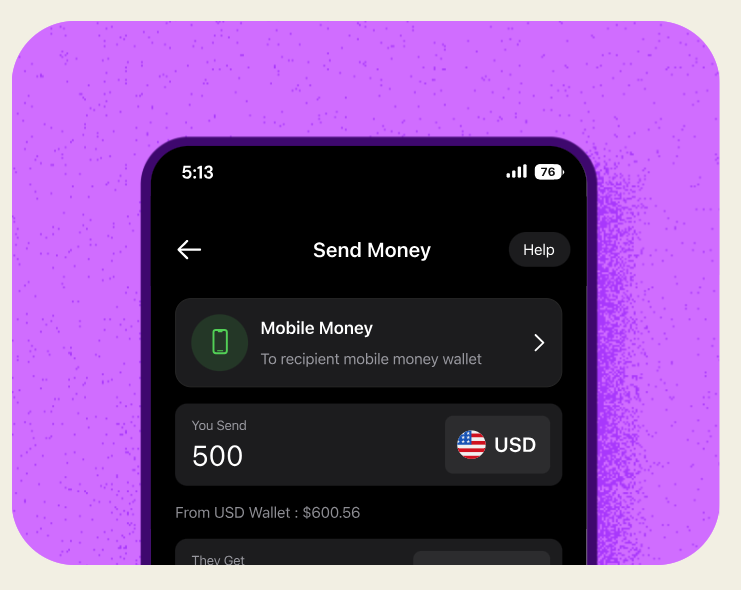

ChitChat, a leading African social commerce platform, has launched its new remittance feature, which enables cross-border money transfers across 13 countries worldwide.

Driving The News

This feature expands the financial services users can access from within a chat conversation and increases the functionality of the multicurrency ChitChat wallet and USD virtual debit card.

The new remittance feature expands the markets from which users can send and receive funds that can be converted to local currency within the app. Users can send money to bank accounts, mobile wallets, and cash agents in several countries.

For its initial phase, the supported remittance destinations include developed and growing markets like India, Japan, China, the United States, the United Kingdom, Canada, Malaysia, South Africa, Tanzania, Zimbabwe, Zambia, Ghana, and Rwanda.

The Big Picture

Remittances are a crucial source of external finance for many African households, with contributions exceeding 20% of GDP in some countries.

In 2022, remittances to Africa reached $100 billion, surpassing the combined total of development assistance and FDI into the continent.

What They’re Saying

“We are thrilled to introduce remittances as the latest offering on the ChitChat platform. This feature allows Africans at home and abroad to send money easily and securely. Whether it’s a bank deposit to the UK, a mobile wallet transfer to Zimbabwe, or a cash payout in Ghana, we aim to provide a smooth and accessible service for all,” said Perseus Mlambo, CEO of ChitChat.

Between The Lines

Future updates will include group wallets inside group chats.