Opening a bank account in Ghana can sometimes feel like a strenuous process. From filling out long paper forms to providing documentation about your identity and place of residence, it sometimes feels like you’re trying to register for a top-secret agency than opening up an account to store

There are a few banks in Ghana who are trying to be the digital frontrunners when it comes to banking in Ghana. Standard Chartered is one of those

At Tech Nova, we decided to give this a test run to see how easy it was to open a bank account with just their mobile app.

Online Registration

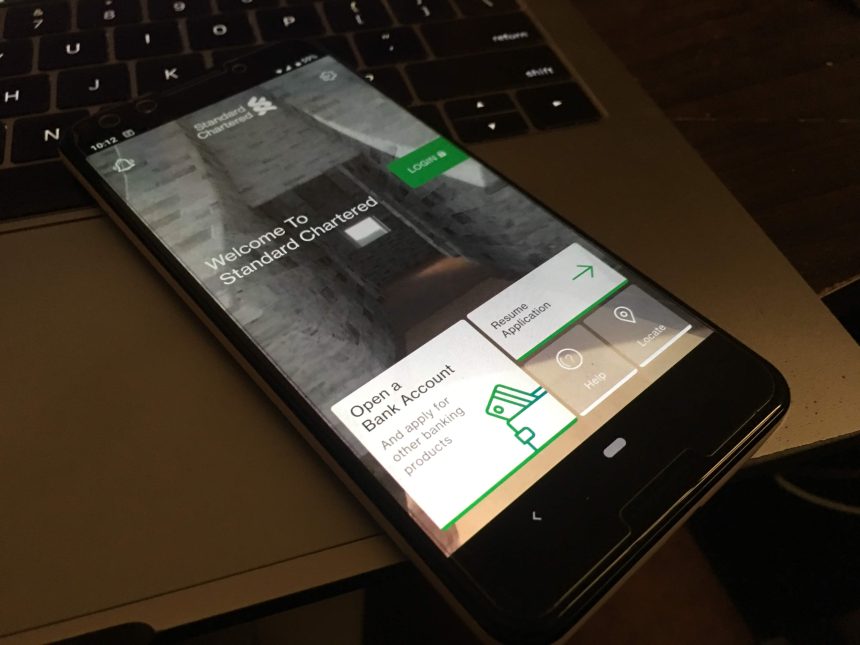

The SC Mobile app has a great landing page with a nice scrolling video in the background along with big buttons asking users to “Open A Bank Account” or “Resume Application” if you have started the registration process.

Online registration was pretty straight forward. You fill in your personal details such as your name, Date and Place of Birth as well as other personal data.

For identification, you will need to take a picture of a valid ID and upload it to the app. This could be your Driver’s License*, Voter’s ID, Passport and other identification.

*(If you have a biometric Driver’s License, it will not be accepted at the moment according to a rep I spoke to Standard Chartered)

I had a few issues when taking a picture of my ID with my device (I use a Google Pixel 3) where the app would reset when uploading a picture. But if you use any other Android device or iPhone, it’s likely to be a non-issue.

There is a section in the form which requires you to list your place of employment. Unfortunately, it’s a dropdown menu already populated with places of employment. There’s no option to select self-employed or enter your own business. That’s something which needs to be rectified as not everyone’s place of employment would be listed in that section.

Completing The Process And Getting Your Debit Card

After finishing up your online form and submitting, you will be contacted by a rep from Standard Chartered to rectify any issues with your online form.

But if everything is good to go, the process of applying online takes about 2 days. I resolved all

I met with an agent at the agreed location and completed the second stage of activating my account. I received my debit card as well as my temporary login ID for my online account. And that was it.

I had my Debit card and my online banking credentials without ever stepping inside of a bank branch.

So in all, registering for Standard Chartered account online takes about 2 days to complete if you get all your information right.

What Does This Mean For The Future Of Online Banking Registration

There are still some flaws and problems with online registrations. The need to have multiple IDs instead of a National ID might be problematic for some and the addressing system is still not solved (There was no option to input a GhanaPostGPS address when filling out the “Address” section of the online form)

Dispute these small issues, there’s promise in Standard Chartered’s initiative. It makes them standout digitally when it comes to online banking. Having the option of opening an account without the need to physically go to a branch takes away the headache of filling out physically paperwork and going through traffic and unrelenting hot weather.

When the other banks might catch up remains to be seen. The online registration is not flawless by any means but being able to open an account at my place of comfort is an option I would take anytime.

You can check out the experience for yourself by downloading the app on iOS or the Google Playstore.