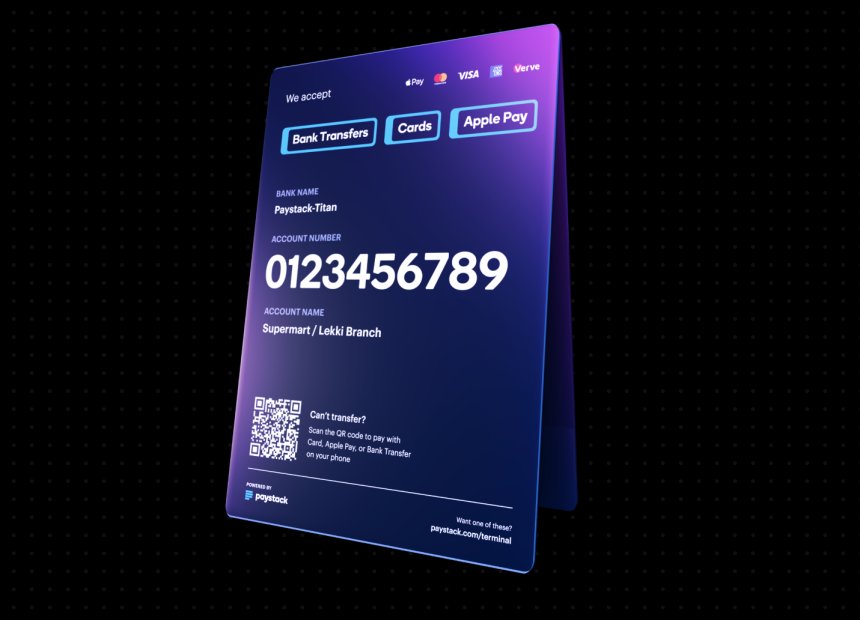

Paystack, the Nigerian fintech company, has introduced virtual terminals as a new product to enable merchants to accept payments through bank transfers.

Paystack’s virtual terminals serve as a digital alternative to physical point-of-sale (POS) devices, which are limited in circulation and can cause transaction delays in high-volume situations.

Details

The virtual terminals will aim to reduce wait times for payment confirmation.

The terminals will also support QR code payments, foreign bank cards, and Apple Pay.

Business owners can assign virtual accounts to sales agents, allowing them to monitor and verify transactions without the need for manager approval or access to the business’ bank accounts.

What They’re Saying

Paystack’s CEO, Shola Akinlade stated, “Bank transfers are fast becoming the go-to payment method for a growing number of consumers in Nigeria. With Virtual Terminal, we’re making it effortless for businesses to accept in-person bank transfers quickly, while providing a dignified customer experience.”

Why This Matters

This launch of virtual terminals is an expansion of Paystack’s strategy to extend its services beyond web-only payment collection. Since its establishment in 2015, the Nigerian payments market has experienced significant growth, with numerous fintech companies offering digital fund collection and settlement services.

Offline payments have emerged as a critical segment driving the growth of electronic payments in Nigeria, with POS transactions accounting for approximately a fifth of the volume.

By The Numbers

The bank transfer payment method has seen significant adoption, representing 12% of transactions on Paystack in 2021 and increasing to 28% in 2022. In 2023, this method has surged, accounting for 34% of Paystack payments in Nigeria.

Source: TechCabal

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.