Kenya fintech firm Zanifu has closed a $1 million seed round to scale its business and improve on its platform, Zanifu offers short-term working capital loans to MSME’s in the Fast-moving Consumer Goods (FMCG) Supply Chain.

They also plan to enable financial access for more than 15000 FMCG retailers in the next 12 months. The round included Saviu Ventures, which invested in a pre-seed round in early 2020.

Others who participated include Launch Africa Ventures, Sayani Investments & Angel investors from Kenya & Nigeria, including founders & executives of some of the top tech start-ups in Africa.

Founded in 2017 by Steve Biko & Sebastian Mithika, the company launched in 2018. They have disbursed over 85,000 loans worth over $13M to over 7,000 MSME’s in Kenya. Zanifu says it is one of a few digital B2B lenders in Kenya, specializing in MSME loans.

Similar companies in the African Tech ecosystem include Numida in Uganda & Pay Hippo in Nigeria.

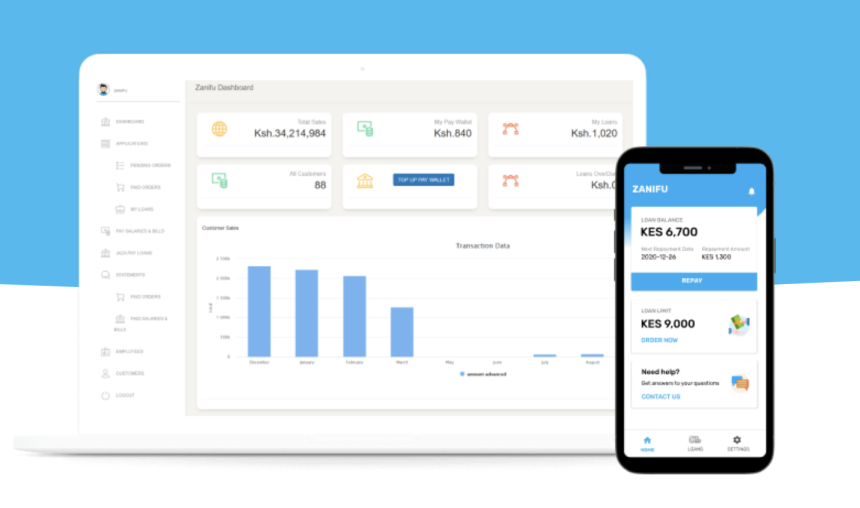

Zanifu works with several manufacturers and distributors to extend the credit to these small businesses with retailers already sourcing products from the startup’s partners qualifying for the financing. Zanifu has created platforms for manufacturers, distributors, and retailers that ensure seamless ordering, payment, tracking, and fulfillment.

Retailers borrow through Zanifu’s loan app, where they upload information that includes historical purchase data.

The retailers are then assigned a credit limit, after its algorithm scores them, within six hours after signing up. Retailers have up to a month to pay back the loans, which attract an interest rate of 3.5 to 5%.

Zanifu, which has a presence throughout Kenya, is now seeking to enter Ghana and Uganda.

“In Kenya, there are about 5 million MSME’s of which only 1 million are formally registered, & World Bank estimates there is a $20B financing gap here alone. In Sub Saharan Africa, the theme is amplified with a finance gap of $331B & over 44M formal MSME’s,” said Sebastian.

“We serve FMCG retailers, especially the ones that are too small access traditional bank finance for their businesses. The only option these MSME’s have been digital consumer loans, which are not always suitable for them. We are filling a critical gap in providing stock financing, which is enabling small businesses to grow their turnovers by more than 40%,” co-Founder & CEO, Steve Biko.

Source: Techweez