The Ministry of Communication has sent a directive to Ghana’s Mobile Network Operators to cease passing the 9% Communication Tax to its subscribers.

On October 1st, Mobile Network Operations in Ghana began implementing a 9% tax Communication Tax to its users. This has resulted in an increase in fees for the purchase of mobile credit and data. For every GH 1 of recharge purchased, a 9% CST fee is charged the subscriber leaving GHC 0.93 for the purchase of products and services.

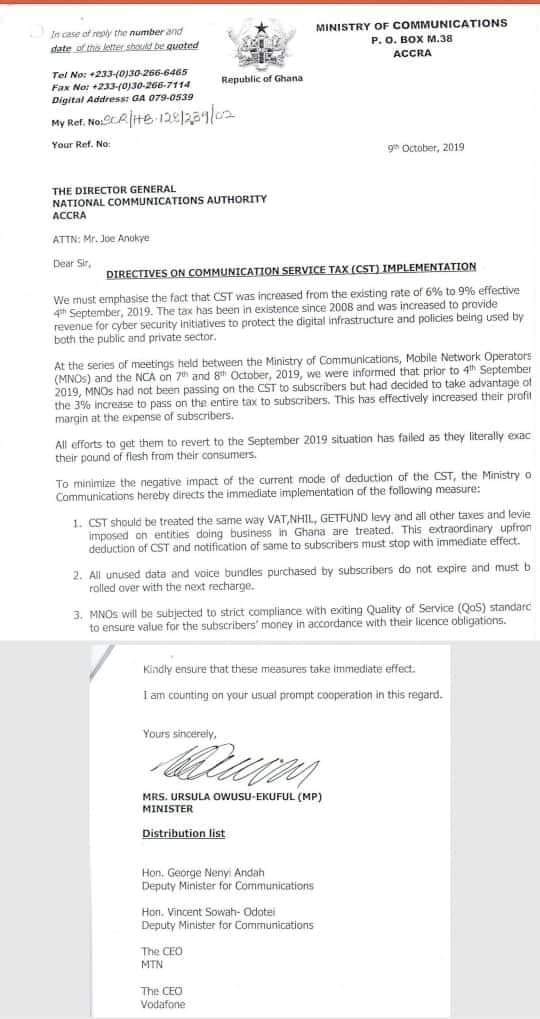

In a letter addressed to the National Communications Authority (NCA), the Communications Ministry stated that the CST should be treated the same way VAT, NHIL, GETFUND levy and all other taxes and levies imposed on entities doing business in Ghana are treated.

“At a series of meetings held between the Ministry of Communications, Mobile Network Organisations (MNOs) and the NCA on 7th and 8th October, 2019, we were informed that prior to 4th September 2019, MNOs had not been passing on CST to subscribers but had decided to take advantage of the 3% increase to pass on the entire tax to subscribers. This has effectively increased their profit margin at the expense of subscribers,” the letter stated.

In addition to the directive asking operators to stop passing the cost of the tax to consumers, the Ministry also directed the operators to roll over all unused data and voice bundles purchased by subscribers.