Jesse Ghansah and his co-founder Barima Effah are ready to go live with their new startup called Float.

According to research, 85% of African SMBs have zero access to financing, and each day, African SMBs have billions locked up in receivables due to long payment cycles. This leads to cash flow problems that cause businesses to be late on important expenses and fulfilment of new orders.

Ghansah co-founded OMG Digital, a startup with offices in Ghana and Nigerian, that wanted to become the “BuzzFeed of Africa.” In 2016, OMG Digital was one of the first African companies accepted into Y Combinator.

Formerly Swipe, Float is an 18-month-old Lagos and San Francisco-based company aiming to close the $300 billion liquidity gap for Africa’s small and medium businesses. The company took part in YC’s Winter batch 2020, making Ghansah one of the few two-time YC founders in Africa.

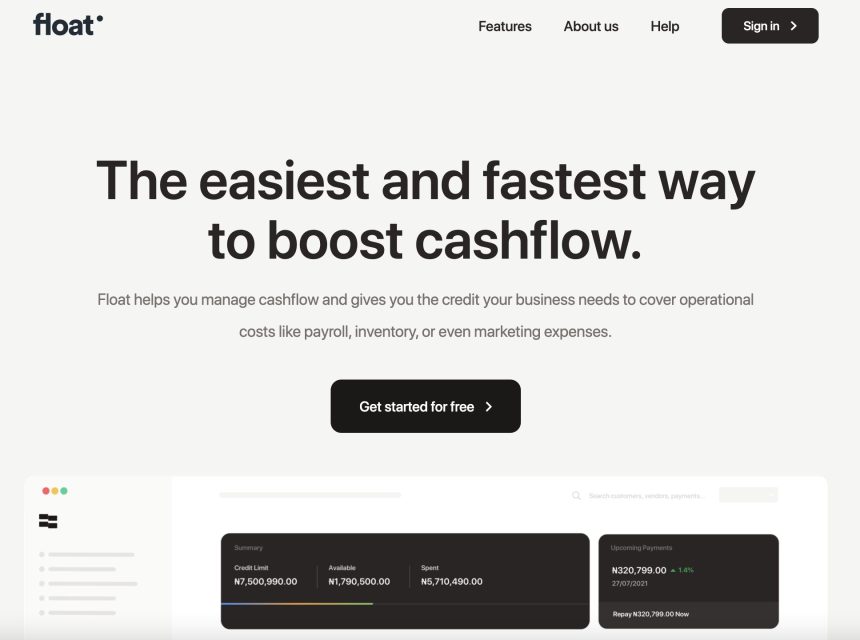

According to CEO Ghansah, Float is “rethinking the way African businesses manage their financial operations, from managing cash and making payments to accessing credit.”

“We’ve advanced $2.8 million to our pilot customers in Nigeria, and we don’t have any losses in the last eight months; it’s because of the type of loans we’re giving. We give businesses money to boost their working capital. So we’re essentially giving you an advance for your future revenue.”

After 18 months in stealth, Float is finally going live in the coming months.

Original Article: TechCrunch