Here’s a look at five apps that help with savings/investing in Ghana, including what they do well, what to watch out for, and how they differ.

Achieve App

Achieve is a Ghanaian savings & investment platform by Petra Securities Limited (which is SEC-licensed) aimed at helping everyday Ghanaians save towards goals.

Key features

- DigiSave: Their signature savings/investment product. Deposits are invested in a mutual fund (Plus Income Fund, managed by Black Star Advisors) held in a secure custody account.

- Low entry barrier: You can start with as little as GHC 10.

- Goal-setting: You can save for multiple goals in separate “buckets” (e.g. travel, school) to avoid mixing funds.

- Automated top-ups: Set up auto deposits so saving happens without having to remember.

What to watch out for / limitations

- Being an investment fund, returns depend on market performance—so there is risk.

- Withdrawal or liquidity terms might be slower or have conditions compared to a bank savings account, depending on the fund.

- Since it invests via mutual funds, fees, portfolio performance, and management quality matter. Always check recent performance.

Bamboo

Bamboo is a brokerage/investment app that lets users in Ghana invest in U.S. stocks (among other assets) and, more recently, has improved local funding options.

Key features

- Access to U.S. stocks and ETFs: Meaning Ghanaians can invest in global companies rather than being limited to local stocks.

- Fractional investing: You don’t need to buy a whole share; you can invest smaller amounts. This makes entry easier.

- Local currency wallet/funding improvements: Recently, Bamboo integrated with Affinity Africa for easier funding of GHS wallets via local account numbers. This tends to reduce fees or delays when moving money in.

What to watch out for / limitations

- U.S. market exposure means currency risk (USD vs GHS) and market risk. Gains in USD may or may not fully offset local inflation/currency depreciation.

- Some costs/fees around currency conversion, withdrawals, or maintenance may occur.

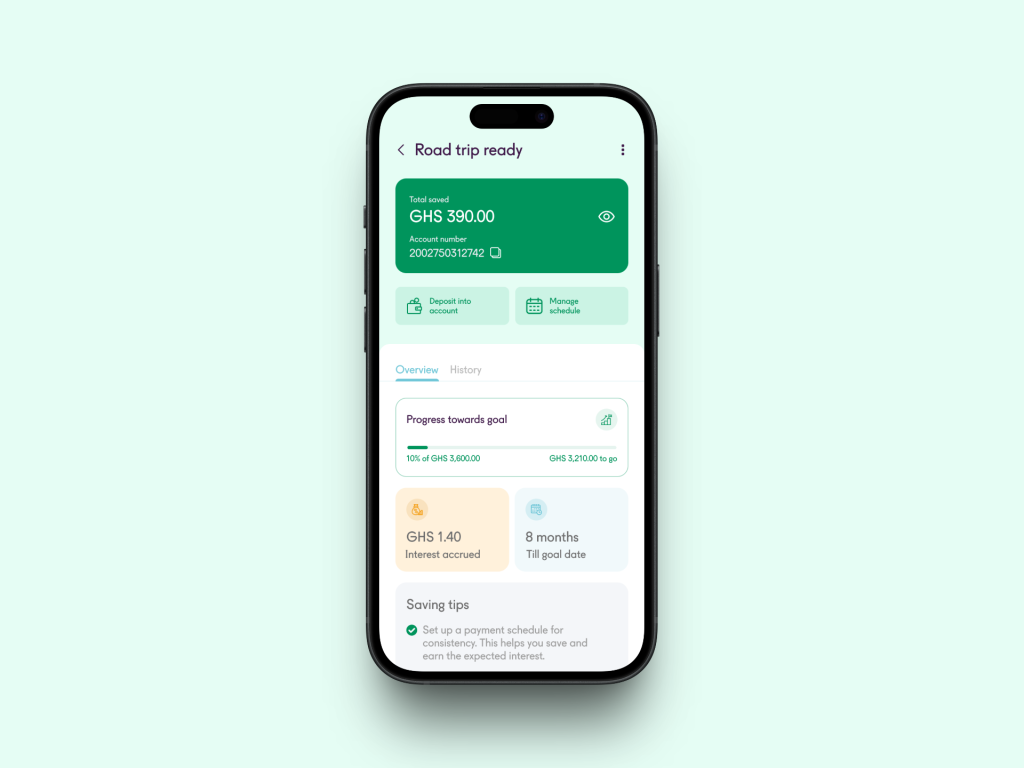

Affinity Africa (Affinity)

Affinity Africa (often just “Affinity”) is a digital banking/savings & loans outfit in Ghana. It’s licensed by the Bank of Ghana under a Savings and Loans license.

Key features

- No fees/no transaction charges: Their savings and investment products are intended to be affordable.

- Instant account setup: You can open an account with just a Ghanaian mobile number and Ghana Card.

- Savings & investment products + lending options: So you can save, earn interest, and also access small loans.

