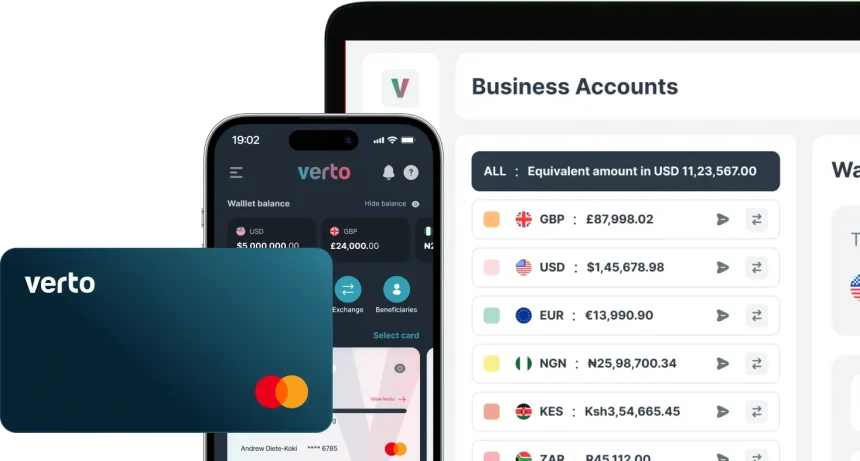

Verto, a cross-border payments platform serving global businesses, has officially launched in the UAE to streamline high-value, time-sensitive transactions between the Gulf and emerging markets—particularly in Africa.

Why it matters

The UAE’s growing trade with Africa has exposed gaps in traditional banking systems, where slow settlements and opaque fees hamper business operations. Verto aims to close that gap by offering instant payments, transparent FX rates, and real-time tracking for enterprises managing complex supply chains.

By the numbers

- $25B+ processed annually for clients like Unilever and Maersk

- Operations in Nigeria, Kenya, South Africa, West Africa, and China

- Licensed by the Dubai Financial Services Authority (DFSA)

The details

Verto’s UAE platform integrates local operations with its global payment rails, enabling:

- Fast settlements: Payments cleared in hours instead of days.

- FX flexibility: Competitive, transparent rates with tools for hedging and rate-locking.

- Transparency: End-to-end payment tracking and no hidden fees.

“The UAE is a pivotal hub for global commerce, and businesses here demand solutions as dynamic as their operations,” said Helen Ghebreluul, UAE Country Manager.

“We’re not just a service; we’re a critical partner ensuring payments move as fast and reliably as business itself.”

What they’re saying

“Businesses are the lifeblood of global supply chains, but they face constant challenges from currency volatility and slow, traditional payment systems,” said Ola Oyetayo, CEO and Co-founder of Verto.

“We empower them with tools to mitigate FX risk, accelerate settlements, and optimize cash flow.”