Writing and covering the Ghanaian tech ecosystem can be tricky at times. The ecosystem has seen growth and expansion in recent years with most of the spotlight focused on the capital city of Accra. But other areas have been on the come up as far as contributing to the tech ecosystem. Tech hubs have been springing up in the Central region, Kumasi, and the Northern region.

As a tech writer, it’s hard not to compare the Ghanaian ecosystem to systems in other African countries including Nigeria, South Africa and Kenya when it comes to evolution of technology and the various startups trying to solve unique problems in their jurisdiction.

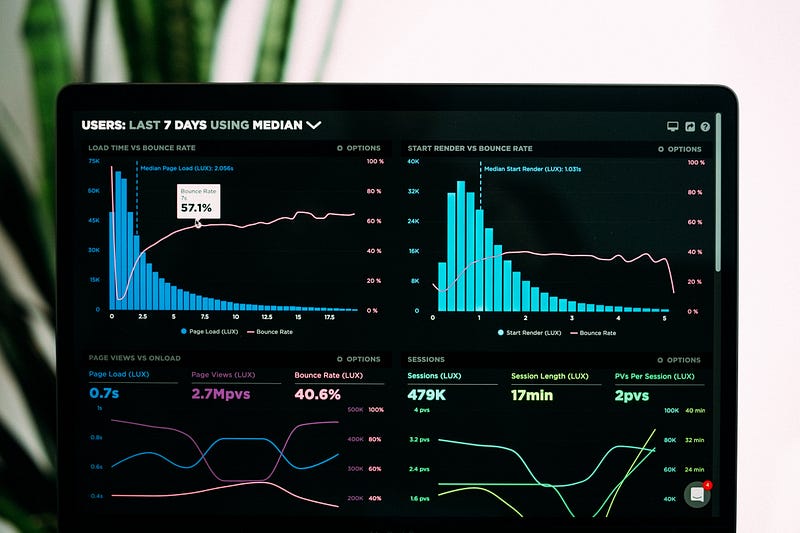

But getting detailed information from these areas including Ghana can be tough. Often times, you can’t help but ask the question: Where’s the data? How big is the current ecosystem and who are the players involved?

Dude, Where’s My Data

One of the main problems with writing about Ghana’s tech ecosystem is finding data about the latest trends and latest companies on the come up. Getting relevant information including the number of active startups, funding, and revenue for companies can be elusive at times.

Google searches don’t really help as much as most searches turn up mostly news items and clippings rather than hard numbers and facts. A reason for this is that most companies in Ghana don’t write as much about their journeys or their numbers (user growth, revenue growth etc). Unless you’re able to get insider information with permission to publish publicly, you’re kind of out of luck.

When you compare Ghana to other tech ecosystems in countries like Nigeria, it’s a bit different when it comes to finding data. Recently, Carbon, a Nigeria fintech company, shared their information on their finances to the public.

Other fintech companies like Flutterwave (2018 year in review) and Paystack (2017 Year in Review) also share yearly updates about how their businesses are progressing in their blog posts. Other companies also publish new features, updates and other relevant information on their company blog sites. It’s hard to say the same for Ghanaian companies or startups. There are a few but it’s still not enough.

But in hindsight, these companies and startups aren’t public companies and they don’t have to disclose anything to the public. But it would help with narrative building on the journey of these companies and how they’re succeeding/failing to get a better picture of how they’re doing.

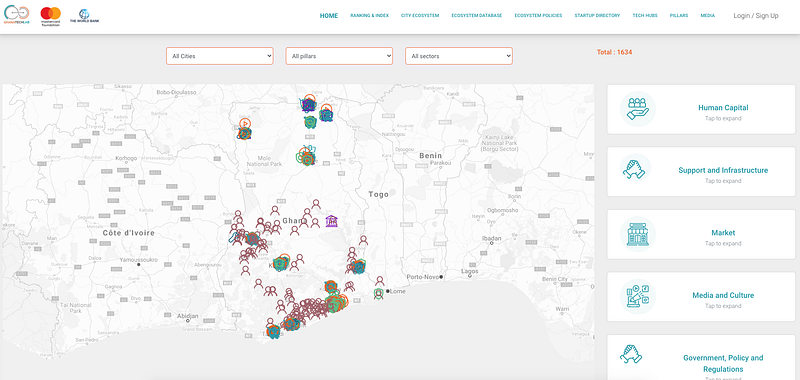

Thankfully, data gathering and open data sources are getting better. Entities like Briter Bridges and their intelligence mapping are helping with data on startups and funding in Ghana and other African countries.

