In a surprising turn of events, Glovo, one of the leading food delivery platforms in Ghana, announced its decision to cease operations in Ghana.

This move, set to take effect on May 10, 2024, has been attributed to profitability issues that have plagued the company’s performance in the Ghanaian market.

Glovo’s journey in Ghana began in 2021 with high hopes and significant investment, aiming to tap into the country’s growing population and internet penetration. However, despite the initial optimism and the expansion efforts, the company has faced challenges that have impeded its growth and sustainability in the region.

Zoom Out

Profitability concerns are not new in the delivery service industry, especially in emerging markets where competition is fierce and operational costs can be high.

Glovo’s departure echoes a similar move by Jumia Food, which also shut down its operations in Ghana in 2023 after its parent company decided to focus on physical outlets.

Possible Reasons for Departure

Macroeconomic Conditions

In 2022, Glovo invested €3.5 Million to help expand its operations in Ghana. In the previous year, Ghana’s exchange rate to the Euro was about $1 to 6.9 GHC. In the following year, when Glovo announced its investment, the Euro exchange jumped from $1 to 8.9 GHC. The next year in 2023, it went up again to 12.6

Essentially, Glovo’s 3.5 Million Euro investment which was about GHC 31 million. But with higher costs in 2022, operational expenses increased, depleting its investments at a rapid pace.

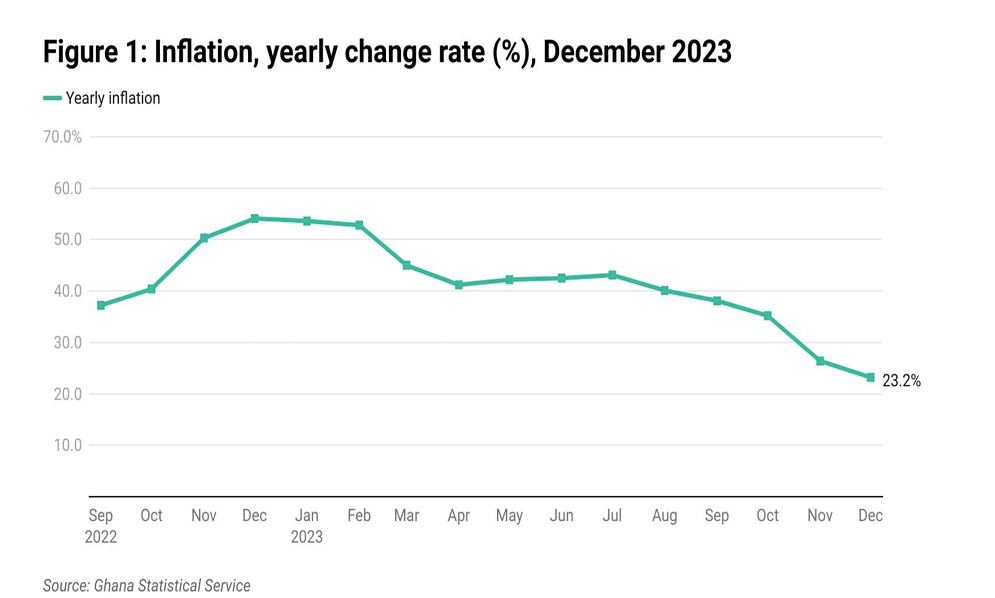

Inflation rates skyrocketed to a decade’s high of 50% which increased food and other costs, further putting pressure on the company’s cost of operations.

High Taxes

The increase in taxes due to macroeconomic conditions and Ghana’s application to the IMF program could also have contributed to Glovo’s sudden exit.

In 2021, Ghana added a 1% COVID-19 Levy to all goods and services. In 2022, Ghana’s parliament passed an Electronic Levy which initially placed a 1.5% levy on transfer of funds between mobile money accounts. Lastly, the government increased the VAT rate from 12.5% to 15%.

The country’s revenue authority has also embarked on an aggressive campaign to collect taxes from businesses to reach their tax collection goals.

These factors could have accelerated Glovo’s exit as the cost of business operations increased, further postponing the company’s chance of profitability in the short term.

Repercussions and Outlook

Glovo had reportedly contracted with approximately 400 businesses in Accra, providing a convenient service for delivering goods from pharmacies, restaurants, food stalls, and grocery stores to customers’ doorsteps.

The company’s exit raises questions about the viability of delivery service platforms in emerging markets like Ghana. It also opens up discussions on the strategies that companies must employ to navigate the complexities of such markets successfully.

As Glovo redirects its focus to focus on other markets, it leaves a gap in the local delivery ecosystem in Ghana, presenting both challenges and opportunities for existing and potential players in the sector.

The departure of Glovo from Ghana serves as a case study on the importance of thorough market analysis, adaptive business models, and agility to respond to the dynamic economic landscapes of emerging markets.

It also brings about the discussion of the infrastructure of food delivery in emerging markets. A topic that would probably need to be explored in another article.

As stakeholders in Ghana’s delivery sector assess the implications of Glovo’s exit, it is clear that innovation, local market understanding, and sustainable business practices will be key factors in determining the success of future ventures in this space.

Catch up on news and other tidbits on our WhatsApp Community Page, Twitter/X, and subscribe to our weekly newsletter to ensure you don’t miss out on any news.