Fintech appears to be the trend these days in the tech startup space in Africa. More and more startups are building products that enable users to make payments for services including data, airtime, stocks, insurance, and other services. Companies are making make the push for cross border transfers between African countries.

In this article, we wanted to highlight a couple of apps that are on the come up and need to be paid attention to as they grow and scale with more users.

Here are payments that you need to pay attention to for the rest of 2020:

BitSika

BitSika is a payment and remittance app which helps makes cross border payments easier and efficient. The app also allows you send crypto currency.

The company which is lead by CEO, Atsu Davoh, is barely a year ago recently hit milestones including processing more than $1 million in transactions and receiving financial backing from ventures such as Microtractions.

The app has features including the ability to create a Dollar virtual Card, purchase airtime and send money to other users of BitSika.

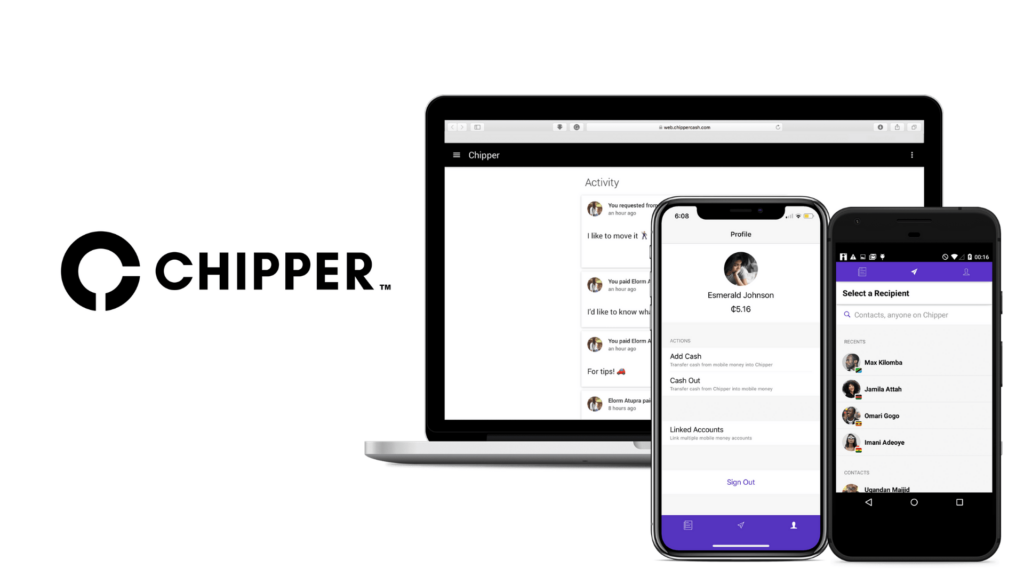

Chippercash

Chipper Cash is another payment app focused on cross border payments. The app enables users to send money to other countries including Ghana, Kenya, Rwanda, and Tanzania as well as other Chipper Cash users.

The company has recently raised $13 million in its Series A this year and is already expanding to other countries with bases already in Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa, and Kenya.

Barter By Flutterwave

Billed as a “lifestyle” app, Barter by Flutterwave allows users to make cross border transfers to other African countries as well as receive money.

The app also features the ability to purchase mobile airtime and create a virtual USD card for spending on services including Netflix, Spotify, and Amazon.

With Barter, you can also send and receive money from other Barter users.

Eversend

Lastly, Eversend is a payment app which has similar services with the other aformentioned apps.

The app is best described as a multi-currency e-wallet that allows you to exchange, spend, and send money at the best possible rates. Other features include purchasing of insurance (in some markets), creation of virtual debit cards, and bill payments.

Eversend also allows access to USSD channels so that anyone with a mobile phone can access financial services.

The app allows you to hold multi-currency wallets including Dollar, Euro, Naira, Kenya Shillings, Uganda Shillings, and British Pound.

ExpressPay

Locally, ExpressPay is the most visible fintech app in Ghana. The company’s app allows payments of airtime, data, and utilities including electricity and water. ExpressPay was one of the first companies to enable users to send money directly to their bank accounts with their “Bank Direct” feature.

What makes ExpressPay stand out is that stellar customer experience which makes them a big favorite amongst users.

ExpressPay gets a special mention because currently, it’s the only app which doesn’t do cross border transfers but is still highly rated amongst Ghanaian users.

There’s no word on if the company plans to expand to other countries or if they will continue to push and evolve their features in Ghana or what direction they might be leaning in. It’s still an app to keep an eye on.