The Africa Financial Industry Summit-AFIS and Deloitte have released the third edition of their African Financial Industry Barometer.

Based on an in-depth survey to be carried out in the second half of 2023, the barometer offers insights into Africa’s progression towards building a world-class financial industry.

Optimism about short-term macroeconomic prospects

An overwhelming 95% of financial industry leaders are optimistic about the economic outlook over the next three years despite macroeconomic uncertainties and tensions in financial markets.

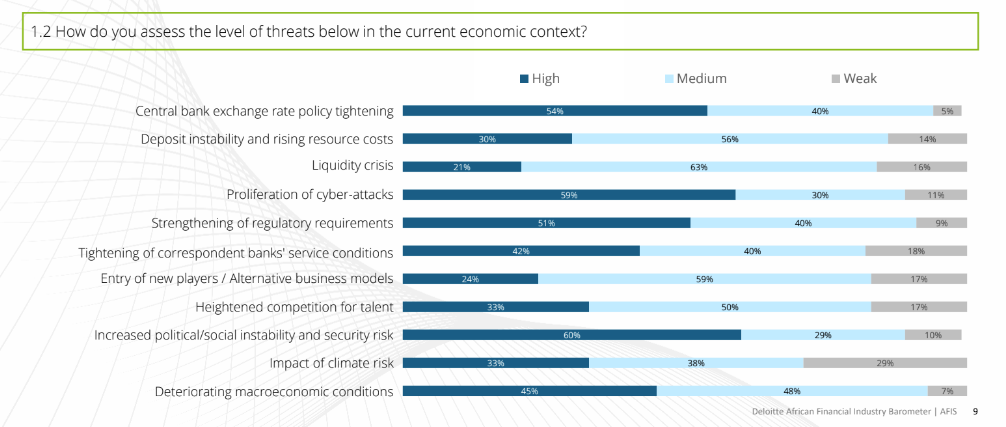

The industry is however strengthening its asset-liability management (ALM), risk management (cyber security in particular), and capital management in response to persistent inflation and the potential for tighter interest rates and regulation.

Enhanced digital maturity

Up 10 points on the last Barometer, industry leaders perceive their digital maturity has increased, propelled by open banking/insuring, which has been the key driver of digital transformation.

Information technology is meanwhile the investment priority for the majority of respondents (33%) with more than one in three executives saying they have launched or are ready to launch migration to the cloud.

The industry is also keeping a cautious eye on artificial intelligence with 8% of business leaders reporting that this technology has been effectively integrated into their processes.

Challenges to address in capital markets

Financial performance indicators remain solid despite profitability declines in several sectors. Yet access to capital management instruments remains limited.

The struggle for liquidity and refinancing via capital markets persists with 70% of respondents (compared with 56% in the previous Barometer) rating market access and depth as insufficient despite an increase in transaction volumes. This problem is particularly noticeable in foreign exchange transactions and fundraising due to strict regulations.

Green finance and carbon neutrality: Room for improvement

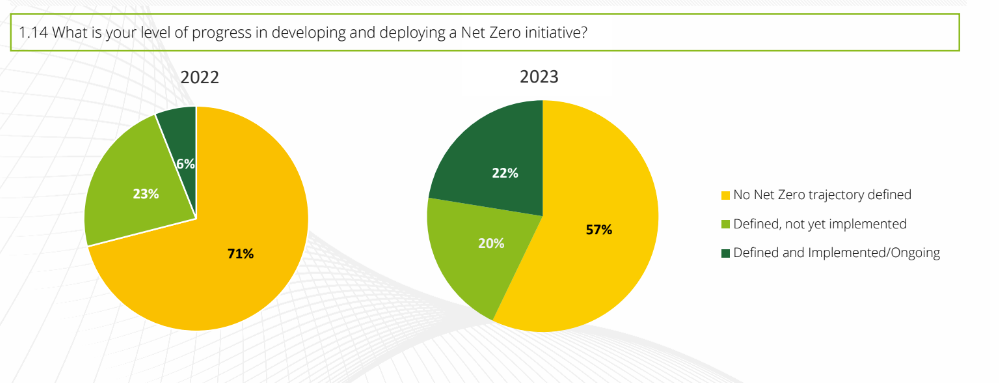

Despite Africa’s $250bn annual climate finance needs, investment in green finance remains limited with only 10% of respondents committed to green bond issuance.

The industry will also need to explore realistic paths towards the zero-carbon objective, given that only 22% of financial institutions have a clear net-zero trajectory.

Industry attractiveness declines but doors open for local champions

The African financial industry’s perceived attractiveness has been severely impacted by political turmoil in the region and divestments by major international players over the last five years, such as Standard Chartered, BNP Paribas and Société Générale.

Only 48% of respondents consider the industry more attractive, compared with 61% in the last Barometer.

Nevertheless, international banks scaling back African operations has benefited a number of local banks, which have not only increased in size and geographical presence but have reworked their business models to become true continental champions that can compete on an international scale.

Capitalizing on pan-African opportunities

With 72% convinced that PAPSS – the Pan-African Payment and Settlement System initiative is a major accelerator of regional integration, leaders should harness this momentum and accelerative implementation of the African Exchanges Linkage Project (AELP) and African Continental Free Trade Area (AfCFTA) initiatives, whose short-term impact is still too weak.

As many as 90% of respondents meanwhile favour introducing a harmonised pan-African prudential framework for solvency and liquidity.

What They’re Saying

Ramatoulaye Goudiaby, Director AFIS, said: “The third edition of the African Financial Industry Barometer highlights significant progress and persistent challenges in the African financial industry. As the sector continues to navigate a complex global environment, this study underscores the importance of innovation, digital transformation, and regional integration in shaping a resilient and prosperous African financial future. The commitment to green finance and carbon neutrality, albeit nascent, is a positive step towards sustainable development.”

Aristide Ouattara, Partner, Financial Industry Leader, Deloitte Francophone Africa added: “By capitalizing on pan-African opportunities and overcoming structural obstacles, the African financial industry is well positioned to play a leading role in the global economy. Deloitte and AFIS remain dedicated to providing key insights and supporting the development of this vital sector for Africa’s future.”

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.