The 2025 Partech Africa Tech Venture Capital Report reveals a market in a state of “resilient recovery.” After two years of contraction, the African tech ecosystem is rebounding, driven by a record surge in debt financing and a stabilization of equity markets.

The Big Picture

African tech funding climbed to $4.1 billion in 2025, a 25% year-over-year increase. This marks a definitive break from the “funding winter” of 2023–2024, signaling that the ecosystem has found its footing in a higher-interest-rate environment.

- Debt is the new engine: For the first time, debt financing is no longer a footnote. It hit a record $1.64 billion (+63% YoY), now accounting for 41% of all capital deployed on the continent.

- Equity finds its floor: Equity funding reached $2.4 billion (+8% YoY). While the “growth at all costs” era is over, deal sizes at Series A and B grew by 21% and 12%, respectively, signaling a return of investor conviction in scaling companies.

Winners and Losers

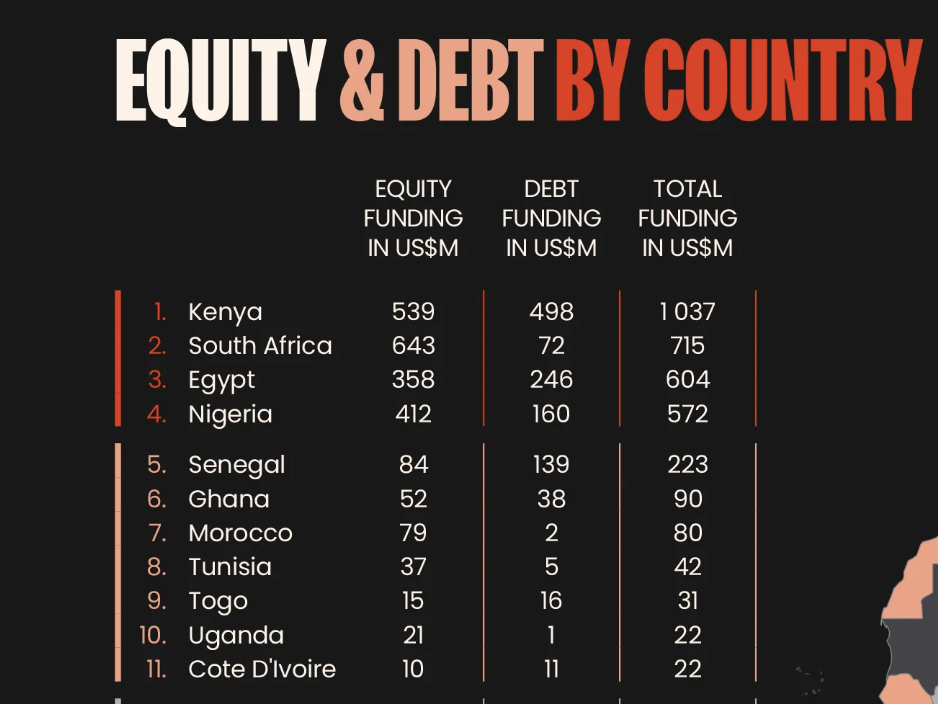

Geographic dominance: The “Big Four”—Kenya, South Africa, Egypt, and Nigeria—captured 72% of total capital.

- Kenya took the top spot for total capital ($1.04B), largely due to its dominance in cleantech and debt.

- South Africa reclaimed leadership in equity deal flow for the first time since 2017, proving its status as the most “normalized” and mature equity market.

- Nigeria remained highly active but saw lower absolute volumes compared to its historical peaks.

Sector shifts:

- Fintech still leads with $769 million in equity (25% share), but its dominance is shrinking as the market diversifies.

- Cleantech ($550M, +186%) and Healthtech ($215M, +232%) saw explosive growth. This is the first time since 2022 that multiple non-fintech sectors exceeded $200 million in annual funding.

Between the Lines

The report highlights a “bifurcation” in the market.

- Investors are flocking to early-stage (Series A) and late-stage (Growth) companies with proven unit economics.

- The Seed+ stage continues to struggle, with funding decreasing by 4% as “tourist” investors who lacked local presence have largely exited the market.

The Bottom Line

The African tech ecosystem has matured. The rebound isn’t being driven by hype or a few massive “megadeals,” but by a disciplined increase in mid-to-late stage activity and a sophisticated use of debt.

What to watch

As Francophone Africa gains ground (now 68% of equity funding outside the Big Four), look for the next wave of regional hubs to emerge from Senegal and Morocco in 2026.

Learn more about other African tech startups on Labari Insights, our data repository for tech in Africa: insights.techlabari.com