Tyme Group, a South African-born fintech with operations in Africa and the Philippines, has secured $250 million in Series D funding, pushing its valuation to $1.5 billion and cementing its unicorn status.

Driving the news

- The round was led by Nu Holdings (owner of Nubank), Latin America’s most valuable fintech, which invested $150 million for a 10% stake.

- M&G Catalyst Fund contributed $50 million, with existing shareholders chipping in the remaining $50 million.

Why it matters

The deal signals a rebound in fintech investment after a global slowdown caused by rising interest rates and underscores the growing investor appetite for digital banking in emerging markets.

By the numbers

- Tyme now serves 15 million customers across South Africa and the Philippines.

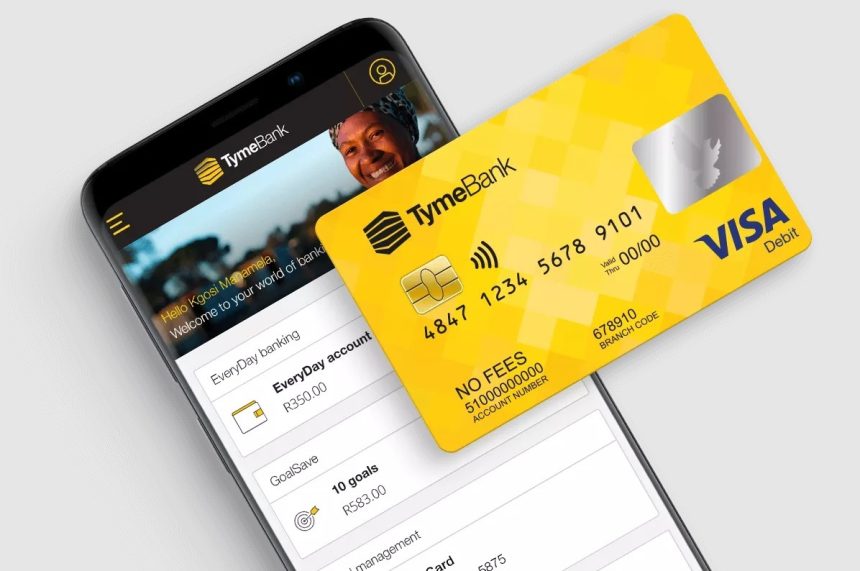

- In South Africa, its TymeBank brand has 10 million users.

- Its GoTyme brand, launched in 2022 in the Philippines in partnership with Gokongwei Group, has already attracted 5 million users.

- Tyme has raised over $400 million in deposits and provided $600 million in financing to small businesses.

Zoom in

Tyme operates a hybrid digital banking model that combines online banking with physical service points, offering checking and savings accounts, debit cards, and credit through buy now, pay later and cash advance products.

The big picture

- Nubank’s move aligns with its strategy to diversify geographically and tap into underpenetrated markets in Africa and Southeast Asia.

- With over 100 million customers across Brazil, Mexico, and Colombia, Nubank is looking to replicate its digital banking success in markets with large unbanked populations and growing smartphone adoption.

What They’re Saying

- David Vélez, founder and CEO of Nubank: “Tyme Group is extremely well-positioned to be one of the digital bank leaders in Africa and Southeast Asia. We are excited to work with Tyme to share our learnings of scaling this model to hundreds of millions of customers,”

Between the lines

Nubank’s interest in Tyme highlights its preference for strategic investments in growth markets over building operations from scratch.

- The deal follows Nubank’s 2021 investment in Indian neobank Jupiter.

What’s next

Tyme plans to expand into Vietnam and Indonesia in 2025, further solidifying its foothold in Asia while maintaining its growth momentum in Africa.

Source: Techcrunch

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.