As Ghana approaches the end of 2025, the tech scene is at a crossroads.

The success or failure of several policy levers — in telecom, broadcast, and regulation of digital assets — may define how the next 3–5 years unfold.

Below is a synthesis of what to monitor in 5G rollout, DSTV pricing, venture capital/funding, and the crypto / virtual asset bill.

1. 5G Rollout

- The NGIC’s target of deploying at least 50 live 5G sites in Accra and Kumasi, with a working 5G core, remains a key performance benchmark.

- The company has been given till the end of the year to fully roll out services to consumers

- A meaningful indicator will not be just site count, but uptake/usage — i.e. how many subscribers migrate, and which services take advantage of the enhanced speeds/latency.

- If 5G becomes “real” (not just symbolic) before year-end, it could help underpin digital finance, fintech, edge / mobile apps, IoT, and even cryptographic / blockchain use cases

2. DSTV and Broadcast Pricing

- The government’s pressure on MultiChoice Ghana to cut DSTV subscription fees (seeking a 30% cut) is a high-stakes confrontation.

- The committee formed between NCA, the Ministry, and MultiChoice to propose a new pricing model will likely deliver its recommendations in Q4 — that outcome (and whether it is accepted, resisted, or litigated) will be closely watched.

- A mandated cut could reduce short-term revenues for MultiChoice, but may also push more consumers toward streaming, local content providers, or hybrid models.

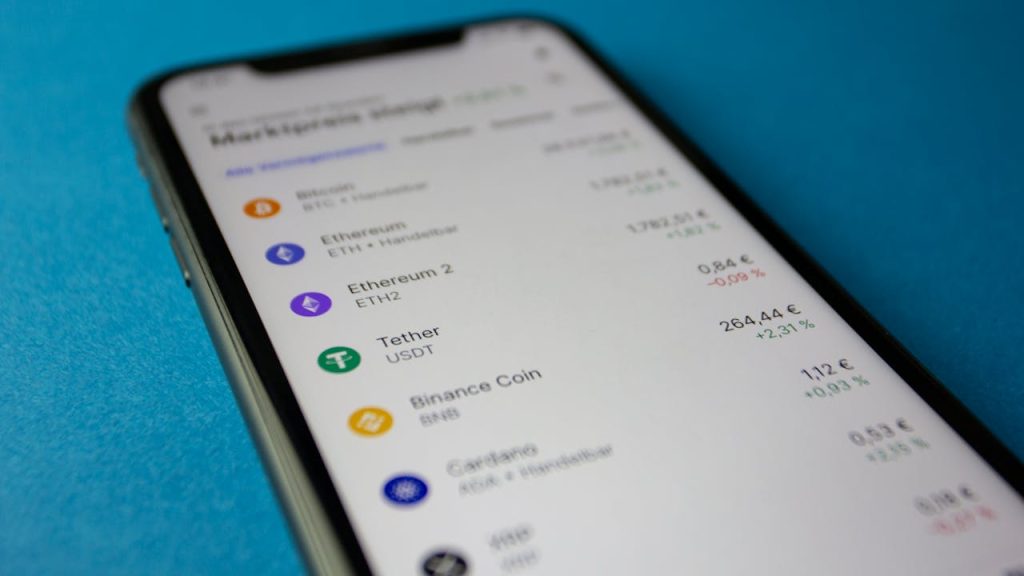

3. Crypto / Virtual Assets Bill: A New Wild Card

This is the newest — and possibly one of the most consequential — dimension to the Ghana tech regulatory landscape.

What’s going on with the crypto bill?

- The Bank of Ghana (BoG) has finalized a draft bill on licensing cryptocurrency platforms / virtual asset service providers (VASPs), which it plans to submit to Parliament by September 2025.

- The move is driven by the fact that Ghanaian crypto transactions are estimated to exceed US$3 billion annually, raising concerns over oversight, consumer protection, illicit finance, and integration with the formal financial system.

- Under the proposed regime, crypto exchanges and VASPs would need licenses, be subject to supervision (by BoG or a designated authority), and comply with KYC / AML / reporting obligations.

- While Ghana currently has no formal regulatory framework for crypto — meaning exchanges have been operating in a gray zone — the new bill, if passed, would shift crypto activity into a legal, supervised domain.

What to watch in Q4 2025

- Parliamentary passage: Whether the bill actually becomes law by year end, or is delayed. If delayed, the regulatory limbo continues — good for some risk-takers, bad for institutional players.

- Regime design & licensing terms: What capital, transparency, governance, and reporting requirements will be imposed? How onerous will they be? Will small/local exchanges be able to comply?

- Scope / inclusiveness: Will the law cover all virtual assets (stablecoins, tokens, DeFi)? Will it allow innovation (e.g. tokenization, NFTs) or strictly restrict to exchange / custody?

- Enforcement and transition rules: Will existing operators be grandfathered? What grace periods will be allowed? How will BoG or other regulators police non-compliant actors?

- Impact on investment & innovation: A clear regulatory regime can reduce uncertainty and attract institutional/foreign investment, but overly tight regulation may stifle startups or push activity offshore.

- Tax treatment & reporting: The bill or complementary fiscal rules may introduce tax obligations (capital gains, withholding, etc.) that will affect user incentives.

- Integration with banking/payments: How the crypto regulatory regime aligns or integrates with banking, mobile money, and payments infrastructure will matter a lot.

4. Funding / VC: Surprises or Stagnation?

- The first half of 2025 shows that Ghana’s tech sector is staying on investors’ radar, with notable deals in fintech, clean energy, mobility, and banking.

- Current data suggests Ghana’s tech ecosystem has raised about $51 million in the first half of 2025. If current trends continue, it will be well below the amount it raised in 2024 ($127 million)

- Domestic capital mobilization (e.g. via pension funds or local institutional investors) will be a critical source of future growth; regulatory clarity across sectors (including crypto) becomes all the more important to attract such capital.

- A “surprise” year would mean at least one or two mega rounds in late 2025 (e.g. tens of millions) in tech or Web3, pushing total funding beyond 2024’s benchmark.

What’s happening with AT Ghana?

Over the past year, AT Ghana has faced mounting financial, operational, and structural stress. Key developments include:

Debt & vendor claims

- As of early September 2025, AT Ghana’s debt was reported to exceed 3.5 billion cedis (≈ US$289 million), including ~1.5 billion cedis owed specifically to tower operator American Tower Company (ATC Ghana).

- Because of nonpayment, ATC Ghana began cutting power to several radio access sites operated by AT Ghana. This threatened widespread outages.

- In response, the government had to force an emergency measure: migrate about 3 million AT Ghana subscribers to Telecel’s network under a national roaming arrangement, so customers would not lose voice, SMS, data, or mobile money services.

Governance/ownership & planned restructuring

- The Ghanaian government owns 100% of AT Ghana (after acquisition from the prior Airtel / Millicom owners).

- Plans seemed underway to merge AT Ghana with Telecel Ghana, with the aim of consolidating operations, cutting duplication, reducing costs, and forming a stronger alternative to MTN. (The Minister of Communication denied that this was a merger or acquisition.)

- The government has appointed KPMG as a transaction advisor to oversee and advise process

- In addition, a Canadian infrastructure/energy firm, Rektron Group, has expressed interest in acquiring a 60% stake in AT Ghana, in partnership with a local firm (Afritel Ghana).