Ghana-based fintech Oze has secured investment from Visa and German development finance institution DEG to expand its AI-powered digital lending solutions for SMEs.

The round also saw participation from existing investors, including Speedinvest and AfricInvest.

Why it matters

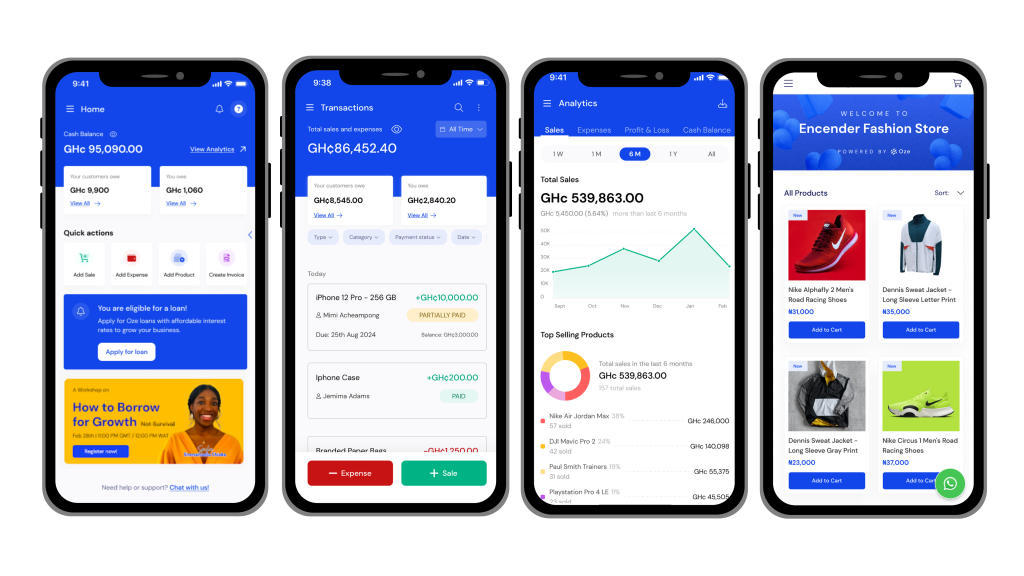

Oze is pioneering AI-driven digital lending in Africa, enabling banks, microfinance institutions, and fintechs to offer unsecured loans to small businesses.

The funding will help scale its Lending Management System (LMS) across more markets.

What they’re saying

- “Visa is committed to fostering financial inclusion in Africa, and Oze’s vision aligns perfectly with that mission,” said Fabrice Konan, Visa Ghana’s Country Manager.

- “Oze’s technology unlocks financial opportunities for millions of SMEs, driving sustainable development,” said Dr. Tobias Bidlingmaier, Head of Up-Scaling at DEG.

- “This funding accelerates our mission to empower small businesses across Africa,” said Meghan McCormick, Oze’s Co-founder and CEO.

Between the lines

The investment follows Oze’s participation in the Visa Accelerator Program, where it was one of the first startups to receive backing.

The program supports top African fintech startups with mentorship and growth resources.

What’s next

In partnership with commercial banks such as Ecobank, Oze operates in Ghana, Nigeria, Guinea, Benin, Rwanda, Madagascar, Zimbabwe, and Lesotho, with plans to expand further across the continent.

It was also named a finalist for the Milken Motsepe Prize for Fintech, competing for a $1M award.