In a landmark regulatory upheaval, Nigeria’s central bank has shown they can balance innovation and maturity with thoughtful financial services regulation.

The “Nigeria Payments System Vision 2025” marks a significant shift in the nation’s approach towards virtual asset service providers (VASPs) granting them the ability to operate accounts within banks and other financial institutions. Africa’s first comprehensive crypto regulator will refine their approach as they learn from the market and other regulators across the continent will follow suit.

This article is designed to be curious about dabbling into the space.

Crypto Beginnings

Since its 2009 inception, cryptocurrency has captured global imagination, and Africa has emerged as a fertile ground for its adoption, regulation, and innovation. Between 2012 and 2023, the African continent witnessed a remarkable transformation in its financial sector with the adoption and integration of cryptocurrency.

This period is not just a story of technological adoption, but a narrative of economic resilience, innovation, and a paradigm shift in financial practices. In this comprehensive analysis, we explore the journey through quantifiable data, impactful case studies, and significant milestones that have marked the continent’s foray into the digital currency space.

In 2018, the World Bank reported that only 42.6% of people over the age of 15 have an account at a financial institution, making this region home to the highest unbanked population in the world. Recent updates by statista still supports this claim.

The initial phase of cryptocurrency in Africa was characterised by curiosity and cautious exploration. By 2014, Kenya’s groundbreaking venture, BitPesa, demonstrated the practical utility of Bitcoin in facilitating cheaper and faster cross-border transactions. BitPesa’s success was a beacon, illuminating the possibilities of cryptocurrency in revolutionising remittances – a sector crucial to many African economies. In these formative years, though Africa’s contribution to the global cryptocurrency market was less than 1%, the seeds of a digital revolution were being sown.

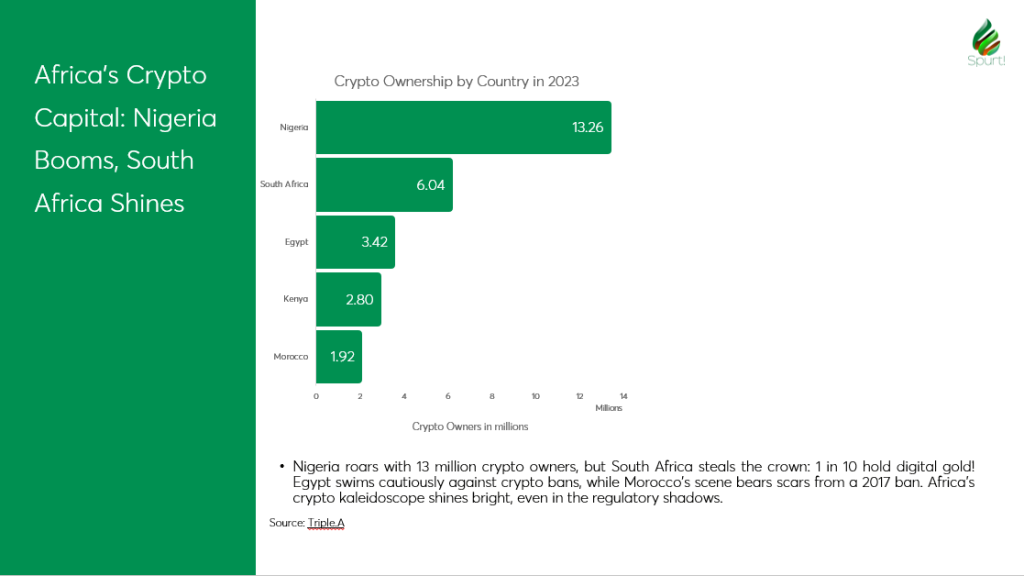

Notably, South Africa emerged as a cryptocurrency hub, with data from 2017 showing over 100,000 Bitcoin wallet holders.

A survey conducted in the same year revealed that 47% of South Africans were cryptocurrency investors or intended to invest, reflecting burgeoning interest. Additionally, Nigeria saw a remarkable rise in cryptocurrency adoption, driven by economic factors and a young, tech-savvy population. Reports indicated a 100% increase in Bitcoin wallet downloads in South Africa and a 1,200% rise in Nigeria. This period also saw a diversification in cryptocurrency usage, with Ethereum and Litecoin gaining traction alongside Bitcoin.

By 2020, the continent accounted for 14% of global P2P trading volumes, a clear sign of a growing appetite for digital currencies amidst varied regulatory landscapes. Nigeria’s weekly P2P Bitcoin trading volume consistently exceeded $10 million.

In 2018, world bank reported that only 42.6% of people over the age of 15 have an account at a financial institution, making this region home to the highest unbanked population in the world. Recent updates by statista still supports this claim.

