Last year, I asked someone in Lagos how they do their regular banking transactions.

“Everyone uses online banking or banking apps”.

This is a sharp contrast to what you see in Ghana’s landscape. In Ghana, banks are now getting the memo that going digital is beneficial for their customers. It was only in 2017 that some banks started embracing the concept of “apps” with good design as well as online banking services.

Some banks have gotten the hold of the online concept while others are playing catchup.

Often times, it seems like banks are “hesitant” to take the full plunge into going more digital. In this modern-day and age, we still hear stories of customers literally drawing the directions to their locations on a piece of paper for their home address.

Also, customers still have to fill out a physical paper application to join a bank or write on a paper form when making cash deposits or cheque deposits.

When are Ghanaian banking customers going to get paperless methods when they visit their banks?

Dude, Where’s My API?

Banks in Ghana tend to be walled gardens sometimes. Sealed off from outsiders like third-party apps and developers. It’s understandable sometimes because of the security concerns when dealing with money and finances.

But banks can still be open and embrace technology with the use of APIs.

An API is an Application Programming Interface. It is a way for one program to offer services to other programs.

In this case, it is a way for banks to offer services to other entities. A Banking API could be such that if a third-party developer was to “plug in” to that API, they could build an app that can get customers bank balances and other related information (with in-built security and permissions of course).

So, do banks in Ghana have APIs? I’m not too certain but there might be some banks developing these APIs. But we’re in 2018 and it would seem banks are playing catch up with the technology.

If banks opened up with the use of APIs, budding and upcoming developers can come up with innovative apps that allow customers to easily do transactions without leaving the comfort of their homes.

Until banks open up with APIs, they’re still closed off.

Adapt (With Technology) Or Die

We saw the collapse of Capital Bank and UT Bank last year. Of course, it can’t be blamed on their refusal to adapt to more technology.

But we just crossed into 2018 and getting the best customer experience is crucial for banks if they want to get more customers. If banks refuse to make the customer experience better and allow customers to do more digital transactions, they’ll be left out in the long-term. As someone who values convenience and time, I absolutely refuse to use a bank which doesn’t have a banking app or an online component for me to check my finances.

I think it’s absolutely ridiculous that I can’t do an instant normal transfer to someone in this 21st century and rather have to wait 3 days for the money to show up in their account*.

(*Backstory: I sent money via an online option and the normal procedure is that it takes 3 days for the money to settle. But if I wanted an instant transfer, I’ll be charged a 15 GHC fee).

Printing statements, money transfers, requests for cheques, transaction disputes etc. All these should be online features so the customer should not have to drive to their bank branch to stand in line for a long time.

Rise Of Fintech Apps

At the moment, there are lots of fintech apps out there including ExpressPay, Slydepay and Mazzuma. What these apps are doing is simply filling in a gap left by the banks. They allow you to do transactions like buy mobile credit, pay for bills and other transactions.

So will the banks simply allow these apps to do their jobs for them? And at what point do these fintech apps try to take advantage and charge certain fees for their users? Not saying that taking fees is a bad thing, but wouldn’t the customer be better off going directly to the source (bank account) and making a transaction and not having to use a third-party where they charge fees?

I’m a fan of the local fintech apps. They make my life easier. But if my bank decided to build in features like ExpressPay, I might consider using that app instead.

At what point do banks decide to build their own mobile/online apps where customers can do everything that these fintech apps do?

Until that happens, we’re probably going to get more fintech products if the banks can’t pull their weight.

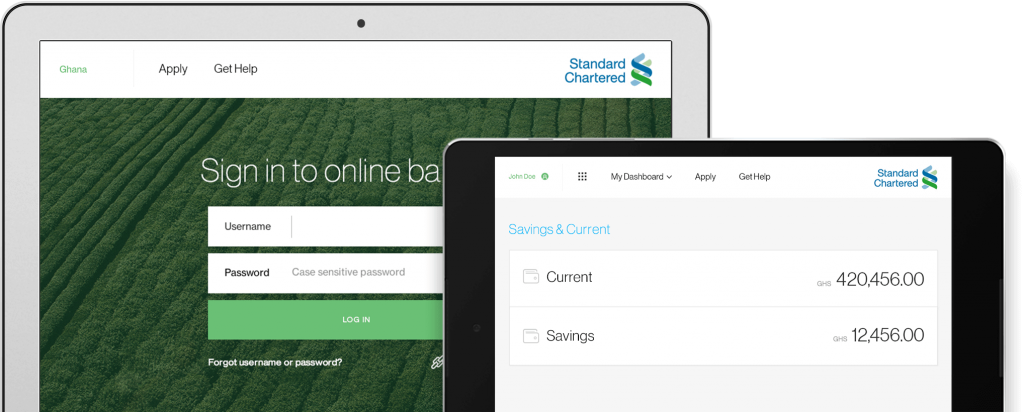

The Banking experience in Ghana is one of frustration, to say the least. They’re not all bad but there’s a LOT of room for improvement. Some banks like Stanbic, Standard Chartered and Ecobank have made strides in going more digital.

But they’re still not as open. APIs and other technology advances like better mobile app experiences and services could help other banks catch up and be more at the forefront of technology use.

Until then, banks in Ghana are looking more and more like walled gardens when it comes to technology.