African insurtech aYo Holdings, jointly owned by telecommunications giant MTN and insurer Sanlam Allianz, is launching omnichannel insurance premium collections and claims payouts, through a partnership with payment orchestrator, Revio.

Details

This development will make it easier for aYo’s millions of customers to pay for life and hospital cash insurance by choosing their preferred method from a range of locally relevant payment options, in addition to MTN mobile money and airtime currently offered by aYo in its seven markets across the continent.

By The Numbers

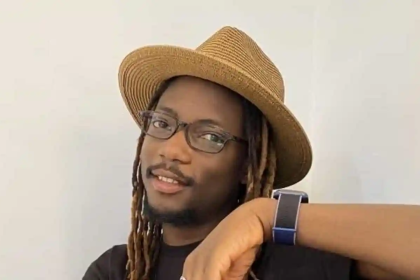

Miles Bloemstein, aYo’s Chief Operations Officer, who is championing the omnichannel payment strategy was inspired by the growth in alternative payment methods and adoption across the continent. While Africa’s digital payment transactions are growing 16% year-on-year – and are projected to reach $146 billion in 2023 – the continent’s payment landscape is notoriously complex and fragmented, with few universal and interoperable payment methods available.

Revio, which recently raised $5.2 million in funding from leading investors QED Investors and Partech, aims to reduce the complexity, cost, and risk of payment operations in Africa. Its single API is pre-integrated with more than 50 payment methods, with the ability to selectively expose methods and route transactions based on success rates and local adoption.

What They’re Saying

“Localisation of payments and collections is key to business success in Africa. Our team has spent significant time in our different markets to understand local payment preferences and cultures, and the feedback is clear – payment methods matter. If customers do not see the payment methods they trust and prefer, they will not buy the product.,” said Bloemstein.

Revio’s co-founder and Chief Operating Officer, Nicole Dunn, shared, “It’s fantastic to see market leaders like aYo adopting such a customer-centric approach to collections and payments. Today, the customer payment experience is almost as important as the customer experience of the product. aYo’s team deeply understands its customer base and has invested in the capabilities to reach new customers and retain them for longer. We’re excited to support them on this journey.”

“Africa’s collection challenges are complex and unique. By helping aYo collect revenue from its customers using their preferred payment methods, we not only increase payment success rates, but reduce lapse rates and churn,” said Dunn.

Why This Matters

The partnership will reduce aYo’s integration effort to launch new markets, and ongoing operational cost associated with managing multiple payment methods and providers.

It is estimated that it will save at least 10 months’ development effort per market. In the process, aYo will reduce integration and setup costs considerably through a single integration project for all of the company’s existing markets.

What Happens Next

The partnership is live in Nigeria and will soon be launching in aYo’s other markets. Not only will aYo customers have access to more localised and accessible payment methods for premium collections, but also payouts.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.