The Central Bank of Nigeria (CBN) has granted an Approval In Principle (AIP) to Abeg Technologies Limited, a product of Piggytech Global Limited, as a Mobile Money Operator (MMO) in Nigeria. With the platform becoming Nigeria’s first social commerce platform to secure the CBN’s AIP for an MMO license, the announcement marks a crucial development in the company’s bid to support seamless payments and online commerce throughout the country.

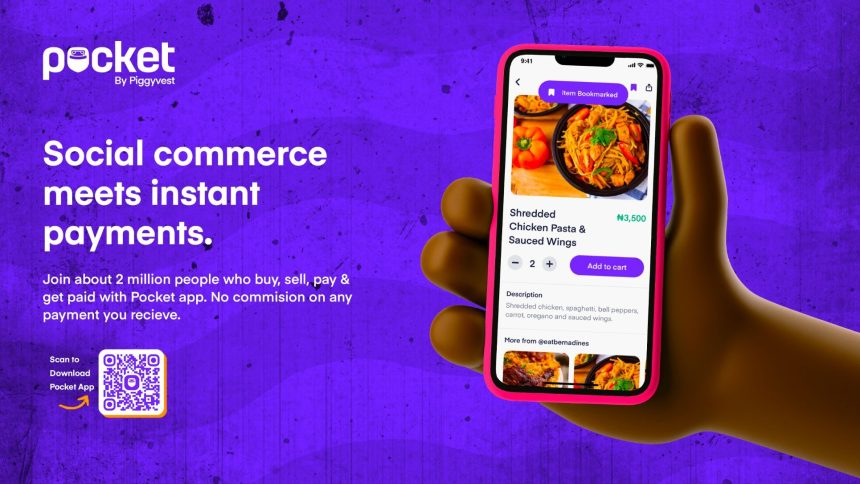

Additionally, in a move to underline its evolution from a money transfer app to a social commerce platform, Abeg is rebranding completely to “Pocket by Piggyvest” (PocketApp).

The platform’s new name references its added functionalities for users to buy and sell items via virtual pocket shops and reinforces its push into a social commerce market estimated to reach US$23.8 billion by 2028 in Nigeria alone.

PocketApp received an AIP dated April 25, 2022, from the Central Bank of Nigeria (CBN) for a license application to operate as a Mobile Money company. For the Piggytech subsidiary, this is the first step towards final approval, subject to the fulfilment of certain conditions as stipulated by the CBN.

Commenting on the approval, Odunayo Eweniyi, Co-Founder and COO of Piggytech Global Limited, stated, “We’re incredibly pleased that PocketApp has been granted an approval in principle as a Mobile Money Operator in Nigeria. We will now work closely with the Central Bank to meet all its conditions to receive the full operating license, enabling us to continue growing and expanding the scope of our social payments, social commerce and other digital financial products to reach millions of Nigerian micro-entrepreneurs.”

PocketApp affirms its commitment to the financial inclusion agenda of the CBN and the Federal Republic of Nigeria and will continue to make it easier for our teeming young population to seamlessly carry out their transactions while saving them costs and giving them more access to get paid.

The Mobile Money Operator license will enable the company to carry out activities around: Wallet Creation and Management, E-money issuing, USSD, agent recruitment and management, pool account management, non-bank acquiring as stipulated in the regulatory requirements for non-bank merchant acquiring in Nigeria, card acquiring, and any other activities that may be permitted by the CBN.

Speaking on the company’s evolution, Patricia Adoga, COO of PocketApp, states, “For the last 18 months, we have been focused on building the core infrastructure that will enable secure social commerce and payments at scale. We believe that social commerce will thrive better in a more trusted environment. So we added escrow to our payment infrastructure, protecting buyers and sellers and many other features, ensuring a smooth shopping experience on the app.”

The app was launched as Abeg App in 2021. New as PocketApp, the payments app has about 2 million users to date. The company initially started its journey as a payment platform for sending and receiving money. It has since ventured into a full social commerce app, connecting buyers and sellers across Nigeria and soon Africa.