The potential of embedded finance in Ghana’s insurance sector is multifaceted. Firstly, it can increase accessibility. By embedding insurance offerings into widely used services, such as mobile phone platforms or retail outlets, insurance becomes more accessible to the average Ghanaian.

This ease of access is crucial in a country where, according to a 2021 UN Development Programme survey, around 70% of Ghanaians do not have insurance.

Secondly, embedded finance can enhance understanding and trust in insurance products. Often, the lack of insurance uptake is due to a lack of understanding or distrust of the products. By integrating insurance into everyday services and products, companies can leverage their existing customer relationships to educate and build trust.

Moreover, embedded finance can lead to the development of more tailored insurance products. With access to customer data, companies can design insurance products that better meet the specific needs of different consumer segments. This customization can lead to higher uptake and satisfaction rates.

Policies

The National Insurance Commission (NIC) of Ghana has recognized the need for innovation in the sector. The Insurance Act of 2021, for instance, introduced a special license for companies with new or innovative products or services, aiming to modernize the sector and increase penetration.

Challenges

However, the implementation of embedded finance is not without challenges. It requires robust regulatory frameworks to ensure consumer protection and data privacy. Additionally, there needs to be a concerted effort from both the financial and non-financial sectors to collaborate and drive the adoption of embedded finance.

In conclusion, embedded finance holds significant promise for increasing insurance penetration in Ghana. By making insurance more accessible, understandable, and tailored to the needs of consumers, it can play a crucial role in the financial inclusion of Ghanaians.

As the country continues to navigate the digital transformation of its financial services, embedded finance could be the key to unlocking the full potential of the insurance sector.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.