Today was the second and final day of the Africa Money And Defi Summit West Africa which was held at the Movenpick Hotel in Accra.

If you didn’t get the first-day highlights, you can check here.

Most of the morning events were filled with mostlt Masterclasses and panel sessions. Here are some highlights from the day:

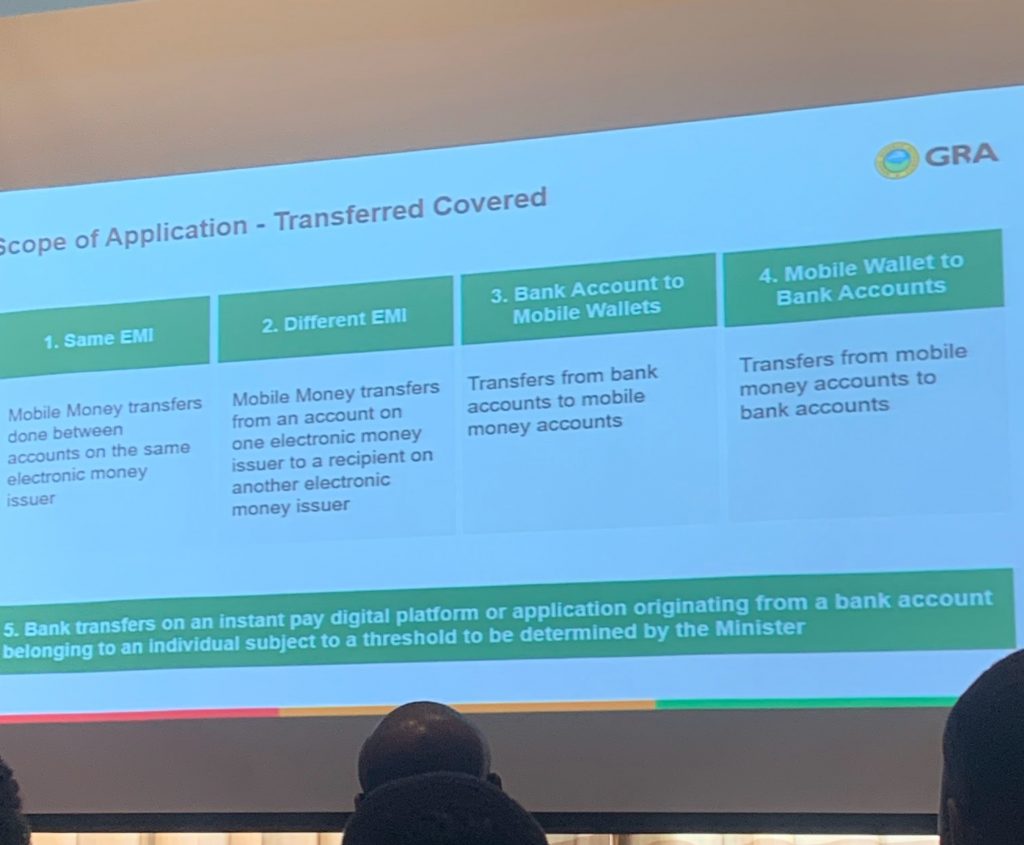

Ghana Revenue Authority E-Levy Masterclass

The Ghana Revenue Authority (GRA) held a masterclass about the E-Levy and its impact on businesses in Ghana. Although the reps from the GRA did not show data on how the levy is affectig businesses after the passage of the levy, here’s one major thing we learned:

The Ghana Card Tracks Your Threshold

Now that the GRA common platform has been fully implemented, a user’s daily threshold is essentially tracked across payment plaforms. That means, if you send 50 GHC on MTN mobile money to someone, it counts towards your threshold. If you then use Vodafone cash to send 50 GHC to someone else on MTN, that counts and exhausts your daily threshold. That user sending money on MTN again will be charged the e-levy. Make sense?

How does that happen? It’s because of the linkage of your Ghana Card to the GRA system (and presumably your SIM card).

For banks, the threshold is higher (20,000 GHC) than the 100 GHC on mobile money.

The GRA’s position was that it is only implementing the policy put out by the Ministry of Finance.

EMTECH Masterclass

EMTECH is a very interesing company in the finance space. They are providing a regulatory sandbox for regulators and fintechs. It’s basically a space where fintechs can see if they pass regulation from most central banks in Africa.

In their masterclass, they showed a live version of their platform and how it can help fintechs plugin and see what kind of documentation they need for regulation as well as use APIs for use cases.

DeFi Might Be The Future (?)

We sat through a couple of panels but what stuck out for us was the concept of DeFi (decentralized finance).

DeFi uses emerging technology (crypto, stablecoins etc) to remove third parties and centralized institutions from financial transactions. DeFi could make things interesting for traditional money transfer operations because a user could use stablecoins to make that transfer and incur very low fees.

This could be applied to other sectors like Real Estate and remove middle men and third parties from the equation.

We’ll see what the future looks like for DeFi and if it will take off in Ghana and the rest of Africa.