The Pan-African Fintech Accelerator (PAFA) is excited to announce the selection of the ten (10) fintech startups to participate in the maiden edition of the six-month virtual acceleration and immersion program.

Featuring the industry’s most promising and exciting startups, the 2021 cohort brings together businesses from Ghana, Uganda, Kenya, Senegal, and Côte D’Ivoire. They range in industry focus from personal finance to lending, insurance, regulatory technology, payment and money transfer, accounting, and expense management.

Kicking off in March 2021, each business will receive industry-specific training on how to assess and enhance their fintech product for the North African market as well as invaluable access to pre-identified potential clients, corporate investors, industry experts, and an ecosystem of institutional partners.

The program will culminate with a showcase in June, where the startups will have the opportunity to meet and present their solutions to a global audience and industry network.

Thus, after a careful evaluation of submissions from over eight African countries, these are the selected startups:

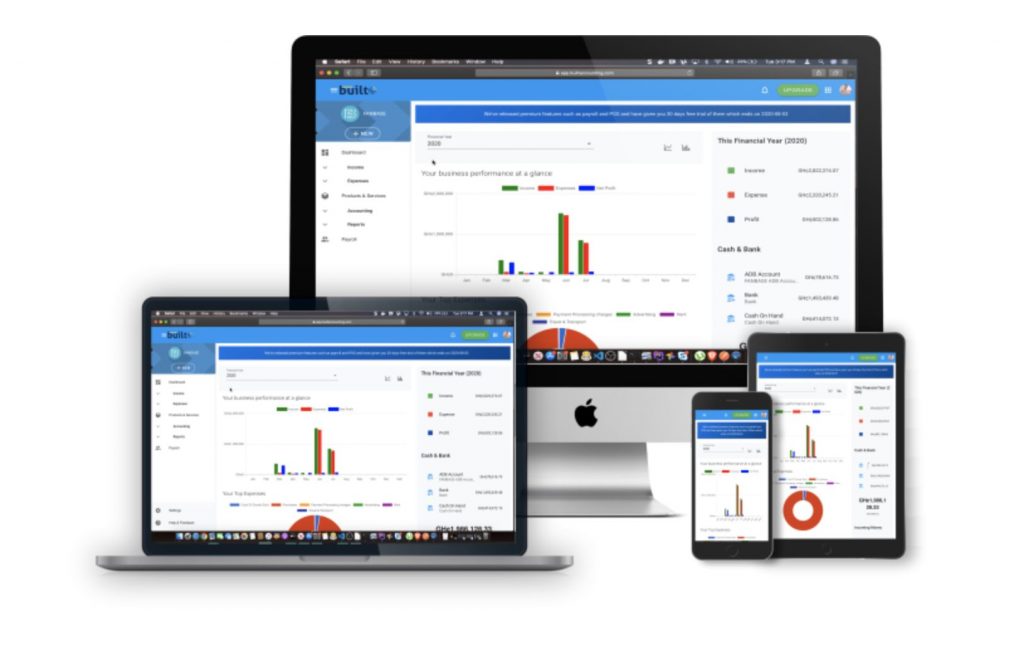

Built Accounting is a financial technology and services company with the mission of building the digital infrastructure that SMBs need to launch, run and grow their businesses. The company’s flagship product is a cloud-based accounting application that helps SMBs stay on top of their business finances. The app, available on the web and mobile, comes with invoicing, billing, payments, inventory management, payroll, and reporting features.