New initiatives from the Ghana Tech Lab and their new ecosystem platform are also helping to put out data on tech hubs in Ghana.

The question is, will Ghana companies and startups be more forthcoming with their own data to help paint a better picture of the Ghanaian tech ecosystem?

Only time will tell.

Attack Of The “Clones”

One thing that sometimes plagues the Ghana Tech Ecosystem is “duplication”.

In certain sectors, there is an overcrowding of the same solutions being peddled by different companies with just a few outliers. One sector is fintech and the payment space. Lots of companies are deploying payment apps that allow users to pay for services including data bundles, airtime, and mobile money.

Unfortunately, many of these apps and solutions aren’t that unique and don’t offer any “unique” differentiation from the other. Competition in a specific sector is good but when companies all put out the same solution, it can be hard to find out how well that space is progressing.

There are a lot of sectors and areas yet to be exploited by technology in Ghana including insurance, investment/portfolio management, and homeownership/rent.

When Uber first entered the Ghanaian market to take on transportation with technology, lots of local competitors like Yenko and Uru Ride suddenly sprung up to compete. Unfortunately, the Uber brand might have been a little big for local competitors to overcome.

But nevertheless, it might be that Ghanaian tech ecosystem needs a spark from competitors in other countries before we start developing the same solutions and they might have to offer something a bit different to standoff.

Exposure

A common conversation among tech circles in Ghana is that tech startups and companies aren’t as “loud” when it comes to broadcasting what they do and what they offer and their successes.

There are lots of local startups which are attempting to solve unique problems but unfortunately, most don’t get the spotlight that they deserve.

Startups like BACE Group and Appruv are two companies using facial recognition to help with quick onboarding to institutions like banks and. BACE Group got a great press run recently when they and their founder Charlette N’Guessan won the 2020 Africa Prize for Engineering Innovation.

Appruve recently announced that they had gone live in Egypt for their identity solution.

But why don’t local startup get more local press? Why does BACE group have to win a prestigious prize before being “claimed” as company offering a unique solution?

Sometimes companies do tend to focus on their product rather than mass marketing or promotion. They don’t take advantage of new media including social media and podcast to tell their stories and update their users on new products and features coming out.

Mass media unfortunately also doesn’t do a good job of reporting on the tech startup space unless it’s something really major like an acquisition from a major firm or winning an international competition.

CitiFM’s Philip Ashon does have a show on Citi FM where he features tech CEOs and players in the tech space and has relevant discussions about the tech ecosystem in general.

But general exposure on technology in Ghana is still low when compared to other spaces like General Business and Entertainment news.

It could also be that tech companies and startups don’t want too much attention or maybe they’re trying to get regulators or government off their backs so they can focus on building. Or maybe it’s a cultural thing when it comes to not being “loud” about your success.

At this point, it’s more of a guessing game.

Collaborations, Acquisitions and Mergers

There aren’t a lot of mergers or acquisitions in the tech space in Ghana. I might be wrong as there might be behind the scenes discussions but on the forefront, nothing appears to be really happening.

That’s not to say there hasn’t been activity in the merger and acquisition space. There were reports of a merger between Zeepay and eTranzact but appears to not have come to fruition.

There also have been some past acquisitions including Emergent Technologies buying Interpay, a fintech company.

Aside from that, news of collaborations and acquisitions remain scarce.

In some tech circles, discussions about “trust” and working together appear to be a non-starter as some fear the stealing of their “ideas” or PSTD from previous bad deals.

But building a strong ecosystem definitely needs more collaborations and partnerships. And it’s not just with each other but rather with educational institutions and government as well.

Embracing User Experience

“User Experience” or UX is still a new concept for most companies and startups in Ghana. There is more focused towards coding and developers at the moment with design put on the sidelines.