Despite having the highest unbanked population globally, Africa is witnessing a surge in blockchain industry funding. According to a 2022 report by CVVC, African blockchain businesses experienced a staggering 429% increase in funding compared to a mere 34% rise in general venture funding. Notably, African countries secured 1.8% of global blockchain funding, a significant leap from the previous 0.3%.

Crypto Surge

As the cryptocurrency market cap globally soared, reaching approximately $800 billion by the end of 2017, African governments and regulators started paying closer attention. The period between 2018 and 2020 was pivotal in shaping Africa’s cryptocurrency landscape. Peer-to-peer (P2P) trading became a cornerstone of the crypto economy in Africa, particularly in Nigeria. By 2020, the continent accounted for 14% of global P2P trading volumes, a clear sign of a growing appetite for digital currencies amidst varied regulatory landscapes. Nigeria’s weekly P2P Bitcoin trading volume consistently exceeded $10 million.

This surge was partly attributed to the foreign exchange restrictions imposed by the Nigerian government, which led individuals and businesses to seek alternative means of accessing foreign currencies. The total value of monthly cryptocurrency transfers to and from Africa under $10,000 rose by 55% in a year, reaching over $316 million by the end of 2021. The number of monthly transfers also recorded a 50% increase.

The total market value of cryptocurrencies on the continent had skyrocketed, showcasing an astonishing year-on-year increase of 1200% from 2020 to 2021

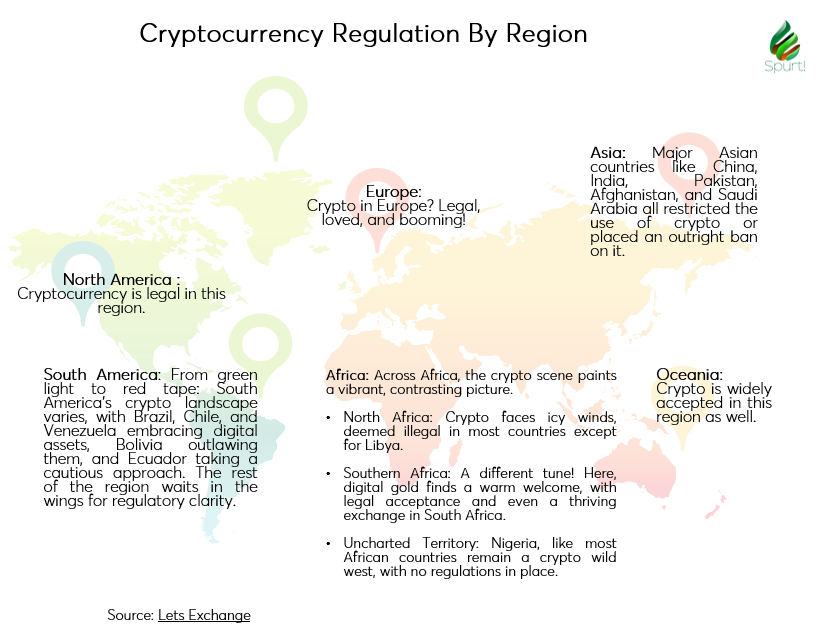

Crypto and Regulation

However, the increasing popularity of cryptocurrencies also caught the attention of regulators. In several African countries, regulatory stances varied, oscillating between cautious endorsement and stringent restrictions. For instance, Nigeria’s Central Bank, in 2021, issued a directive to banks to stop facilitating cryptocurrency transactions, citing concerns over volatility and financial security. Despite such challenges, the cryptocurrency ecosystem demonstrated resilience, with the market adapting through informal channels and decentralised platforms.

By 2023, the narrative around cryptocurrency in Africa had shifted from scepticism to integration. The total market value of cryptocurrencies on the continent had skyrocketed, showcasing an astonishing year-on-year increase of 1200% from 2020 to 2021. This phenomenal growth was not just in trading volumes but also in the adoption of cryptocurrencies for everyday transactions and in innovative projects.

One notable example is the Akoin project in Senegal, envisioned by musician Akon. This ambitious project aimed at creating a futuristic city powered by the Akoin cryptocurrency, demonstrating the potential of digital currencies in urban development and community empowerment. Such initiatives signified a broader trend where cryptocurrencies were no longer fringe assets but integral components of economic strategies.

What’s Next For Cryptocurrency in Africa?

Over the past decade, Africa has not merely witnessed the adoption of cryptocurrency; it has become a crucible of innovation, demonstrating the potential of digital currencies in fostering financial inclusion and economic development.

The journey from 2012 to 2023, rich in data and diverse case studies, reflects a continent dynamically engaging with the digital currency revolution. As cryptocurrency continues to evolve, its role in Africa’s economic landscape is poised to expand, promising new avenues for growth, innovation, and empowerment.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.