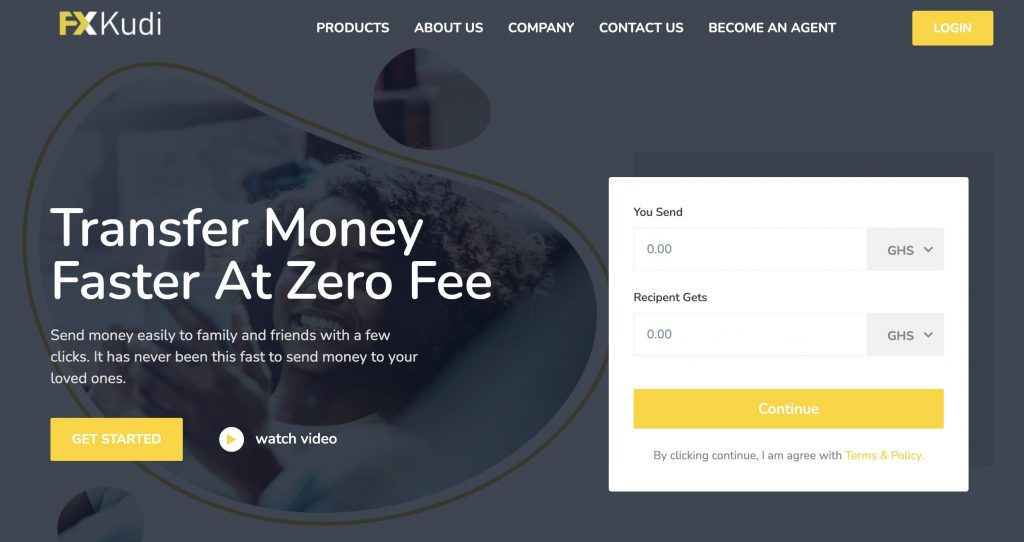

FXKudi (Ghana)

FXkudi Company Limited is a Financial Technology company established to give access to borderless money transfer and payment power to Africa. They also hold the responsibility of powering small and medium scale businesses in Africa to accept payment easily, and by so doing, are providing them with a technology that simplifies the process of running their business profitably. While working hard to serve the African market, Fxkudi is focused on delivering excellence and creating a strong relationship with consumers and businesses using our services.

Touch By InTouch (Senegal)

Touch is a Pan-African fintech created in 2014 and specializing in the aggregation of payment methods and the integration of digital services. Touch offers merchants a universal solution that allows them to accept all means of payment and offer a wide catalogue of services via a single device (smartphone, computer, etc.)

The Touch platform is currently used in 10 countries by more than 500 total stations, more than 25,000 independent outlets (multi-services, hair salons, pharmacy, neighbourhood shops, etc.) and more than 1000 B2B partners.

Matontine (Senegal)

MaTonine is a Digital Financial Service platform that enables access to small loans and a range of financial & non-financial services (e.g. insurance, financial education etc.) to the financially excluded in Africa.

For women, MaTonine digitizes their saving groups & credit score so they can be eligible for financial services. For the FSPs, they enable them to provide their services directly to the women through their platform using plug & play tools; thereby greatly reducing their costs-to-serve and time to go-to-market.

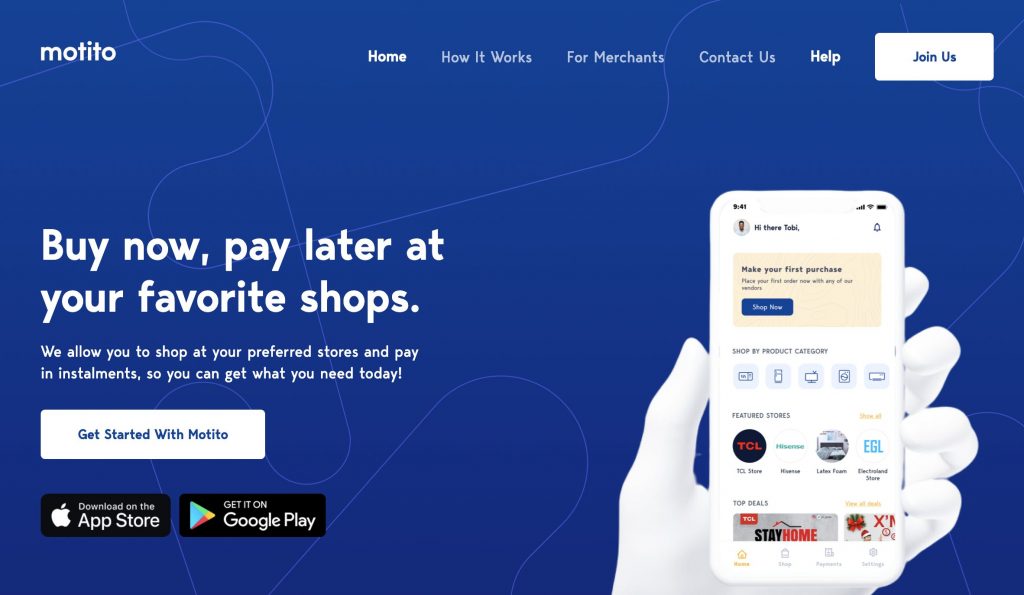

Motito (Ghana)

Motito is increasing the standard of living and strengthening the African economy by making credit more accessible for individuals living in Africa.