It’s hard to find startups who employ UX designers or user researchers on their teams and sometimes it shows when it comes to product releases. Most products aren’t as refined with Good UX design and there are gaps in what their products want to achieve versus what they’ve coded or built.

A few companies including ExpressPay and some banking apps offer good UX experiences.

UX and Design Thinking are terms that companies are now getting familiar with. But there’s a long way to go for them to build apps and services which are design consistent, functional and provide the best experiences for the end user.

Hopefully, more companies will place more emphasis on designers to help improve their products with UX.

Government Intervention And Regulation

This is probably the writer’s opinions but far too often, Government tends to get in the way of the private sector and tech companies when it comes to deploy technology solutions.

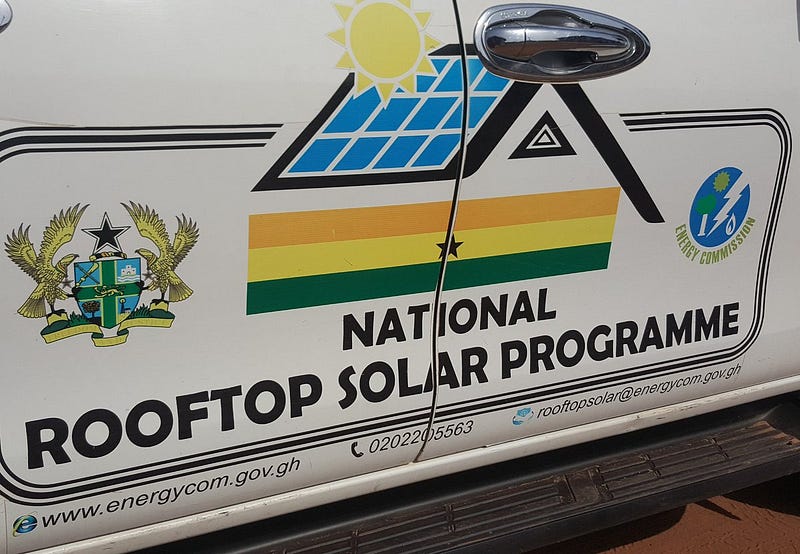

A perfect example is the deployment of Solar to residential areas. In the past, the Government of Ghana embarked on a National Rooftop Solar project.

The primary objective was to take the load of lighting for residents off the national grid by the use of Solar Photovoltaic (PV) technology.

Although it can be viewed as a great initiative, it might have been better for Government to set up the regulatory environment for solar companies to conduct this exercise with Government partnership in granting subsidies and reducing import levies for solar products.

The current government administration has been a bit forward-thinking on digitisation and has been bringing onboard local tech firms to implement some of its projects such as the digital addressing system and online payment for local government services.

With regulation, there have been strides made by some regulators. For the Fintech market, the Bank of Ghana is spearheading initiatives with its recent passing of the Payments Act to help provide guidelines for local fintech companies.

There’s a lot more that can be done with regards to regulation including reduction of bureaucracy and a better and more efficient way for registration of a business at the Registrar General Department.

More lobby groups by ecosystem players might help to push for better regulation in the long term.

What The Future Looks Like

The tech ecosystem in Ghana is still maturing. It has definitely come a long way with many opportunities and gaps to be exploited.

There are still issues with different circles not intersecting and collaborating with each other which only slows down the growth of the ecosystem. More company and educational institutional collaborations with groups like DevCongress or Ghana Facebook Circles could streamline developer talent to most of these companies.

The ecosystem is evolving but outside competition is not too far away especially from other tech ecosystems. Companies like Flutterwave and Paystack are already working locally and offering solutions that local startups aren’t offering.

More multinational companies are also looking to explore the African space. An attractive ecosystem could help bring companies like Facebook and Microsoft further into the Ghanaian space. Facebook is already looking to set up an office in Nigeria and Twitter CEO Jack Dorsey is looking to place his footing in an African country or countries.

Going forward, we hope more data about local startups and tech companies is more readily available to help get a better picture of the ecosystem at large. We also hope for more collaborations or partnerships between tech companies as well as mergers or acquisitions.

Stripe’s acquisition of Paystack will help to put more spotlight on African startups and Ghanaian companies need to be ready to show that they can run with everyone else.