“Buy Now Pay Later” (BNPL) has become a huge trend in the fintech world. New firms like Klarna and Affirm have been the most popular ones offering consumers a new way to pay for goods and services.

With BNPL, customers can pay in installments over a specific period of time instead of a one-time payment. BNPL consumers usually check out online with selected retailers when buying high or low-value goods like televisions, smartphone devices, video game consoles, and more.

The biggest draw of using BNPL is that there are no interest fee payments when making monthly payments.

Most of the already established fintechs like PayPal, Stripe, and most recently Apple, have started to offer BNPL payments on their payment platforms.

BNPL is big in the western parts of the world like US and Europe but it’s also making small strides in Ghana. Let’s take a look at some of the BNPL platforms that are trying to popularise BNPL:

Motito

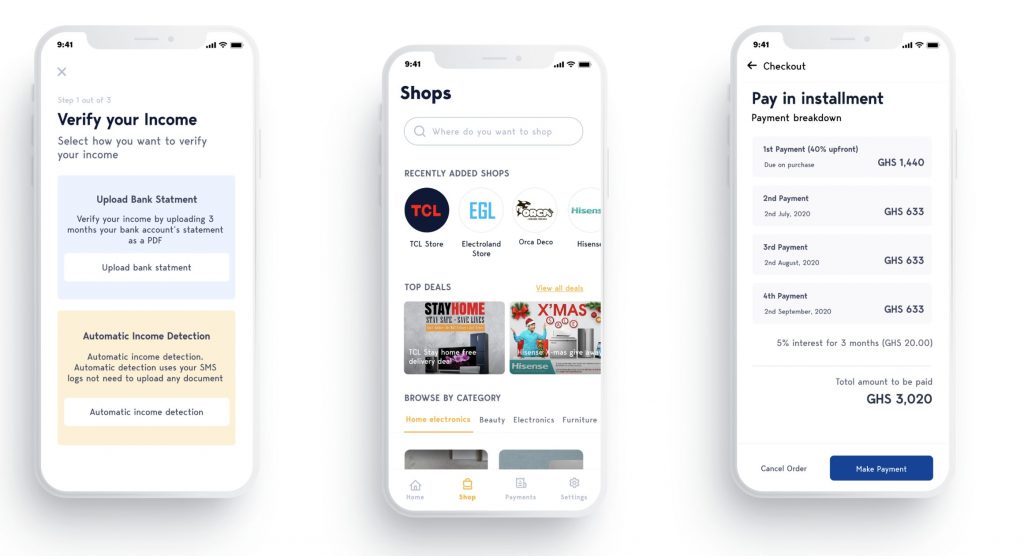

Motito is a BNPL startup that provides online shoppers with BNPL payments for selected retailers on their platform.

Founded by Tobi Martins and Betty Blavo in 2020, the platform has onboarded merchants including Electromart, Ashform, and TCL Electronics which provide monthly installments for online consumers.

Motito was recently selected for the Norrsken Impact Accelerator along with 8 other African startups.

Paveleon

Pavelon is an Accra-Ghana Fintech Startup that provides a cloud-based BNPL platform designed for large merchants, banks, and other financial institutions.

Pavelon also offers “Buy Now, Pay Later” Services using their Commerce API. The company has partnered with institutions including Ghana Commercial Bank to offers BNPL services for consumers to make payments for smartphone devices and other goods.

There are more rising BNPL startups across Africa who are trying to grab market share in this new space. But can the space be successful in the long run?

One of the reasons that BNPL runs well in developed countries like the US is because they have robust credit systems. Most African countries don’t run on credit systems and so knowing if you have a credit-worthy consumer who can pay back a purchase good online can be difficult.

But that’s not stopping startups like Nigeria’s CredPal and Kenya’s Lipa Later, which raised $12 million for expansion efforts to other African countries including Ghana.

Other African fintechs are also looking to add BNPL services on their platforms as well.

It’s too soon to tell if BNPL will be successful in the long run but that’s not stopping African startups from testing the waters.