The implementation of cashless society is slowly coming along in Ghana. But that hasn’t stopped startups and other companies from building apps and backends to take advantage of cashless transactions.

A new form of paying online and making online transactions comes in the form of a new service called Barter.

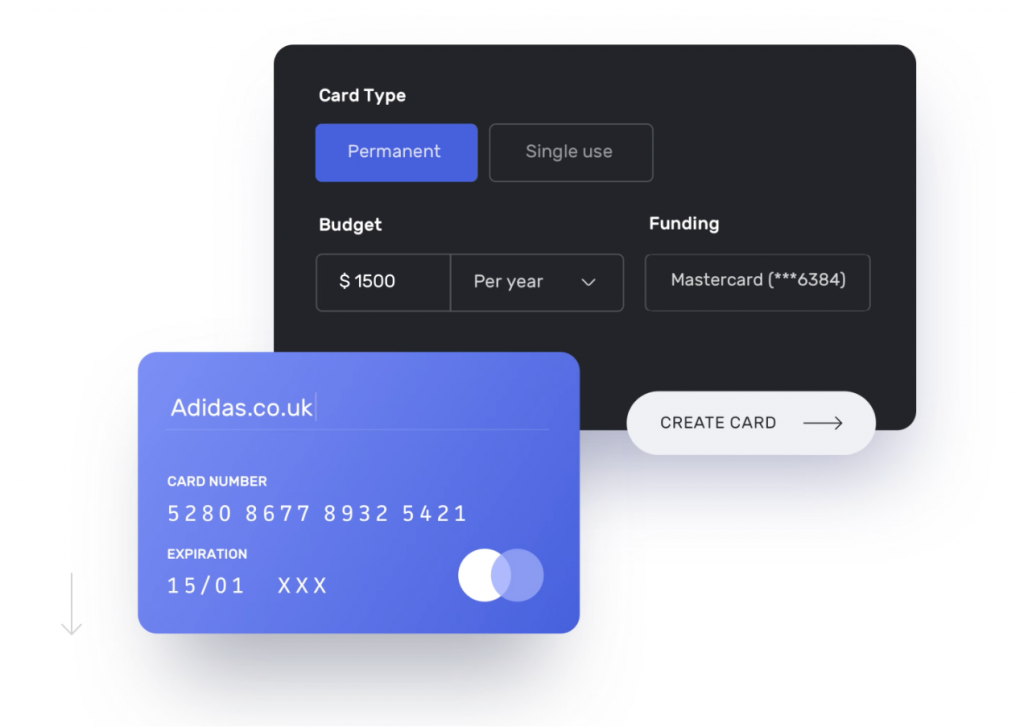

Barter is an American card company which offers virtual cards for it’s users. What is a virtual card? Just imagine a physical credit card but it’s online and can be used to purchase stuff.

So How Does It Work?

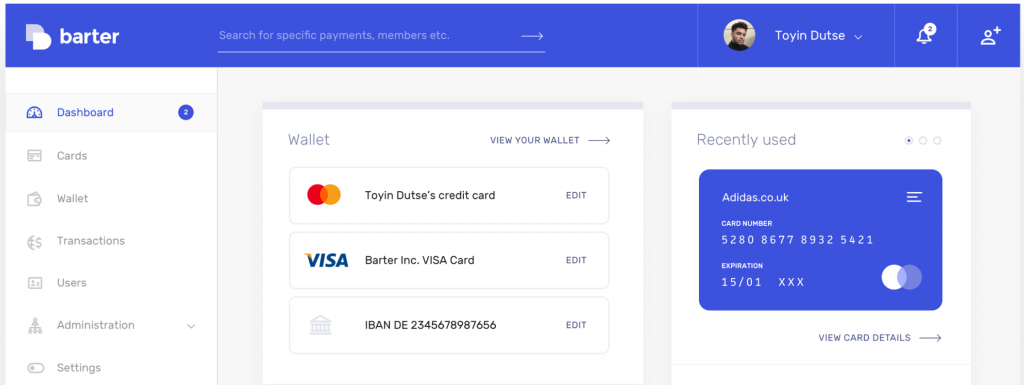

It’s simply a matter of signing up, adding funds to your online account and then you’re good to go.

So What Exactly Can You Use The Card For?

Virtually anything! Need to pay for that Netflix or that Spotify subscription but for some reason, your local card doesn’t work? Just use Barter. There are no limits to how much you can put on the card and you can use it on any site to make a purchase. If you’re done with the online card, you can simply just close the account.

For now, you can’t use Barter to transfer funds from the online account to another account but that could change in the future if possible.

Flutterwave To The Rescue

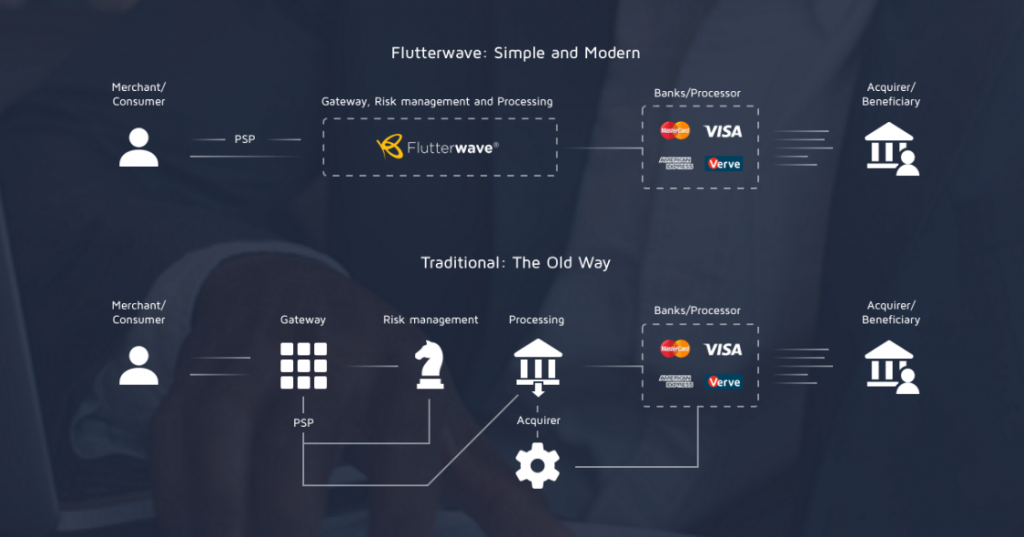

Barter currently relies on Flutterwave, a company with a team of technology experts trying to build a modern payment infrastructure to connect Africa to the global world. Barter uses Flutterwave’s virtual card API which allows users to use their VISA and MasterCard accounts to make payments anywhere in the world.

It’s a cool mission when you consider how some citizens in Africa can’t make online payments from their home country because of some sort of blacklist or global politics.

The Barter service currently runs in Nigeria, Kenya, Ghana and the US.

The service is currently free and users can sign up and try it out for themselves. Look out for a review of Barter in the coming weeks.

Find out more information about Barter from their website