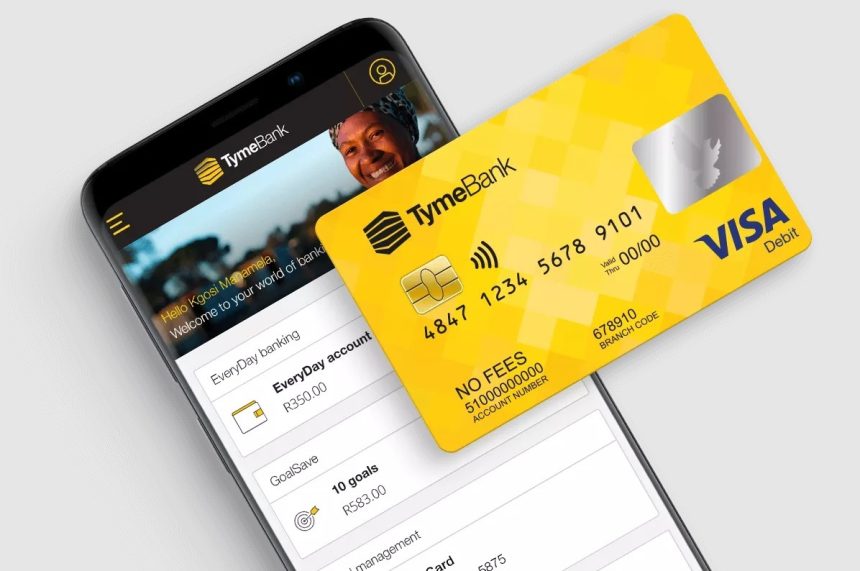

TymeBank, a South African digital bank backed by China’s Tencent Holdings Ltd., is raising $150 million to build scale as it prepares for an initial public offering (IPO).

The digital bank controlled by African billionaire Patrice Motsepe’s African Rainbow Capital expects to complete the round by the fourth quarter, to fund expansion plans, such as TymeBank’s move into Indonesia by year-end.

What They’re Saying

“We are currently valued at close to $1 billion and busy with our series D capital raise at unicorn valuation,” Chief Executive Officer Coenraad Jonker said in an interview in Johannesburg.

“Our target is to list TymeBank in New York by 2028, and we will most likely also do a secondary listing on the Johannesburg Stock Exchange for our South African shareholders.”

Zoom Out

TymeBank is now one of the fastest-growing digital banks in Africa and follows a similar business model to Brazil’s Nu Holdings Ltd., which also counts Tencent as a shareholder, and was listed in New York in 2021.

Zoom In

The digital bank started in South Africa in 2019 and now controls 10% of the primary bank market share in Africa’s most developed economy.

TymeBank has gone head-on with incumbent banks in the country, such as Africa’s biggest bank Standard Bank Group Ltd., and FirstRand Ltd.’s First National Bank, and is now the third largest and fastest growing lender by customer numbers, according to Jonker.

What Happens Next

Jonker said he plans to focus on expanding its markets in fast-growing Asian countries and already has operations in the Philippines and Vietnam.

Jonker wants to reach profitability in the Philippines in the next 18 months and provide a full retail banking proposition in Vietnam by next year, he said.

Source: Bloomberg

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.