PalmPay, the African digital bank and payments fintech, is in talks to raise between $50M and $100M in a Series B round.

- The company declined to comment on fundraising specifics, but a spokesperson said PalmPay is “in a strong financial position and exploring growth opportunities.”

- The six-year-old company has already raised nearly $140M in seed and Series A funding.

- It is now profitable, according to people familiar with its financials.

Why it matters

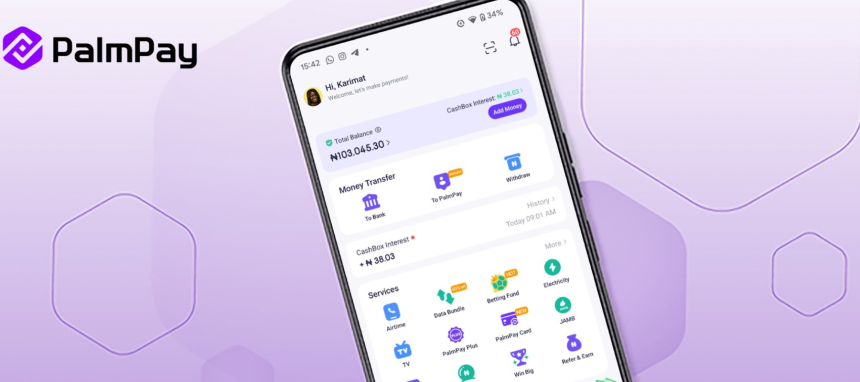

PalmPay is one of Africa’s most-used fintech apps — and it’s preparing to go global.

- The new capital will be used to deepen its Nigerian footprint, scale its business-facing products, and expand across Africa and Asia.

- It’s currently live in Tanzania and Bangladesh, where it leads with device financing and consumer credit.

By the numbers

- 35M registered users

- 15M daily transactions

- Annual transaction value in the “tens of billions”, per the company

- 2023 revenue hit $64M, and has more than doubled since, sources say

The big picture

PalmPay launched in 2019 to serve Nigeria’s underbanked, bypassing traditional banks with a mobile-first, agent-powered model.

- It built a network of over 1M agent merchants to serve small businesses and informal customers.

- Around 25% of users say PalmPay was their first-ever financial account.

- For credit users, 60% say it was their first loan experience, via licensed lender partnerships.

Zoom in

PalmPay’s reach has been boosted by its partnership with Transsion, Africa’s top smartphone maker (Tecno, Infinix).

- The app is pre-installed on financed phones, helping drive mass-market adoption.

- PalmPay plans to introduce device financing in Nigeria, and is courting more OEM partnerships.

What’s next

- Rollout of cross-border payments for merchants, already processing hundreds of millions monthly, per a spokesperson.

- Plans to replicate its hybrid model in more emerging markets across Africa and Asia.

Source: Techcrunch