- Goal-based savings tools (“Boost” etc.): They offer savings products where you set a target, lock funds, and earn interest, and they also provide insight dashboards.

What to watch out for / limitations

- Interest rates may vary and may not always keep up with inflation or currency depreciation.

- Lock-in or withdrawal restrictions for goal-oriented savings products. For example, if you exceed free withdrawals, you could lose interest for that month.

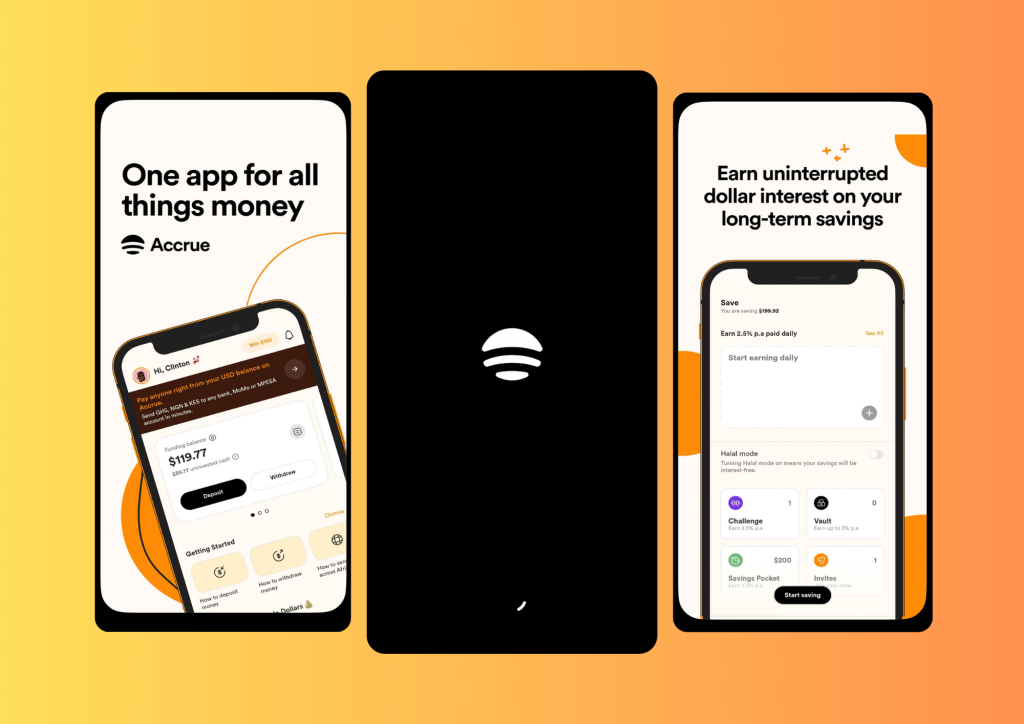

Accrue

Accrue is an app that allows users to invest/save in different asset classes (stocks, crypto, etc.), with features for goal-setting and security. It has both local and international focus.

Key features

- Multiple assets: Not just traditional savings, but the ability to invest in stocks, cryptocurrencies, etc.

- Low minimums: It allows small investments, which helps users who don’t have large capital.

- User-friendly interface: Appeals to people new to investing.

- Regulatory/security features: Two-factor authentication, insured or secure holding of assets etc (depending on region).

What to watch out for / limitations

- Like other investing apps, risk of volatility (especially with crypto or equity).

- Fees may apply (for transactions, currency exchange, withdrawal) — always check those.

- Depending on local regulation and infrastructure, moving money in/out can have delays or cost.

Risevest

Risevest is a digital wealth/investment manager that helps people invest (often in U.S. or international dollar assets), save toward goals, etc.

Key features

- Goal-based plans: Save for things like school, home, or whatever matters to you.

- Dollar vaults / international exposure: Protects (to some extent) from local currency depreciation or inflation by holding dollar‐denominated or foreign assets.

- Different risk levels/stability options: They offer more stable, low-risk investments (vaults) versus higher return options.

What to watch out for / limitations

- Exchange rates and conversion costs when moving between GHS and foreign currency.

- Regulatory or withdrawal delays depending on the jurisdictions involved.

- Exposure to international market risk (stock market volatility, global macro risks).

Comparison & Recommendations

Here are some pointers if you’re thinking which app(s) might be best for you:

| Your Priority | Best Option(s) |

|---|---|

| Protecting from currency depreciation/inflation | Risevest, Bamboo, Accrue (if using dollar assets) — helps hedge against Cedi weakening. |

| Low entry / small amounts | Achieve, Affinity, Bamboo (fractional investing). |

| Goal-based savings (travel, school, etc.) | Achieve, Affinity, Risevest |

| Want simplicity / less risk | Affinity (for more traditional savings), Achieve (if you choose more stable funds), Risevest’s vaults |

| Willing to take more risk for higher returns | Bamboo (stocks, global exposure), Accrue (if you use crypto or riskier assets) |