Growth Factor Technologies (Ghana)

Growth Factor Technologies is a Fintech company focused on delivering value to businesses by providing trade financing solutions that promote access to working capital.

Their flagship product, Nvoicia, is a secured invoice factoring web platform that assists small-medium businesses that have pending payments gain access to cash so that they can efficiently run their businesses.

DigiExt (Ghana)

DigiExt is a social enterprise with the goal of drive inclusive prosperity of farmers through robust technologies in digitalization, mechanization and renewable energy. They are creating a sustainable farm processed product solution to help farmers be part of the upper-value chain in agribusiness and address the primary concern of farmers – which is market volatility.

With a stable market, DigiExt helps farmers access credit to afford digital and mechanization technologies.

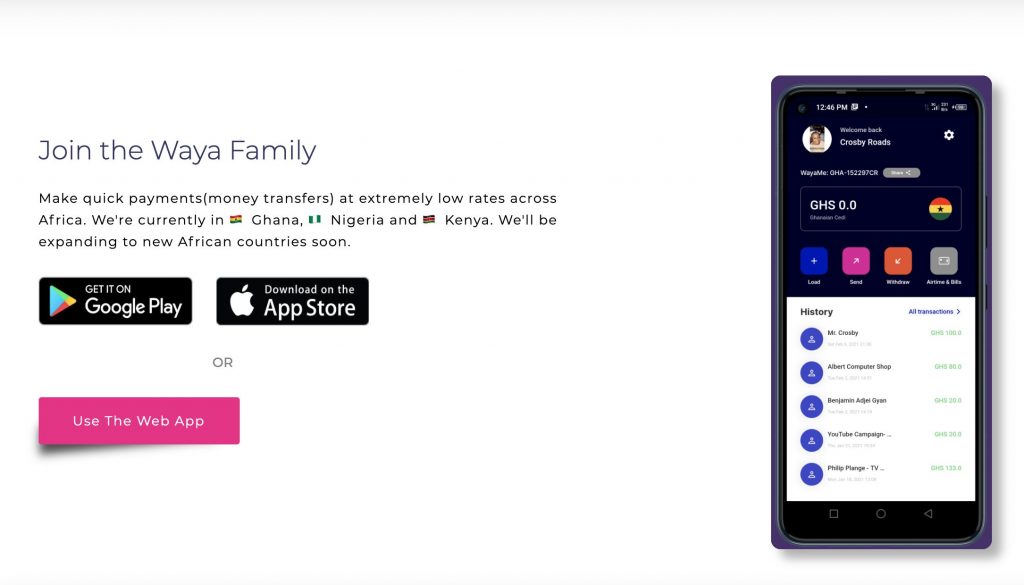

Wayamoney – Ghana

Waya Limited is a financial technology startup company providing cross-border and cross-network payment and money transfer solutions. Their interoperability platform connects with banks, mobile money operators and other digital payments providers from all over the world to serve Africa by providing its users with a multicurrency wallet application.

Waya is registered as a business in Ghana, Kenya, Nigeria, South Africa, Rwanda and the United Kingdom with partners in five other Africa countries.

Moja Bank is a global Digital bank for cross border banking for immigrants. They are providing a digital payment App and a contactless card which is used by consumers to facilitate everyday payment in emerging markets. Consumers in the US use the App to manage their finances, and send money to their families back home.

To make to solution fully integrated, Moja Bank has enabled distribution of the App through transportation networks in emerging markets so consumers can interact with the APP daily. Transport operators and small merchants also use the solution for booking, ticketing, and payment.

RSC Technology

RSC Technology formerly RosleStores.com (RSC in 2012) is an engineering firm specialized in software creation, web service, e-commerce and e-payment service, and Web hosting and/or cloud.

They aim to encourage and simplify the dissemination of goods and services from the African Economic Area around the world. The company has existed as a SARL since 2015 with 5 years of exercise in the Ivorian market. RSC Technology plans to launch its e-commerce service platform and enlarge its customer portfolio in the field of e-commerce and e-payment in the West African sub-region.

The Pan-African Fintech Accelerator program was designed to accelerate the growth of Fintech startups in Africa and equip them with the skills and knowledge to successfully scale their solutions into North Africa through training, mentorship, acceleration, and market expansion.

It is funded by the Entrepreneurship Academy of the SANAD Fund for MSME, in partnership with MEST and Impact Lab.