Kuda, a startup challenger bank in Nigeria that operates a popular mobile-first challenger bank for consumers and (soon) small businesses, has announced that it has raised $10 million.

The $10 million is being led by Target Global, the giant VC out of Europe, with Entrée Capital and SBI Investment also participating, along with a number of other notable individual fintech founders and angels.

The list includes Raffael Johnen (founder of Auxmoney), Johan Lorenzen (founder of Holvi), Brandon Krieg/Ed Robinson (founders of Stash), and Oliver and Lish Jung (angel investors in Nubank, Revolut, and Chime).

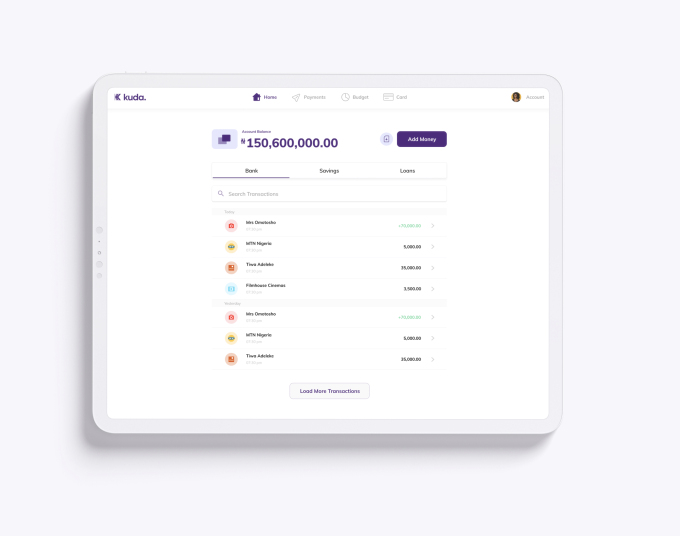

Since launching in September 2019, Kuda has acquired around 300,000 customers — first consumers and now also small businesses — and on average processes over $500 million of transactions each month.

Kuda — which is co-founded by Ogundeyi and CTO Musty Mustapha — had raised $1.6 million in a pre-seed round to launch a beta of its service.

Unlike other challenger banks, Kuda does not partner with other banks to manage and back deposits. Instead, it has obtained a microfinance banking license from the central bank of Nigeria.

This means that it manages payments, transfers, issues debit cards (in partnership with Visa and Mastercard). It also, he said, has partnerships with the incumbent banks Zenith Bank, Guaranteed Trust and Access Bank for people to come in for physical deposits and withdrawals when needed.

Source: Techcrunch