The digital world is full of insecurities like identity fraud, cloning and many other vulnerabilities causing hurdle in achieving a secure environment in organisations. According to a study conducted by Javelin, it recognised that 16.7 million people had faced identity fraud in the year 2017 and this figure is 8% above than last year.

The figure of data theft, illegal transactions and many other fraudulent activities increased rapidly in the past few years. Hackers with their new strategies always try to breach in others system. Artificial Intelligence with its advanced approaches of the machine and deep learning creates an accurate and efficient process solution to eliminate obstacles involved in the organisational processes.

Biometric Authentication

Various biometric solution to achieve maximised security for in and out premises strengthen the identity verification process. It is an essential security protocol implemented in the operational systems.

Biometric authentication comprises deep learning to imitate the process of neural network information such as face detection, voice recognition, thumb imprints verification etc. Deep learning-based algorithms model elaborate enormous data sets such as containing images, faces, voice etc.

Face and Voice Recognition

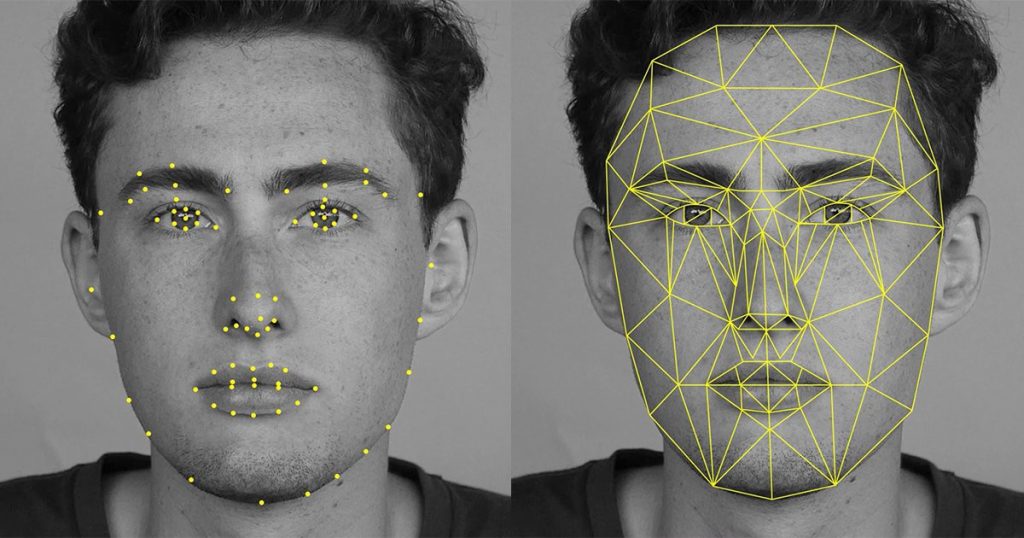

The face recognition technique detects for the image match with a person’s face to verify their identity. The algorithm used in the process perform pattern analysis to distinguish basic shapes like eyes, nose, cheeks and many complex structures like full face and other anomalies resulting in an accurate output saying whether a match was successful or not.

The use of artificial intelligence widely seen in banking sectors to prevent the fraud transactions. The machine learning-based mechanism analyses the real-time data generated from the banks and related assets to search for the anomalies or fraudulent transactions. Various threatening techniques such as card cloning, relay attacks controlled with incredible tools powered by AI.

The use of voice recognition technique appreciated by banking and other sectors implemented to verify customer information by examining their voice. Involvement of the cloud computing presents the valuable platforms to achieve the voice or text-based automated verification services in the applications. Multiple vendors available over internet offers the software, platform-based services with APIs and other useful modules simplifying the development of AI-related applications. They also provide machine learning course for beginners and professionals to drive their career growth with practical knowledge of AI.

The vast amount of data collected from sources in the industries identified with machine learning method by providing the new information as input to the learning models for improvement.

Spam Filtering

Many organisations are relying on the machine learning based classification for filtering spam emails containing the malicious code or asking for fake details. The emails marked as spam by the users are used to analyse the similar emails classification for prevention. Apart from the classification it also helps to track the attacker with its extraordinary pattern recognition methodology.

Addition in The Human Element

Few companies use machine learning to figure out flaws in their orders and then handover the problem to manual reviewers. What manual reviewer team do? They look for the suspicious transactions. According to the Annual Fraud Benchmark report of the year 2017, 83% of the merchants in the United States rely on a manual reviewer. They seem to have a lot of suspicious orders, and out of them, only 29% reviewed. Some of the customers delayed, they remain confused whether their order is confirmed or not. And the manual reviewer does not halt some order.

If we say Machine learning is all enough by itself, then we are wrong. Manual reviewers bring all the problems which were being solved by machines as they are slow and not entirely accurate. A reviewer’s job is to review all the transactions back to back and need to provide a decision as soon as possible. And it loses the ‘bird’s eye view’ impression of data, and this impression helps the machine to find the note and pattern trends. Fraud companies know very well about this problem, and they keep struggling to do their manual reviews up to date with the latest developing trends. The organisation gives them proper time to research and improve their skills in making decisions.

About The Author

Danish Wadhwa describes himself as “a Growth Hacker & Digital Marketing Consultant with an Entrepreneurial instinct”. He is an IT graduate, formerly from India, who landed in digital marketing by will. Being an avid writer, he took everything he learned in his career to help SMEs learn from his Growth Marketing Blog at Fly.Biz/Blog