“Please DM for price”

That’s a common phrase to see on social media platforms like Instagram and Twitter in Ghana. Small businesses and entrepreneurs often sell their goods and services through these online outlets. Users who are interested in buying these products and services usually ask for pricing and pay either through cash or more conveniently, mobile money.

In 2021, Mobile money transactions in Ghana hit GHC 953.2 billion. Mobile money transactions will probably continue to trend upwards but there are potential threats in 2022 which could slow down growth including a pending “E-Levy” tax being proposed by the Government of Ghana.

The Rise Of Online Payment Platforms

For businesses to scale up and expand, they would need to employ online tools to help with online payments and customer information. The unavailability of platforms like Stripe and PayPal has made local platforms become more attractive.

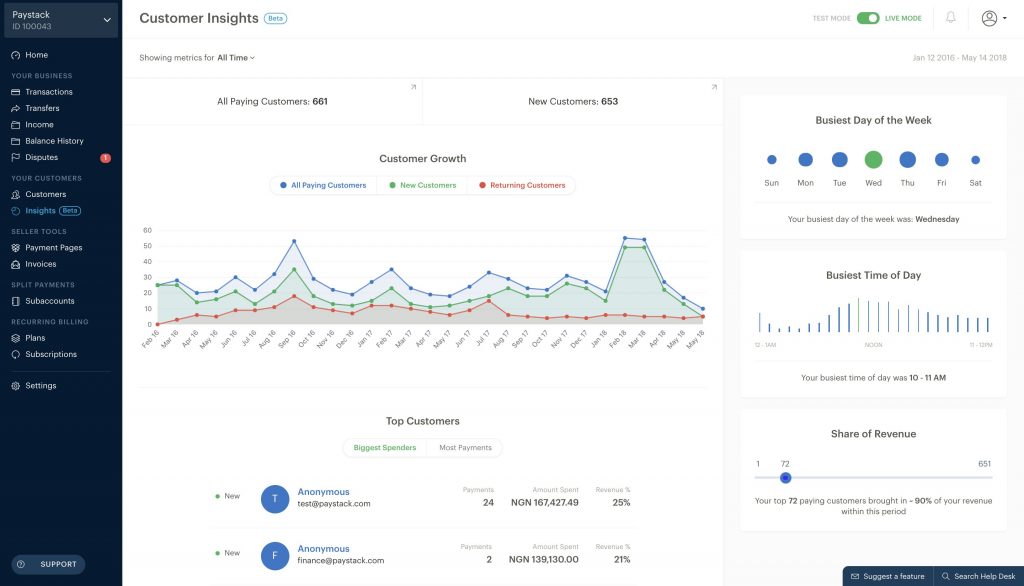

Platforms like Paystack and Flutterwave have allowed local businesses and entrepreneurs to setup to sell their goods and services online to their customers. These platforms enable users to pay for goods and services using not only bank cards but also mobile money as well.

Features on by these platforms including the ability to monitor sales using a dashboard and having customer information allow small business to easily track payment information to gauge how much they’re selling and analyse their transaction numbers.

The current hurdle that these platforms face is transaction fees (which can be up to 2% on card payments and 1.5% for mobile money). But other threats that these platforms face are social apps like WhatsApp and Instagram which make it more convenient for users to just directly message businesses and make transactions with mobile money.

Flutterwave tried to pilot something on Instagram but it didn’t get as much traction and the company had to shut it down.

But both platforms have had success with Paystack being acquired by Stripe and Flutterwave currently in “unicorn” status after reaching a $1 billion evaluation.

Online Stores

As Ghanaians slowly embrace e-commerce, online stores like Jumia are helping to normalise purchases online through its online store platform.

More brick and mortar stores like CompuGhana have started operating online stores where consumers can make purchases and have their items shipped to them.

Not to be left out, payment platforms have also pivoted to help with the creation of online stores for their customers. Paystack has an “Online Storestore” feature which allows users to create a store and list their inventory. Customers make payments using Paystack’s payment platform. Flutterwave also has a similar feature called “Flutterwave Store” which has the same concept.

With these platforms, small businesses and entrepreneurs can easily launch their e-commerce stores and have an in-built payment system baked in.

PAPSS To The Rescue For Easy Cross Borders Transactions?

