Payoneer, an online finance company, has announced that it will now allow users to accept PayPal payments from US clients on its platform.

Payoneer users can send payment requests to clients to receive payments and those clients can select PayPal as a payment method.

The Catch

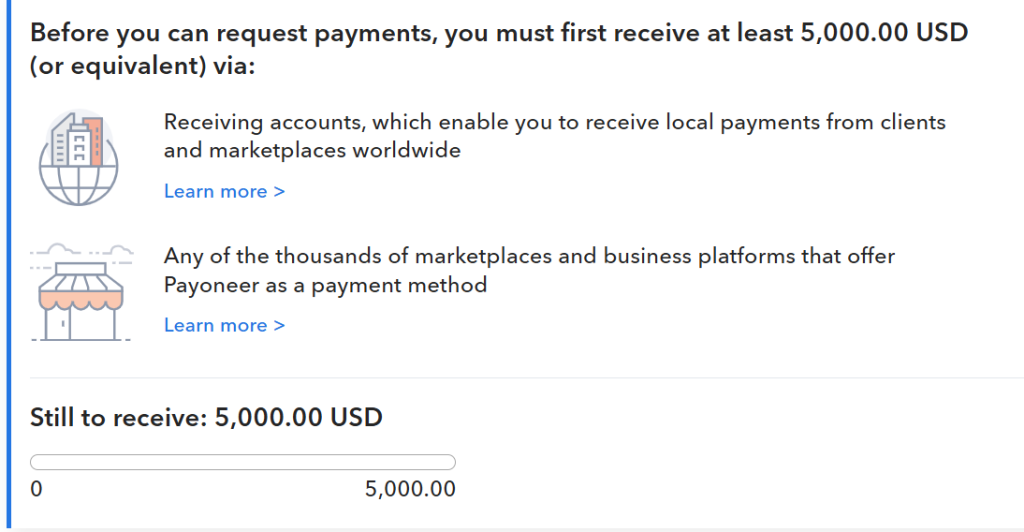

If you’re a new user to Payoneer, getting access to request a payment from a US-based client is not straightforward.

According to Payoneer policy, new users first have to receive $5000 in their accounts via different means including using trusted sources including Buy Me Coffee, Fiverr, and Upwork.

Zoom In

In 2019, Vice President Mahamudu Bawumia commented at an event in which he stated that PayPal would be available in Ghana by the second half of 2019 and Ghanaians would be able to make payments in early 2020.

Unfortunately, those plans did not materialize.

Zoom Out

In 2004, PayPal blacklisted Ghana, along with Nigeria and some other sub-Saharan countries due to the high incidence of credit card fraud. Nigeria was removed from the blacklist in 2014.

Our Take

We would suggest alternative options for receiving money from US clients by local means. Paystack and Flutterwave offer international payments for users based abroad.

US clients can also remit payments via remittance platforms including LemFi, Sendwave, WeWire, and Remitly.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.