Ghana is one of the fastest-growing fintech markets in Africa, with a vibrant ecosystem of startups, investors, regulators, and consumers. The country has been at the forefront of promoting financial inclusion and innovation through its progressive policies and regulations.

The country currently has a number of fintech operating in the region including Paystack, Zeepay, Flutterwave, and expressPay.

One of the key milestones in Ghana’s fintech journey was the enactment of the Payment Systems and Services Act, 2019 (Act 987), which provides a comprehensive legal framework for licensing and regulating payment service providers (PSPs) and electronic money issuers (EMIs).

So what are the different license types for fintechs in Ghana?

License Types

If you are a fintech company looking to operate in Ghana, you will need to obtain a license from the Bank of Ghana (BoG), which is the central bank and the main regulator of the payment systems industry.

Depending on your business model and activities, you will have to apply for one of the following license categories:

| License Category | Description |

|---|---|

| E-money issuer | This license allows you to issue e-money for storing value or making payments. You will need to have a minimum capital of GHC 20 million (about ~$1. 5 million) and comply with specific requirements related to e-money issuance, redemption, safeguarding, etc. |

| PSP card scheme | This license allows you to issue or acquire cards for payment purposes. You will need to have a minimum capital of GHC 8 million (about ~$630,000) and comply with specific requirements related to card security and interoperability. |

| Enhanced PSP | This license allows you to provide any form of payment service, including issuing e-money, operating payment platforms, facilitating cross-border transfers, and providing merchant acquiring services. You will need to have a minimum capital of GHC 2 million (~$160,000) and comply with various prudential and operational requirements. |

| Medium PSP | This license allows you to provide limited payment services, such as operating payment platforms, facilitating domestic transfers, and providing merchant acquiring services. You will need to have a minimum capital of GHC 800,000 (about ~$63,700) and comply with less stringent requirements than an enhanced PSP. |

| Standard PSP | This license allows you to provide basic payment services, such as operating closed-loop payment systems or providing third-party processing services. There is no minimum capital required. |

Full categories of licenses can be found on the BoG website

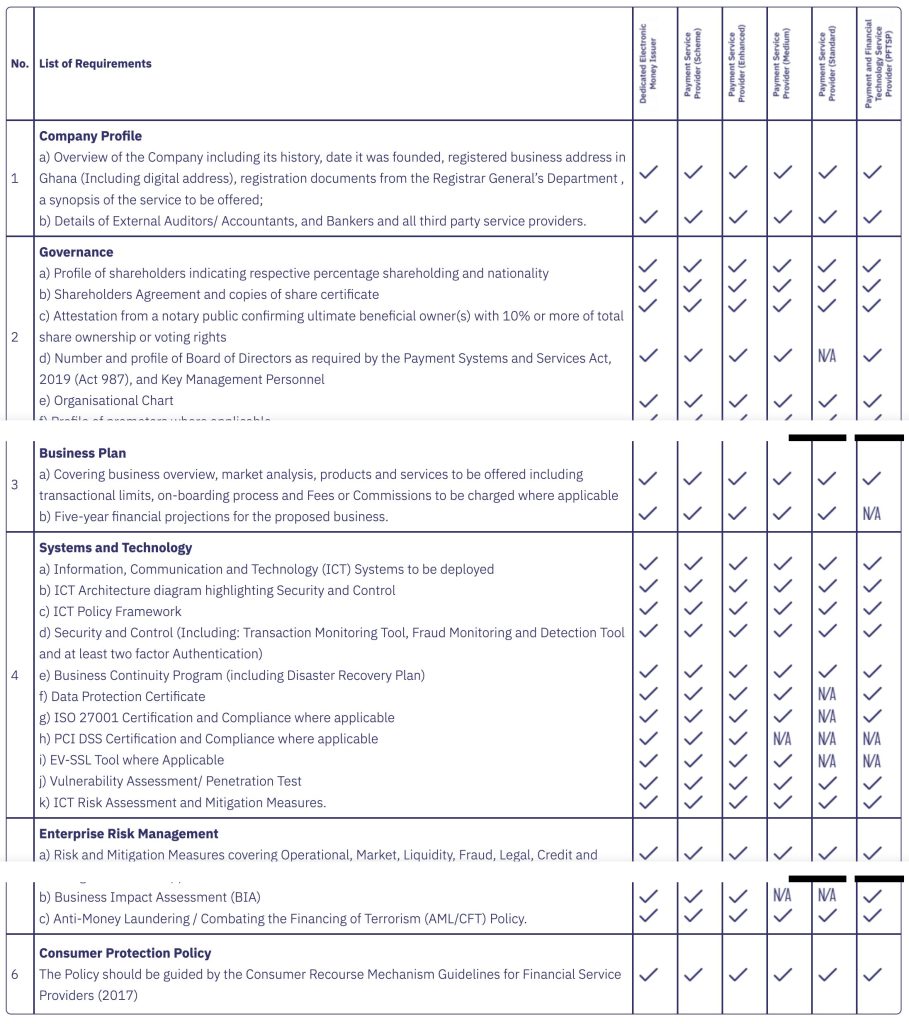

To apply for any of these licenses, you will need to submit an application form along with supporting documents such as business plan, financial projections, governance structure, risk management policies, AML/CFT policies, IT security policies, and audited financial statements, to the FinTech & Innovation Office at BoG.

You will also need to pay an application fee ranging from GHC 10,000 (about $ 1,700) to GHC 50,000 (about $8,500) depending on the license category.

Timeline and Approval

The BoG will review your application within 90 days and may request additional information or clarification if needed.

If your application is approved,

you will receive a provisional license valid for six months, during which you will have to meet certain conditions before obtaining a final license. Some of these conditions may include:

- Incorporating your company in Ghana with at least 30% local shareholding.

- Establishing a physical presence in Ghana with adequate staff and infrastructure.

- Obtaining relevant insurance coverages.

- Testing your systems and products for functionality and security.

- Signing agreements with relevant stakeholders such as banks, telecom operators, payment schemes, etc.

Once you obtain your final license, you will be able to launch your operations in Ghana subject to ongoing supervision and reporting by BoG. You will also have

to pay a fee every 5 years ranging from GHC 20,000 (about $3,400)

to GHC 100,000 (about $17,000) depending on the license category.

Getting a fintech license in Ghana can be challenging but rewarding if done right. You will be able to tap into a large market opportunity with high demand for digital financial services.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.

Support Tech Labari

Tech Labari currently relies on bootstrapping, ads, and sponsored content to publish news stories and articles to our thousands of readers in Africa and the world.

Financial contributions from our readers are a critical part of supporting our resource-intensive work and help us keep our site free for all.

Any contribution to Tech Labari would help to keep the site running