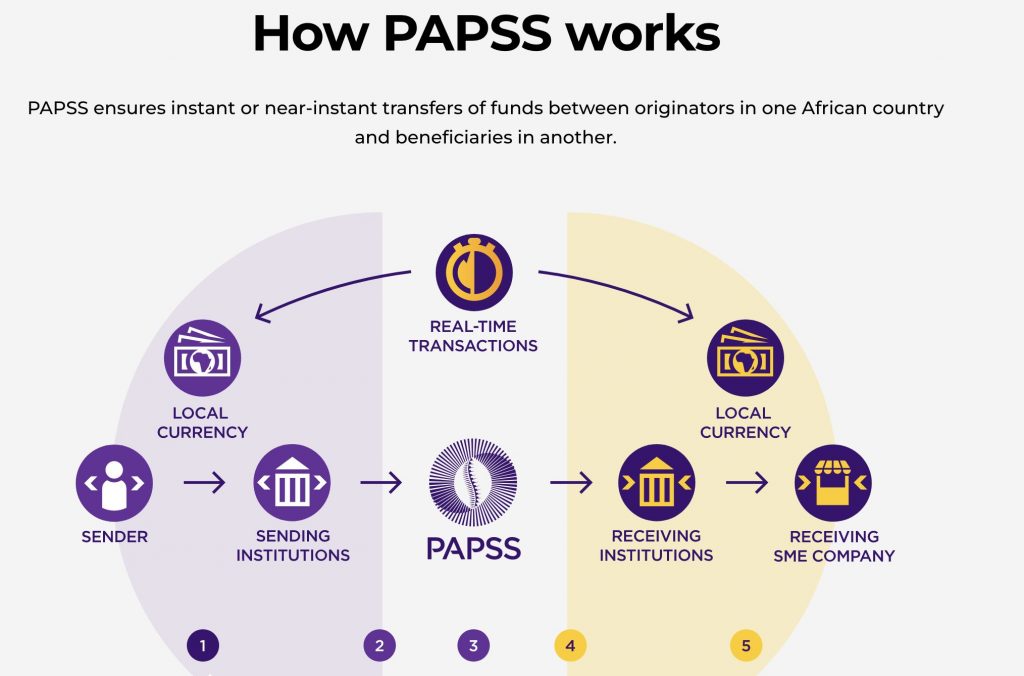

The Pan-African Payment and Settlement System (PAPSS) was recently piloted and launched. PAPSS is a cross-border, financial market infrastructure enabling payment transactions across Africa.

The platform has been launched commercially in Gambia, Gambia, Ghana, Guinea, Liberia, Nigeria, and Sierra Leone make up the WAMZ, a West African economic and integration organization. The PAPSS once it scales can become a big deal across the African contininent.

Currently, there’s not much information on how the system would work for small businesses but the potential is definitely there for businesses to easily start selling across Africa using their local currencies.

Threat Of “E-Levies” & Taxes

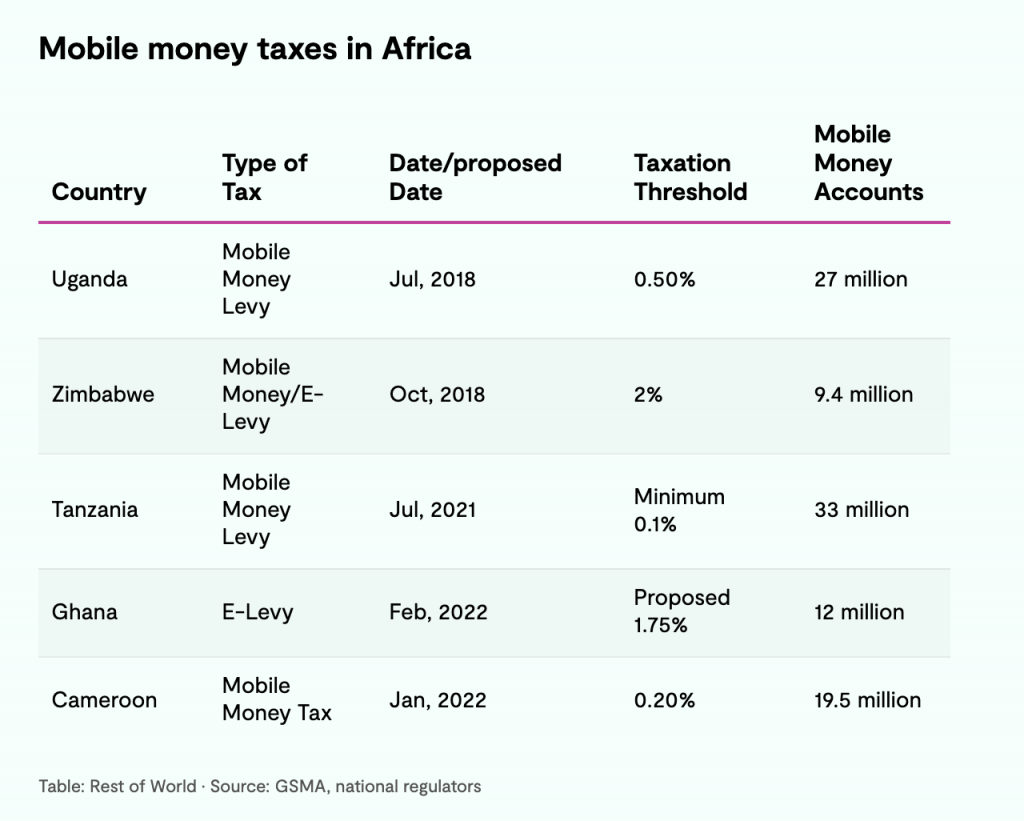

Recently, the Government of Ghana has stated plans to place an “E-Levy” on online and digital transactions including mobile money. There would be a 1.75% tax on mobile money transactions, POS and online banking transactions.

In other African countries, there are also already taxes on Mobile Money and new taxes on being introduced.

The effect from these taxes could change business behavior where businesses resort back to mainly cash transactions to avoid paying higher fees.

The upcoming E-Levy tax in Ghana could deter card transactions which were steadily on the rise. Online payment platforms would also be affected and the end result could be them raising their transaction fees to offset the tax charges.

It’s early days but new taxes like the E-Levy could have serious ripple effects on online trade and e-commerce in Ghana.

E-Commerce is still on the rise. It’s hard to account for how much gets spent through social media apps like Instagram and WhatsApp but since most of the modes of payment are largely mobile money, it’s fair to see that sales and commerce on these platforms are on the increase.

Online payment platforms like Flutterwave and Paystack keep seeing success and are expanding to other African countries and processing more transactions in these regions.

These is also a huge potential for the PAPSS platform which is likely to help with more cross border transactions.

But the threats of taxes like the E-Levy could push back the growth of e-commerce. Local uses could resort back to using cash for transactions which in turn could slow down the growth of e-commerce in Ghana and other places in Africa where the threat of these taxes exist.