DigMo, a new fintech aiming to help low- and middle-income earners in Zambia build wealth, has launched with a wallet service licensed by the Bank of Zambia.

With a focus on accessible, gamified financial planning, DigMo combines engaging tools with incentives to make saving simple and rewarding.

As part of the move to expand DigMo’s capabilities and reach, James Chona, former CCO of Zamtel, has been appointed Chairman and will advise on efforts to grow DigMo in Zambia.

Why It Matters:

Financial planning services in Africa have typically targeted wealthier customers, with high costs and slow-growth options that don’t appeal to the wider population.

DigMo aims to bridge this gap, offering low-cost digital savings and investment options for underserved users. This launch aligns with Zambia’s national goal to increase financial inclusion to 85% by 2028.

Details:

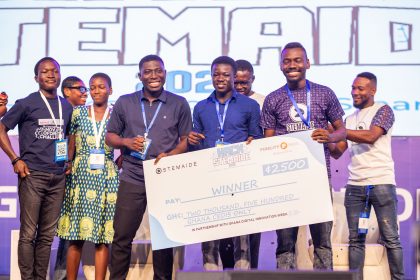

- Innovative Savings Model: DigMo’s first offering, “Save to Win,” is designed to encourage saving with gamified elements and potential rewards, starting from as little as 10 ZMW (about USD 0.37). Participants have the chance to win up to 500,000 ZMW (USD 18,400), making saving accessible and enticing.

- Security & Compliance: Partnering with Africa-focused compliance tech provider pawaPass, DigMo ensures user security with advanced KYC and biometric verification, reducing costs and minimizing risks while preparing for scalability.

Leadership:

- James Chona has been appointed Chairman of DigMo. With over 25 years in telecoms, fintech, and technology—including roles at Zamtel and Airtel Money—Chona will focus on partnerships and expanding DigMo’s reach in Zambia and beyond.

The Big Picture:

DigMo is not just about affordable financial planning; it’s about rethinking traditional methods to match real user needs and behaviors in Africa. CEO Sylvia Brune envisions DigMo as a game studio for financial tools, aiming to find the products that best drive positive change. Brune says, “We’re creating a new approach to financial resilience by blending incentives with savings to encourage long-term planning.”

What They’re Saying

- Speaking on the launch of DigMo, Sylvia Brune, CEO of DigMo Group, said: “We are committed to financial planning innovation for low and middle-income earners across Africa. To achieve this meaningful impact, we approach this like a game studio – where we constantly create and test many new products until we find those with an outsized impact. If we just take existing products and make them more affordable or accessible, it is unlikely that we can dramatically change behaviours. To succeed, we have engaged directly with users, observing and learning from them to develop DigMo, a solution that will dramatically improve their financial well-being and meet their unique needs.”

- Commenting on his new role as Chairman, James Chona said, “Joining DigMo comes at a crucial moment for advancing financial inclusion in Zambia. Africa’s low and middle-income earners face many challenges, from inflation and high payment fees to restrictive financial products with lock-in periods and complex terms that often deter long-term savings. DigMo is rethinking financial planning by disrupting traditional financial planning methods and focusing on African consumers’ real motivations and behaviours. It is a great honour for me to join and advance DigMo’s mission as we bring accessible and innovative financial products to those who need them most in Zambia and across the continent.”

What’s Next:

Building on the success of its Zambian rollout, DigMo has ambitious plans for further expansion across Africa, developing financial tools that resonate with the mass market.