Sending money to Nigeria using Mobile Money (MoMo) is now a streamlined process, especially if you are sending from another African country like Ghana.

Because Nigeria uses a “Payment Service Bank” (PSB) model for MoMo, you can send money directly to a recipient’s MoMo wallet or their bank account.

Here is a step-by-step guide on how to get it done.

Method 1: Using USSD (Direct MoMo to MoMo)

This is the most common method for users in countries like Ghana. MTN has integrated a cross-border feature that allows direct Cedi-to-Naira transfers.

- Dial the MoMo Code: Dial *170# on your MTN phone.

- Select Transfer Money: Choose Option 1 (Transfer Money).

- Select Cross Border: Look for the “Cross Border Payment” option (usually Option 7).

- Select Payment Provider: Select a provider from the list, select an option, and choose Nigeria

- Enter Recipient Details:

- Enter the recipient’s phone number (starting with the country code 234).

- Confirm the recipient’s name

- Enter Amount: Input the amount in your local currency. The system will usually show you the converted Naira equivalent.

- Confirm & Pay: Review the transaction details, enter your MoMo PIN, and you will receive a confirmation SMS.

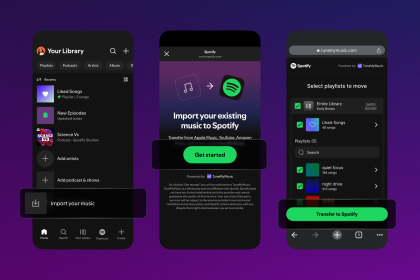

Method 2: Using the MoMo App

If you prefer using a smartphone app, the process is visual and often allows you to see the exchange rates upfront.

- Step 1: Open your MoMo App and log in.

- Step 2: Tap on the Transfer icon and select “Cross Border Payment“

- Step 3: Select Method/Payment Provider

- Step 4: Enter the recipient’s mobile number and the amount.

- Step 5: Select the purpose of the transaction (e.g., Family Support).

- Step 6: Review the summary and authorize with your PIN or Biometrics.

💡 Key Tips for Success

- Check the Limits: Depending on your account tier, there may be daily limits (e.g., Tier 1 accounts in Nigeria often have a 50,000 Naira daily limit).

- Fees: MTN typically charges a transaction fee (around 3-4%) for cross-border transfers. Always check the total cost before hitting “Send.”